Arbitrage Betting Explained: How to Lock in Risk-Free Profit

Key Takeaways

- Mathematical Guarantee: Arbitrage betting exploits market inefficiencies where the sum of implied probabilities is less than 100%, guaranteeing profit regardless of the outcome.

- Operational Security: To avoid account limits, bettors must round stake sizes, stick to liquid markets, and avoid betting on obvious pricing errors (palps).

- Execution Risks: While the math is solid, risks include 'legging out' (odds changing between bets) and differing sportsbook rules (e.g., tennis retirement policies).

- The Gateway to +EV: Arbitrage tools are excellent for identifying value; many pros eventually transition from hedging to 'naked' betting on the value side to maximize long-term ROI.

Definition

Arbitrage betting is a strategy where a bettor places wagers on all possible outcomes of an event across different sportsbooks at odds that guarantee a profit regardless of the result. It exploits price discrepancies in the betting market to eliminate risk.

Table of Contents

Arbitrage betting is the closest thing to a "sure thing" that exists in the volatile world of sports wagering. It is not gambling in the traditional sense; it is a mathematical exploitation of market inefficiencies. While the casual public chases parlays and gut feelings, sharps use arbitrage (often called "arbing") to treat sportsbooks like a stock exchange, buying low and selling high simultaneously to lock in guaranteed returns.

This guide moves beyond the basics. We are not just defining what an "arb" is; we are deconstructing the mechanics of line discrepancies, the operational security (OpSec) required to keep your accounts alive, and the mathematical framework necessary to scale this strategy effectively.

The Mathematical Mechanics of an Arb#

At its core, arbitrage exists when the implied probabilities of all outcomes in a betting market sum to less than 100%.

In an efficient market, sportsbooks add a "vig" (vigorish) or margin, meaning the implied probabilities usually sum to 104%-110%. However, because sportsbooks operate independently—adjusting lines based on their specific liability and sharp action—pricing disparities occur. When Bookmaker A prices the favorite too softly and Bookmaker B prices the underdog too generously, an arbitrage opportunity opens.

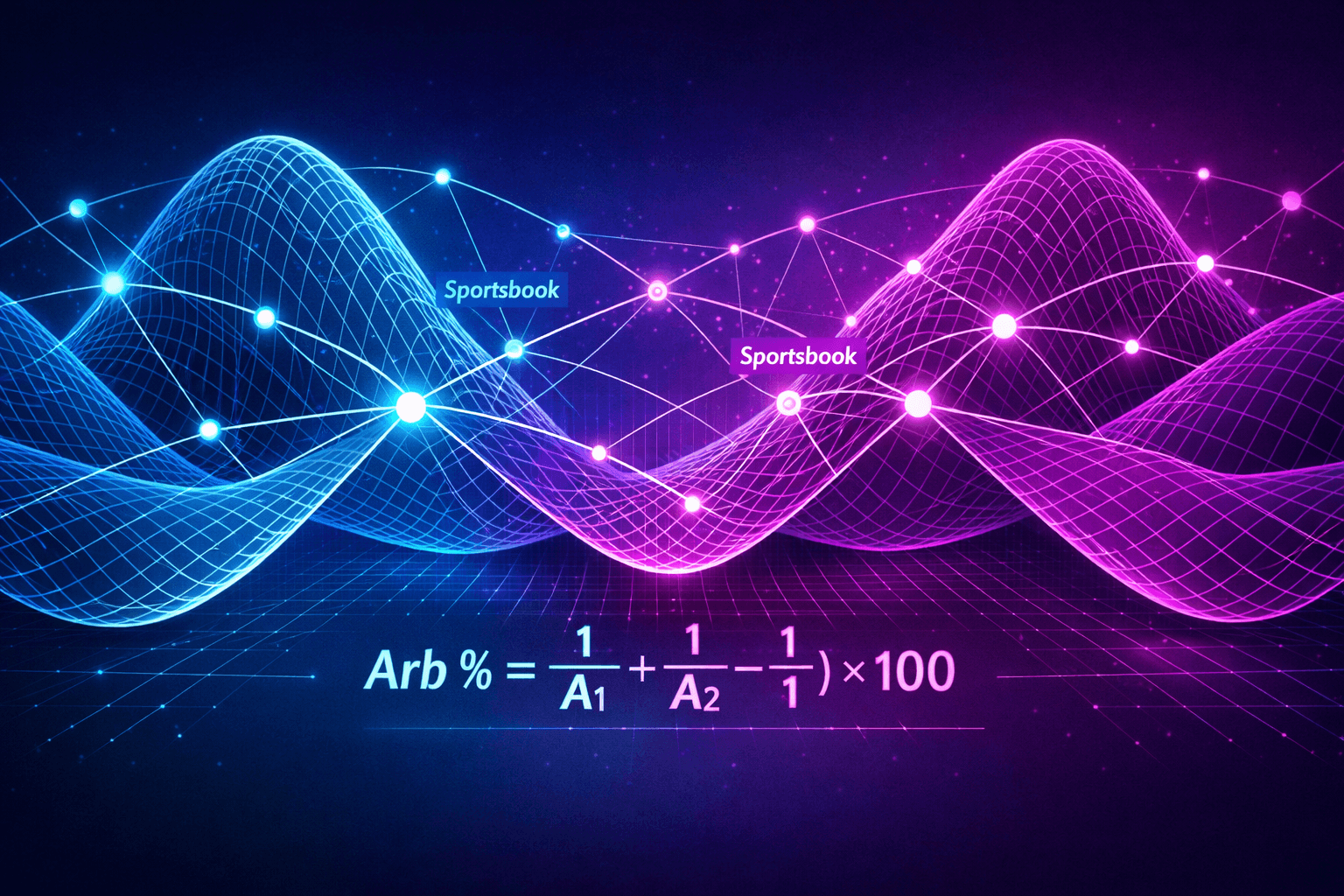

Calculating the Arbitrage Percentage

To identify an arb, you must convert the decimal odds of all mutually exclusive outcomes into an arbitrage percentage ().

If (or 100%), you have a profitable opportunity. The profit margin () is calculated as:

Example Scenario:

- Book A: Kansas City Chiefs Moneyline at 2.10 (+110)

- Book B: Buffalo Bills Moneyline at 2.05 (+105)

Because 0.964 is less than 1.0, this is a 3.73% arbitrage opportunity. By betting on both sides proportionally, you guarantee a return of approximately 3.73% on your total investment, regardless of who wins the game.

Types of Arbitrage Opportunities#

While the classic 2-way Moneyline arb is the most common, sophisticated bettors look for discrepancies across various market types to avoid detection and increase volume.

1. Two-Way Markets

This involves two outcomes (Win/Loss, Over/Under). These are the simplest to execute and calculate. Common markets include NBA spreads, NFL totals, and Tennis moneylines.

2. Three-Way Markets

Common in soccer (1X2) or hockey (Regulation Time), three-way arbs require covering the Home Win, Draw, and Away Win. These are often harder to execute manually due to the speed required to hit three distinct buttons, but the margins can be significantly higher because liquidity is often split unevenly across books.

3. Cross-Market Arbs

This is where market knowledge separates the pros from the amateurs. A cross-market arb might involve betting a team on the Moneyline at one book and betting the opposing team +0.5 spread (Double Chance) at another. While technically different markets, they cover all logical outcomes.

Execution: The Speed of the Market#

The sports betting market is liquid and dynamic. Arbitrage opportunities are ephemeral inefficiencies; they exist only until the market corrects itself or until enough sharp money hits the line to force a move.

The Role of Technology

Manual arbing—scanning screen to screen—is largely dead for high-volume bettors. The latency between identifying a price at Book A and confirming the price at Book B is often where opportunities die. To compete, you need automated tools.

Using an Arbitrage Finder automates the discovery process, scanning hundreds of books in real-time to highlight discrepancies the moment they appear. This reduces the "execution risk" of placing the first leg of a bet only to find the odds have shifted on the second leg, leaving you with an unguarded, negative expected value (EV) position.

Managing Bankroll and Staking#

Once an arb is identified, proper staking is non-negotiable. You cannot simply bet $100 on both sides; you must weight your stakes based on the odds to ensure equal payout.

The Staking Formula

To calculate the stake for Outcome A () based on a total investment ():

Using our previous Chiefs/Bills example with a $1,000 total bankroll:

- Chiefs Stake: (1000 \times 0.964) / 2.10 = \459.05$

- Bills Stake: (1000 \times 0.964) / 2.05 = \470.24$

Note: In practice, betting $459.05 is a red flag (more on this in the Limits section). You would round these stakes to $460 and $470, accepting a microscopic variance in profit for the sake of account longevity.

Account Longevity and "The Limiting Game"#

The biggest downside to arbitrage betting is not financial risk, but operational risk. Sportsbooks despise arbers. If a trading team identifies your account as one that only bets lines that are off-market, they will limit your maximum wager to pennies, effectively banning you.

Flags to Avoid

- Decimal Betting: Betting $459.05 screams "I am using a calculator." Always round your bets to the nearest $5 or $10.

- Betting Obscure Markets: Max betting a WNBA 3rd quarter total or a Table Tennis prop is the fastest way to get flagged. Stick to main markets (NFL, NBA, MLB) where volume is high, and your bet is a drop in the ocean.

- Always Taking the Top Price: If you constantly hit lines the second they move, or lines that are clearly mistakes (palps), you will be marked.

- Withdrawal Frequency: Constant withdrawals prevent you from building the bankroll needed to sustain high-volume arbing. It also triggers manual account reviews.

The "Soft" vs. "Sharp" Ecosystem

To arb successfully, you generally need one "soft" book (a recreational sportsbook with slow-moving lines) and one "sharp" book (a market-maker like Pinnacle or Circa).

- The Soft Book: This is where you find the "off" price. This is the account you must protect.

- The Sharp Book: This is where you hedge. Sharp books generally welcome winners and high volume, as they use that information to shape their own lines. You typically do not need to worry about being limited here.

The Risks: It’s Not Entirely Risk-Free#

While the math is risk-free, the execution is not.

1. Legging Out (Price Changes)

This occurs when you place the first bet, but before you can place the second, the odds change or the market locks.

- Mitigation: Always place the bet at the "soft" book first, as they are more likely to move the line or reject the bet. If the sharp book moves, you can usually still hedge for a small loss or scratch (break-even).

2. Palpable Errors (Palps)

If a book accidentally posts a line of +500 instead of -500, and you arb it, they have the right to void that bet after the game starts. If your hedge bet at the other book stands and loses, you face a massive loss.

- Mitigation: Avoid arbs that look "too good to be true" (e.g., margins over 5-10% on major markets usually indicate an error, not an inefficiency).

3. Rule Differences

Different books have different rules for sports like Tennis (retirement rules) or Baseball (pitcher action vs. listed pitcher). If one book voids the bet and the other grades it as a loss, you are exposed.

- Mitigation: Read the house rules. Only arb across books with identical grading policies for that specific sport.

Transitioning from Arbing to Value Betting#

Arbitrage is often the gateway drug to +EV (Expected Value) betting.

When you find an arb, it usually means one book is wrong and the other is right. In arbitrage, you bet both to lock in a small profit. In +EV betting, you simply bet on the "wrong" line (the value side) and ignore the hedge.

Over time, naked value betting yields higher returns than arbitrage because you aren't paying the vig on the hedge bet. However, it introduces variance. Many pros use an arbitrage tool not to hedge, but to identify which lines are off-market, and then hammer that specific side.

Conclusion#

Arbitrage betting is a powerful tool for bankroll building and understanding market dynamics. It requires discipline, speed, and a professional approach to account management. It is not a get-rich-quick scheme, but a grind that rewards precision.

For those ready to stop gambling and start investing, the path begins with identifying the inefficiencies the market leaves behind. Whether you use it to secure risk-free ROI or as a signal for value betting, understanding arbitrage is a prerequisite for any serious sports bettor.

Frequently Asked Questions

Is arbitrage betting illegal?▼

How much money do I need to start arbitrage betting?▼

What is the risk of 'legging out' in arbitrage?▼

Why do sportsbooks limit arbitrage bettors?▼

Can I arbitrage bet on live games?▼

Related Articles

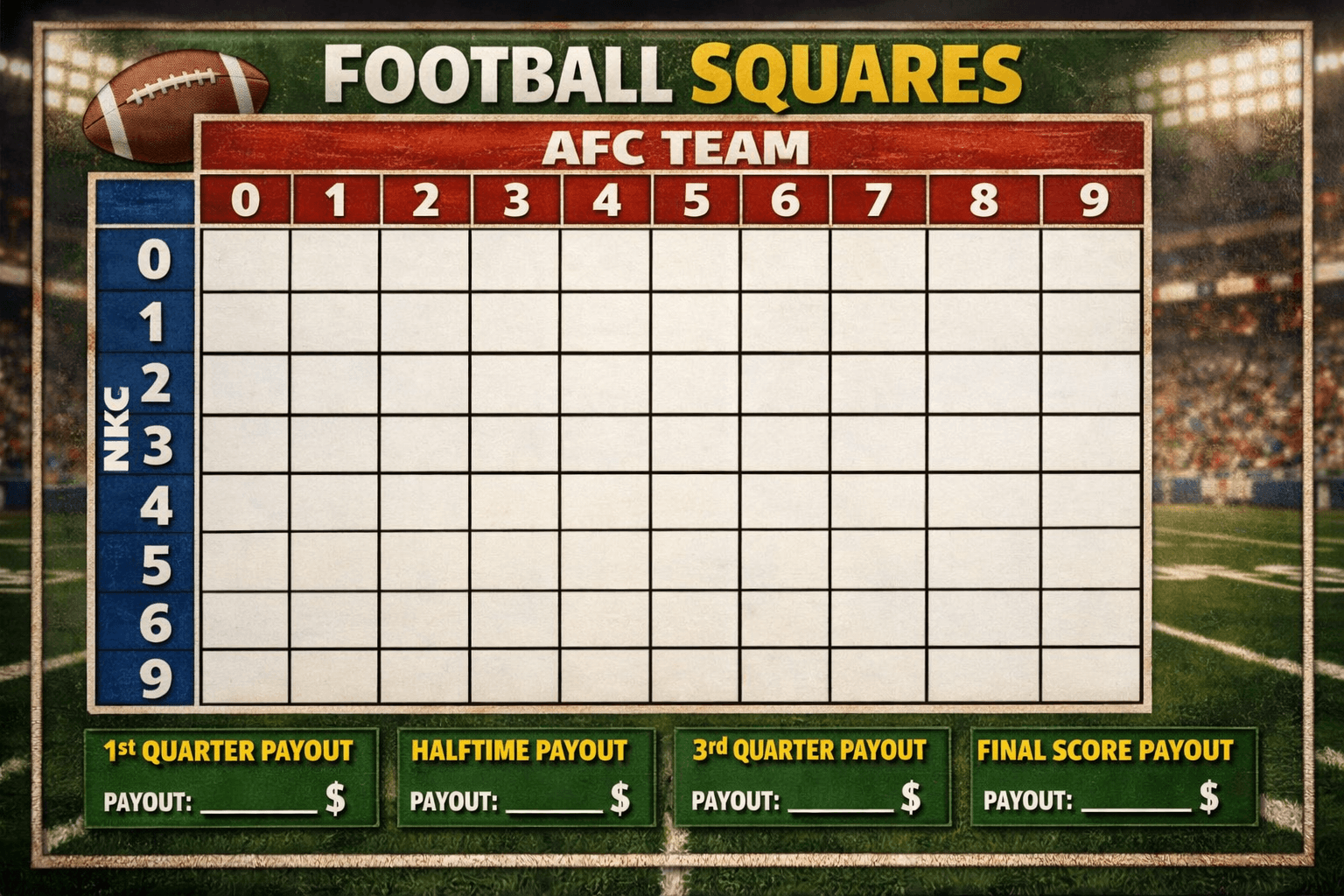

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

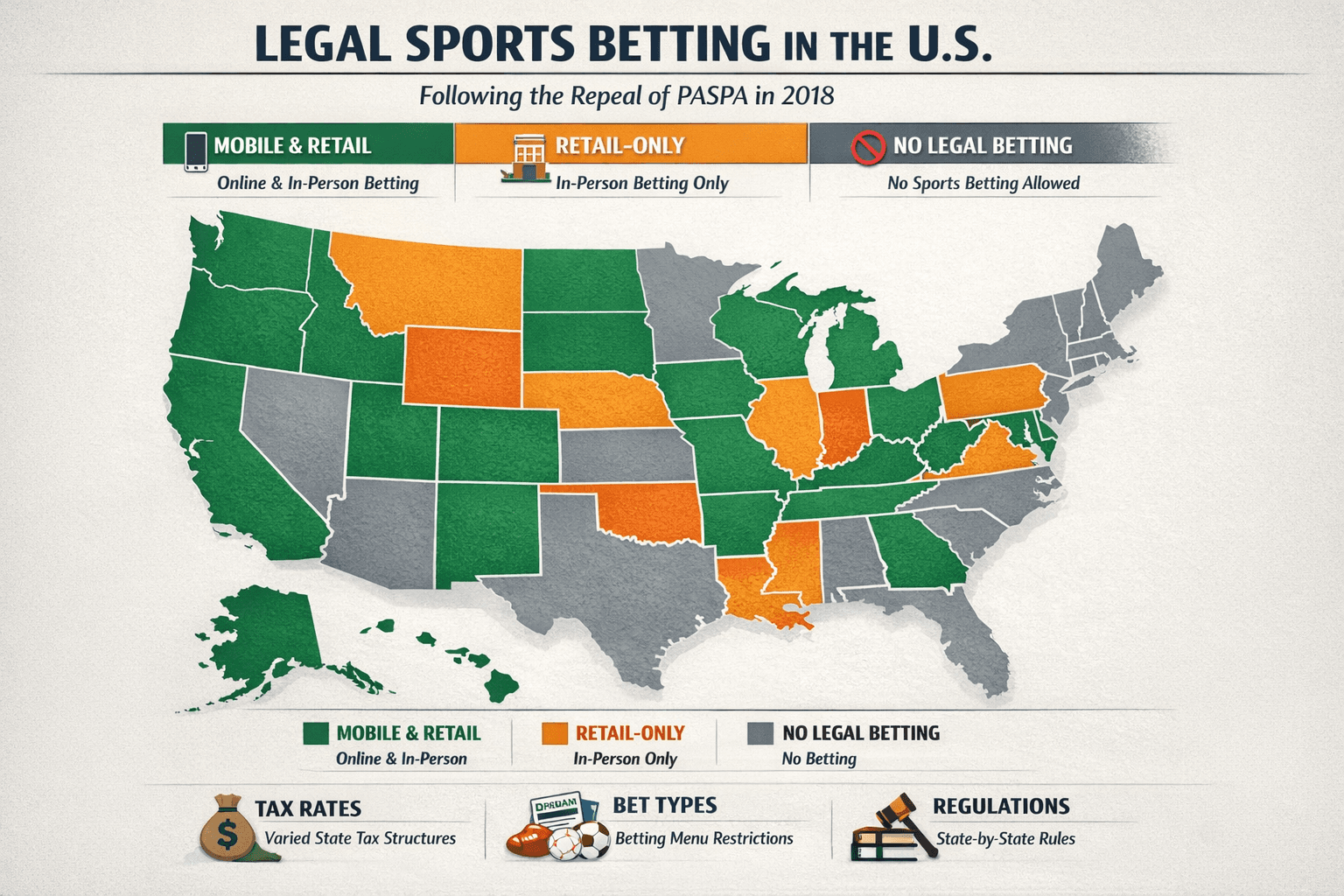

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.