How to Find Expected Value (+EV): The Mathematical Edge

Key Takeaways

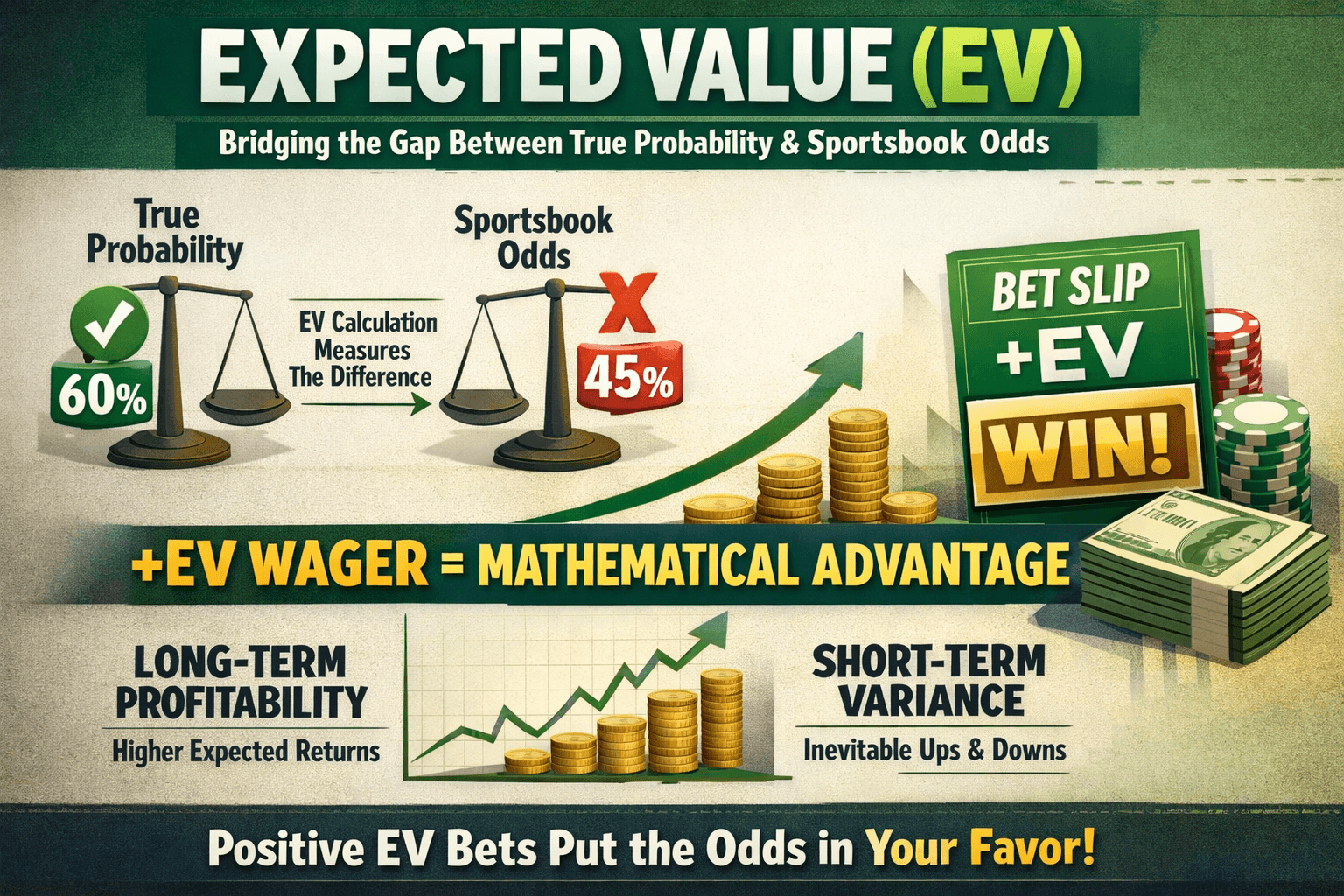

- Definition of Value: +EV is the mathematical difference between the true probability of an event and the implied probability of the odds offered.

- The Formula: EV is calculated as (Probability of Winning × Profit) - (Probability of Losing × Stake).

- Market Efficiency: The most reliable way to find 'True Probability' is by de-vigging the lines from sharp sportsbooks (Market Makers).

- Volume is King: +EV betting requires a large sample size (Law of Large Numbers) to overcome short-term variance.

- Closing Line Value: The ultimate feedback loop for checking your process is whether you consistently beat the closing line (CLV).

Definition

Expected Value (EV) is a calculation that measures the gap between the true probability of an event occurring and the probability implied by the sportsbook's odds. A positive EV (+EV) wager indicates a scenario where the bettor has a mathematical advantage over the house, ensuring long-term profitability despite short-term variance.

Table of Contents

Most sports bettors operate under a fundamental misconception: they believe their goal is to "pick winners." This is a fallacy. In a probability-based market, picking a winner is irrelevant if the price you paid for that winner was too high.

The goal of a professional bettor is not to predict the future, but to identify mispriced assets. This is known as Expected Value (+EV) betting.

If you treat sports betting as gambling, you will lose to the vigorish (the house edge) over time. If you treat it as an investment market—similar to stocks or options—you realize that value is the only metric that matters. This guide serves as the definitive technical framework for calculating, identifying, and exploiting Expected Value in sports betting markets.

The Mathematics of Expected Value#

At its core, Expected Value measures the average outcome of a random variable over a large number of trials. In betting, it answers a simple question: If I placed this exact bet 1,000 times, would I make money or lose money?

The formula for EV is straightforward:

Where:

- is the true probability of winning.

- is the amount you stand to win (excluding your stake).

- is the true probability of losing (or $1 - P_{win}$).

- is the amount you are risking.

A Theoretical Example

Imagine a coin flip. The true probability of Heads is exactly 50% ($0.50$).

- Scenario A: A friend offers you odds of +100 (Decimal 2.00) on Heads. You bet $100 to win $100. Over time, you break even. The EV is $0$.

- Scenario B: A friend offers you odds of +110 (Decimal 2.10) on Heads. You bet $100 to win $110.

In Scenario B, every time you flip that coin, you are mathematically "earning" $5.00, regardless of the individual result. This is a +5% EV wager.

The Hard Part: Finding "True" Probability#

The EV formula is easy to solve. The difficulty lies in the variable (True Probability). Unlike a coin toss, sports do not have fixed physical probabilities.

To find EV, you must determine the "True Odds" of an event better than the sportsbook offering the line. There are two primary schools of thought for establishing this benchmark: Bottom-Up and Top-Down.

1. The Bottom-Up Approach (Origination)

This is the "Moneyball" approach. You build your own statistical models (using Python, R, or Excel) to simulate the game and generate your own probability.

- Process: Your model simulates the Chiefs vs. Ravens game 10,000 times and determines the Chiefs win 55% of the time.

- Comparison: The sportsbook implies the Chiefs have a 50% chance of winning.

- Result: You have identified an edge based on your data.

The downside: Originating lines that are sharper than multi-billion dollar sportsbooks is incredibly difficult. For 99% of bettors, this is not the most efficient path to +EV.

2. The Top-Down Approach (Market Based)

This is the approach used by most modern sharps and is the logic behind the EdgeSlip Live +EV Feed.

Instead of trying to outsmart the sportsbooks with physics equations, you rely on the Efficient Market Hypothesis. You assume that the sharpest sportsbooks in the world (like Pinnacle or Circa Sports) have the most accurate lines because they accept the highest limits and welcome professional action.

When a sharp book moves their line, it represents the "True Market Price." If a recreational book (like DraftKings, FanDuel, or BetMGM) hasn't moved their line yet, that lag creates +EV.

Step-by-Step: How to Calculate EV Using Market Width#

To calculate EV using the market-based approach, you must "de-vig" the sharp lines. Sportsbooks add a margin (vig/juice) to their odds to ensure profit. To find the true probability, you must remove this margin.

Step 1: Identify the Sharp Line

Let's say Pinnacle has the following line for an NBA game:

- Over 220.5: -105 (Decimal 1.952)

- Under 220.5: -105 (Decimal 1.952)

Step 2: Calculate Implied Probability (With Vig)

Convert American odds to implied probability:

For -105:

Since both sides are -105, the total market probability is $51.22% + 51.22% = 102.44%$. The 2.44% over 100% is the vigorish (the house edge).

Step 3: Remove the Vig (Devigging)

To find the Fair probability (True Probability), we normalize the percentages to equal 100%.

In this balanced market, the true probability of the Over hitting is exactly 50%. The "Fair Odds" (No-Vig Odds) are +100.

Step 4: Compare to Soft Books

Now, you scan the market (Line Shopping). You find a recreational sportsbook offering:

- Over 220.5: +105 (Decimal 2.05)

Step 5: Calculate the Edge

You know the true probability is 50% ($0.50).

This is a +2.5% EV bet. Over the long run, for every $100 you wager on this line, you expect to profit $2.50.

The Role of Variance and CLV#

Understanding EV requires a strong stomach for variance. A bet with +5% EV is an excellent wager, but it still might lose 45% of the time.

The Law of Large Numbers

EV only materializes over a significant sample size. You cannot judge a strategy based on 10, 50, or even 100 bets. You need thousands of wagers for the actual results to converge with the expected value.

Closing Line Value (CLV)

How do you know if your +EV calculation was correct? You look at the Closing Line. If you bet the Patriots at -3 (-110) and the line closes at Patriots -4 (-110), you beat the closing line. The market moved in your favor, confirming that you bought the asset at a discount. Consistently beating the closing line is the strongest indicator of a winning long-term bettor.

Practical Tips for Finding +EV#

Use an Odds Screen

Manually calculating EV for thousands of markets is impossible. Use an odds screen or a line shopper to visualize discrepancies between books instantly.

Understand Market Liquidity

Not all sharp lines are equal. A line on an NFL Sunday morning is much "sharper" (more efficient) than a line on a Tuesday afternoon. Betting +EV early in the week allows you to capture value before the market corrects, but the limits may be lower.

Avoid "Synthetic" Hold

When calculating EV on futures or multi-way markets (like "First Touchdown Scorer"), be aware that the vig is often significantly higher (sometimes 20-30%). De-vigging these markets requires different formulas than standard 2-way markets.

Bankroll Management

Finding +EV is useless if you go bankrupt during a downswing. Combine +EV betting with the Kelly Criterion, which dictates optimal bet sizing based on your edge. If your edge is higher, you bet more. If your edge is slim, you bet less.

Conclusion#

Finding Expected Value is the separation point between hobbyists and profit-seekers. It requires abandoning team loyalty and gut feelings in favor of cold, hard math. By utilizing the market-based approach—using sharp books to define truth and soft books to execute trades—you turn sports betting into a solvable math problem.

Frequently Asked Questions

What is a good Expected Value (EV) percentage in sports betting?▼

How do you calculate implied probability from American odds?▼

Can you make money with negative EV betting?▼

What is 'devigging' in sports betting?▼

Does +EV guarantee a win?▼

Related Articles

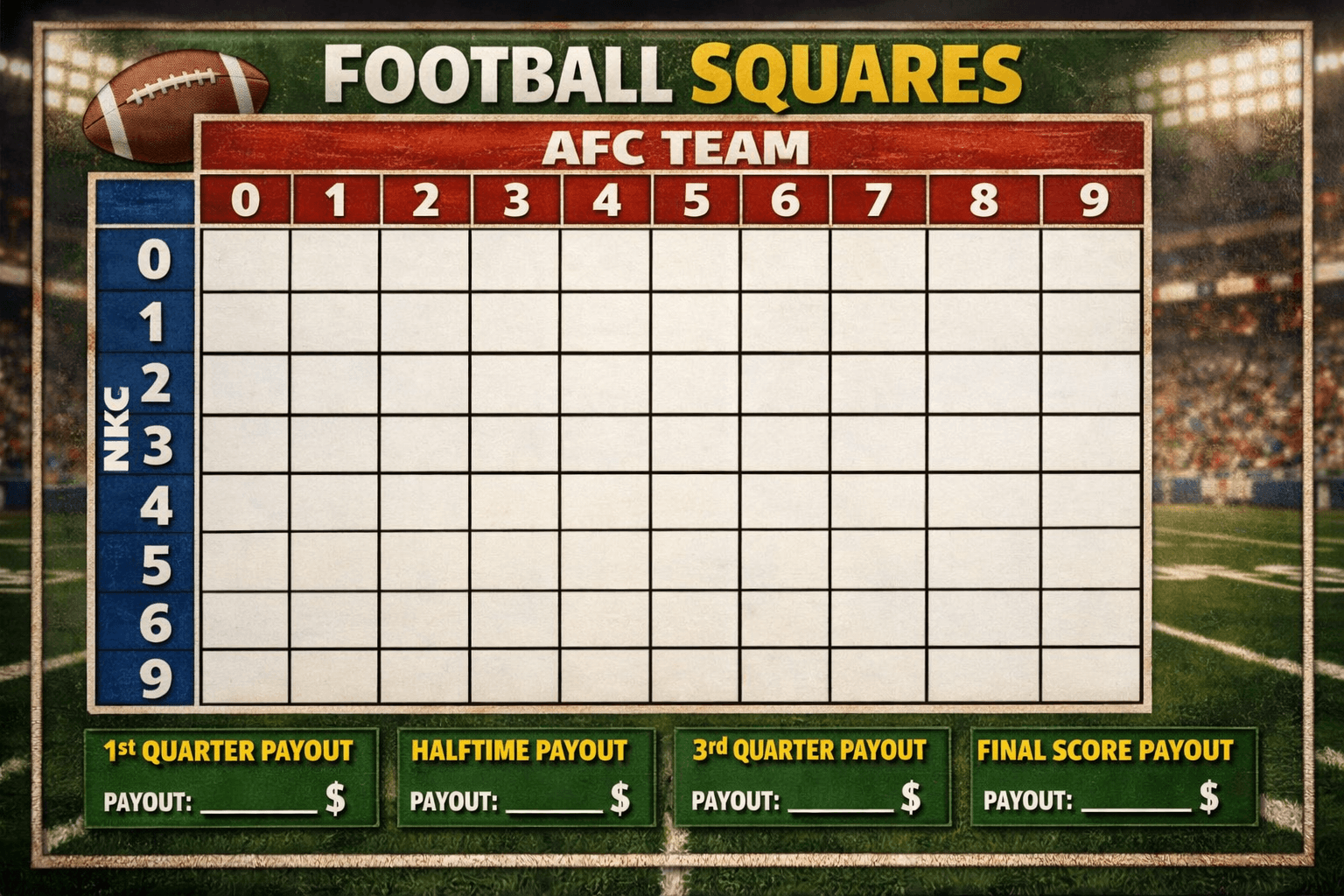

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

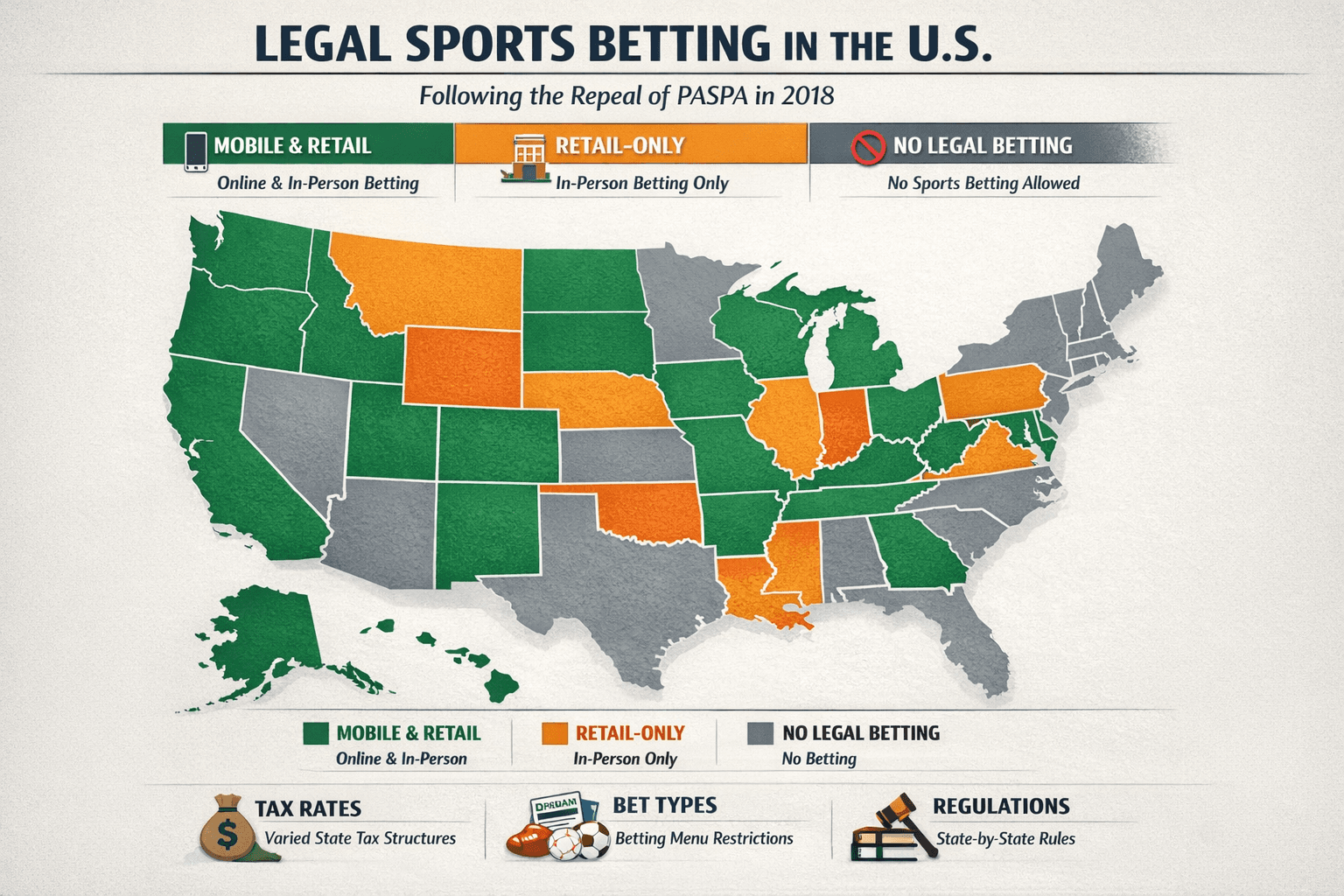

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.