Legal Sports Betting States: 2026 Definitive Sharps Guide

Key Takeaways

- The Mobile vs. Retail Divide: True liquidity exists only in states with full mobile betting (NJ, NY, PA, IL); retail-only or 'on-premise mobile' states (MS, WA) are inefficient for volume betting.

- The Prop Ban Wave: A growing number of states (OH, MD, LA, NY) have banned college player props, removing a key soft market for +EV bettors.

- The Monopoly Problem: States like Florida (Hard Rock) and Delaware operate with limited or single operators, eliminating line shopping and arbitrage opportunities within the state.

- Taxation Impacts Pricing: High-tax jurisdictions like New York (51%) often see worse promotional offers and faster limiting of sharp accounts compared to low-tax states like Iowa or Nevada.

Definition

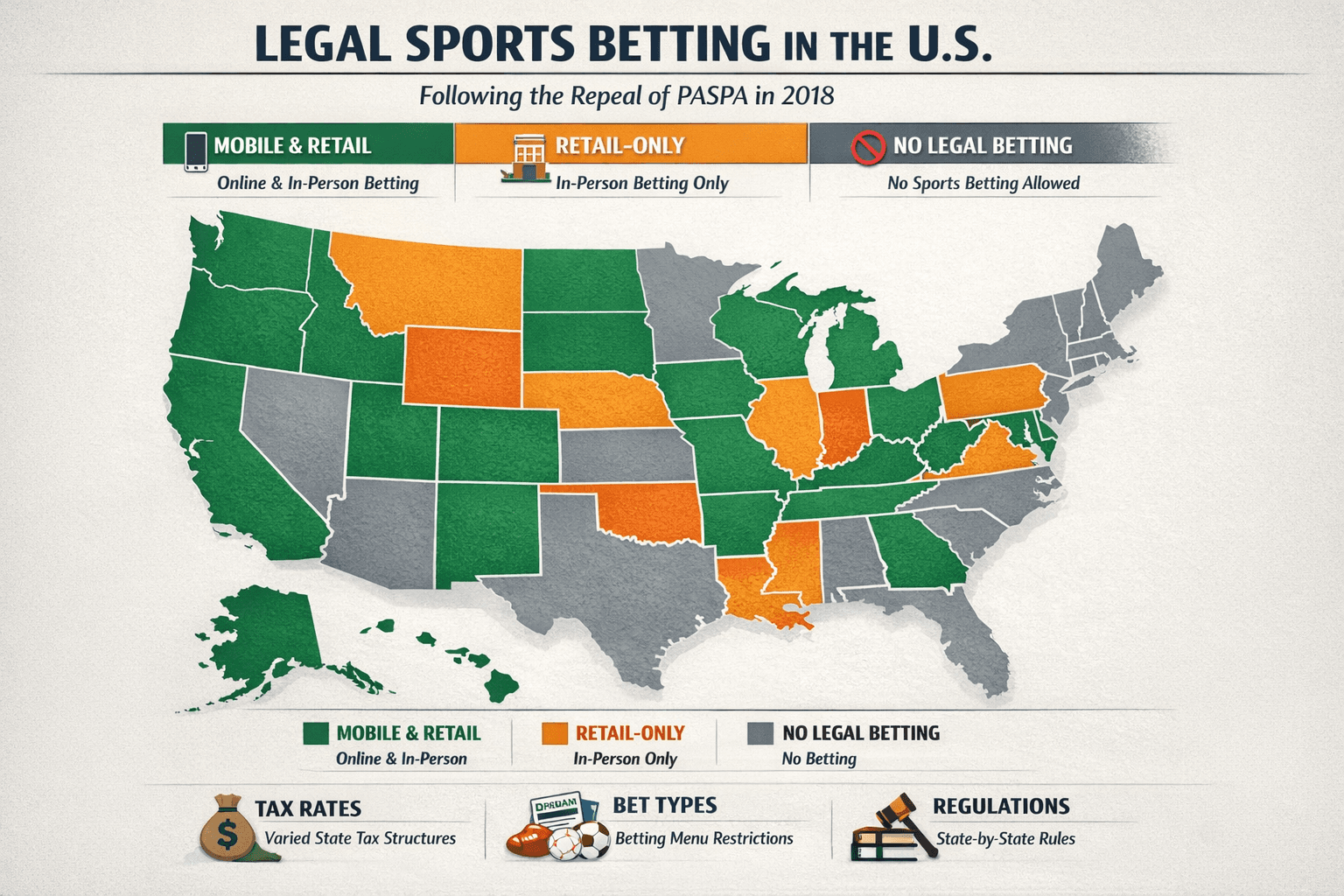

Legal sports betting states are U.S. jurisdictions that have enacted legislation to regulate and tax sports wagering following the repeal of PASPA in 2018. These markets are categorized by their accessibility (mobile/online vs. retail-only), tax structures, and specific betting menu restrictions.

Table of Contents

For the casual fan, a map of legal sports betting states is just a list of places where they can download an app. For the sharp bettor, semi-pro, or advantage player, this map is a liquidity heatmap. It tells you where the edges are, where the limits are highest, and where the regulatory environment is squeezing the juice out of the markets.

As of early 2026, the landscape has shifted dramatically. With Missouri officially joining the mobile ranks in late 2025 and Florida solidifying its unique monopoly model, the US market is maturing. However, maturity brings complexity. State regulators are increasingly clamping down on player props, and tax rates in certain jurisdictions are forcing books to widen their vig.

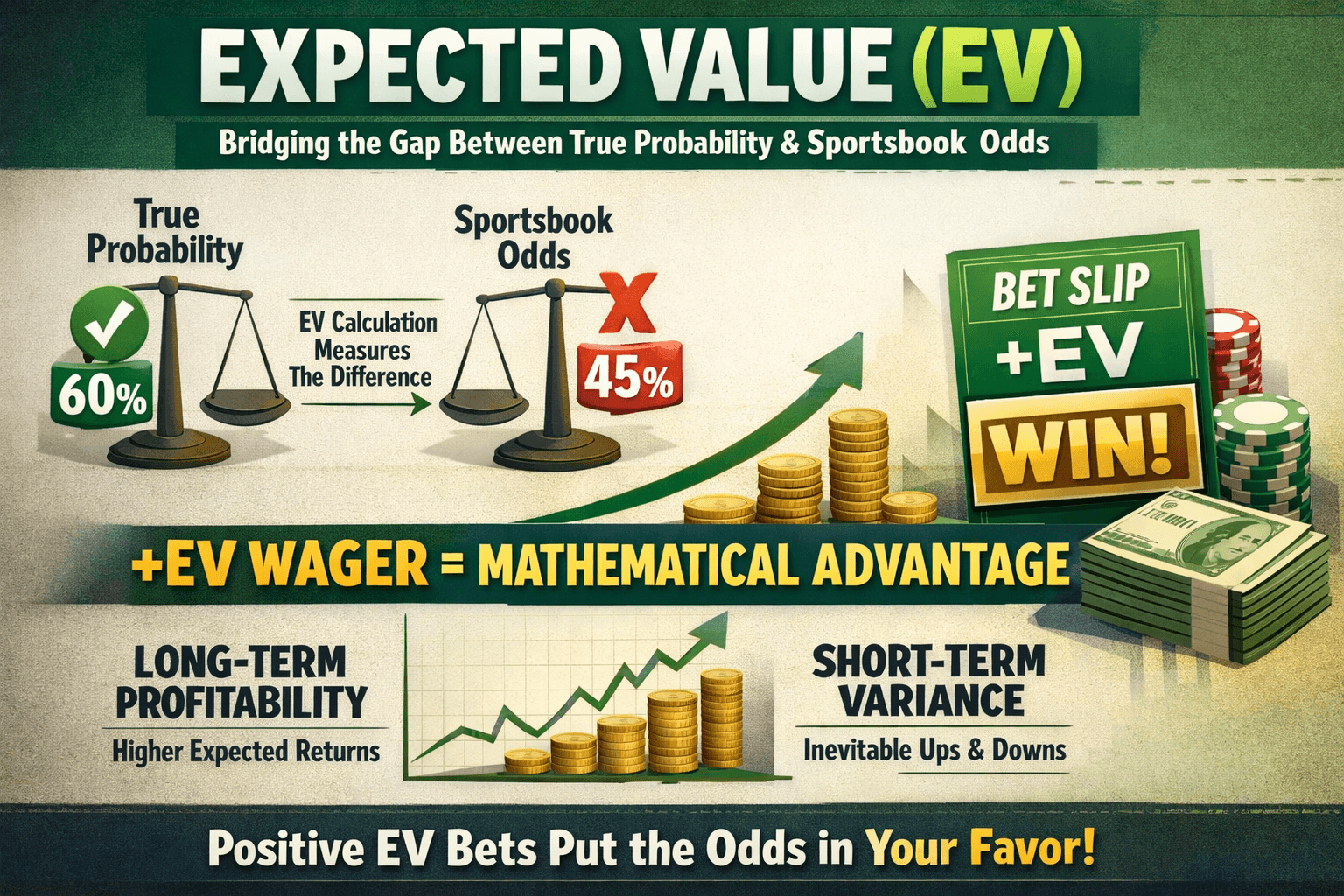

This guide isn’t just about where you can bet; it’s about how state regulations impact your bottom line and how to use tools like the Live +EV Feed to exploit these regional inefficiencies.

The "Green Zone": Prime Mobile Markets#

These states offer full mobile betting with multiple operators (skins). This competition is vital for sharps because it creates arbitrage opportunities and allows for extensive line shopping.

The "Big Three" (Volume Leaders):

- New York: The volume king, but with a catch. The 51% tax rate means books are tighter with promos and quicker to limit winning players.

- New Jersey: The ancestral home of US betting. Still the gold standard for book diversity and liquidity.

- Nevada: The legacy market. Requires in-person registration for most apps, which keeps the purely digital "bonus hunters" out, but remains essential for high-limit access.

High-Value Competitive Markets:

- Pennsylvania, Illinois, Ohio, Massachusetts: Robust markets with plenty of skins.

- Colorado: A haven for niche operators and exchange-based betting experimentation.

- Michigan, Arizona, Tennessee, Virginia: Solid liquidity, standard regulatory frameworks.

- North Carolina & Kentucky: recent additions that have stabilized with strong multi-operator environments.

- Missouri: The newest entrant (Dec 2025 launch), bridging the gap in the Midwest.

The "Yellow Zone": Retail-Only & Monopoly Markets#

These states are legal, but they present significant friction for the serious bettor.

The Monopoly Model:

- Florida: Dominated by the Seminole Tribe (Hard Rock Bet). While liquidity is high due to population size, the lack of competition means zero arbitrage potential within state lines. You pay the price the monopoly dictates.

- Washington D.C.: Initially a monopoly (GambetDC), it has opened up to major operators (FanDuel/DraftKings/Caesars) recently, effectively graduating it toward the "Green Zone," though regulatory quirks remain.

The Retail Grind:

- Mississippi: Technically allows mobile betting, but only while physically located on casino property. For a sharp, this is effectively a retail-only state.

- Nebraska, Wisconsin, Washington State: Primarily tribal retail locations. Inefficient for high-volume automated betting strategies.

The "No-Fly Zone": Strict Prop Restrictions#

This is the most critical trend for 2026. Regulators, bowing to concerns about athlete harassment, have aggressively banned College Player Props.

If your strategy relies on finding edges in NCAAF or NCAAB player performance markets (often the softest markets available), you cannot operate in these states:

- Ohio

- Maryland

- Louisiana

- Vermont

- Massachusetts (Banned on in-state teams)

- New York (Strict prohibition)

- Colorado

- Arizona

- Pennsylvania

Strategy Note: If you live in a restricted state like Ohio, using the Correlation Matrix or Parlay Builder on EdgeSlip often requires shifting focus to NFL/NBA props or strictly mainline college markets (Spreads/Totals) where the edges are sharper but still beatable.

The Legislative Horizon: What to Watch in 2026#

- Texas: The white whale. Despite massive lobbying, the timeline remains stuck. The legislature meets biennially, and 2025 sessions yielded no breakthrough. We are looking at 2027 for the next realistic shot. Texans are currently limited to DFS and Pick'em apps.

- California: Dead in the water. The war between tribal interests and commercial operators scorched the earth in 2022/2024. No immediate movement expected.

- Georgia: Perpetual "maybe." Political gridlock continues to stall bills despite strong support from Atlanta pro teams.

- Minnesota: The last Midwest holdout. Tribal exclusivity negotiations are the bottleneck.

Why Multi-State Access Matters#

For the pro bettor, geography is a tool. "State hopping" or having partners in different jurisdictions allows you to:

- Dodge Limits: A book might limit you in NJ but have a fresh profile for you in PA.

- Tax Arbitrage: Betting in low-vig states (like Iowa) vs. high-tax states (like NY) can save percentage points on your long-term ROI.

- Access Niche Books: Accessing a book like Circa (available in NV, CO, IL, IA, KY, MO) allows for higher limits and a "we welcome winners" model that soft books don't offer.

Summary#

The map is filling in, but the walls are getting higher. State-specific rules regarding props and taxes are creating micro-markets that behave differently. Success in 2026 requires knowing not just if a state is legal, but what the specific rules of engagement are in that jurisdiction.

Frequently Asked Questions

Which states have legal mobile sports betting in 2026?▼

Is sports betting legal in Texas or California yet?▼

Can I bet on college player props in every legal state?▼

Do I have to live in a state to bet legally there?▼

Why are odds different in different states?▼

Related Articles

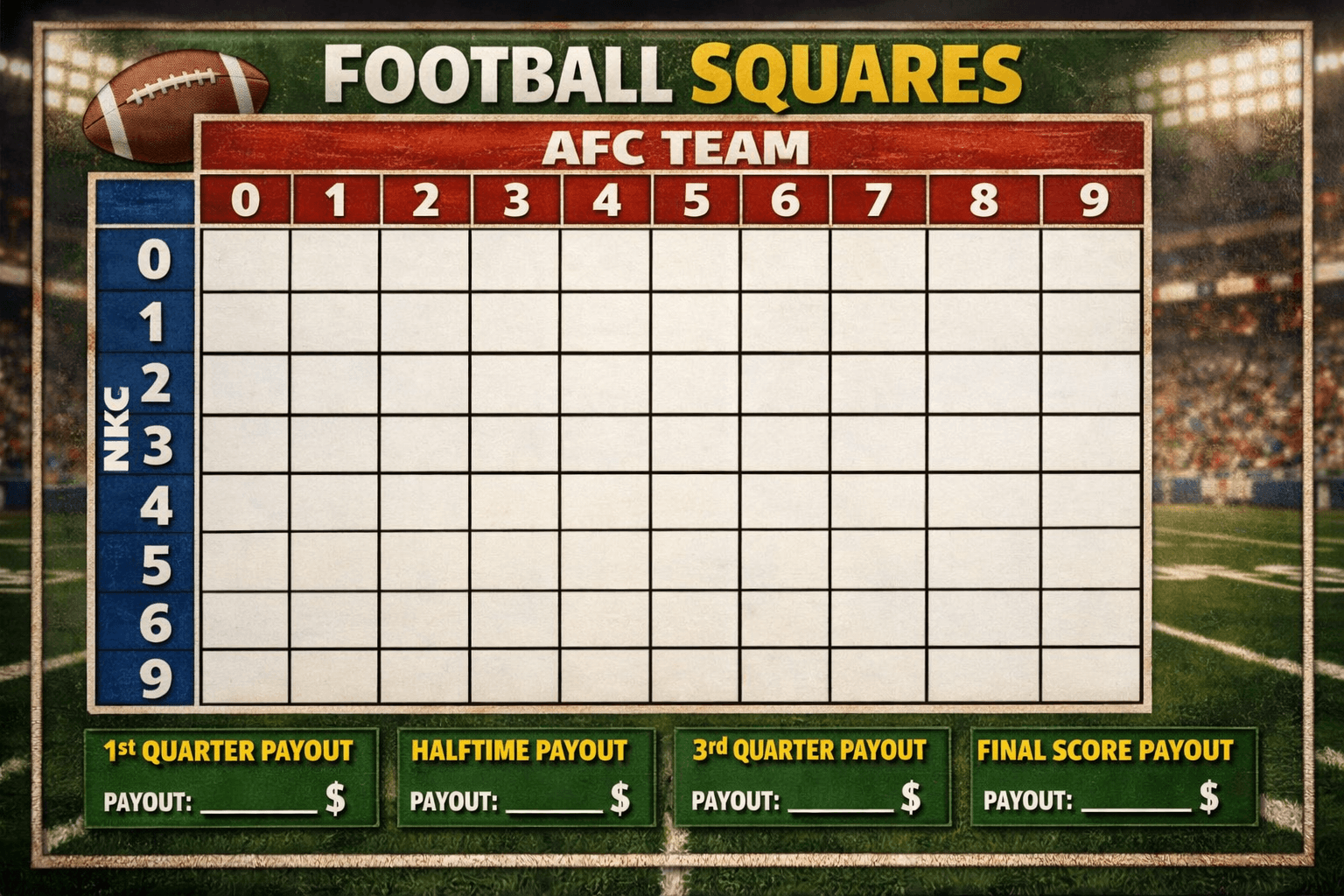

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

How to Find Expected Value (+EV): The Mathematical Edge

Stop guessing and start trading. Learn how to find Expected Value (+EV) in sports betting using probability theory, market de-vigging, and line shopping.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.