Alt Markets Explained: Exploiting Derivatives for +EV Betting

Key Takeaways

- The Definition: Alt markets are derivative wagers that allow bettors to adjust the standard spread or total to a different number, exchanging implied probability for different odds.

- The Trap: Buying points (e.g., moving -3.5 to -2.5) is rarely mathematically profitable due to the heavy juice premiums charged by sportsbooks.

- The Edge: Selling points (increasing risk for higher payouts) exploits 'fat tail' distributions where the probability of a blowout or high-scoring performance is higher than the sportsbook's linear pricing model suggests.

- The Strategy: Correlated parlays using alt lines (e.g., Alt Underdog Spread + Alt Under Total) allow sharps to exploit pricing models that fail to account for the true relationship between game state and scoring pace.

- The Execution: Alt markets often suffer from 'price lag,' meaning they update slower than main lines during steam moves, creating windows to bet stale numbers before the market corrects.

Definition

Alt markets (alternative markets) are derivative betting lines that deviate from the standard consensus spread, total, or moneyline. They allow bettors to "buy" or "sell" points to adjust risk exposure and implied probability, often exposing inefficiencies in a sportsbook's pricing model for tail-end outcomes.

Table of Contents

If you are strictly betting main lines—standard NFL spreads, NBA totals, or MLB money lines—you are swimming in the most efficient, shark-infested waters in the world. The closing line on an NFL spread is arguably the most accurate financial price on the planet, often more efficient than the stock market. Beating it long-term requires an elite model and razor-sharp timing.

Alt markets are different.

Alternative markets (alt markets) represent the derivative pricing of outcomes outside the consensus median. While the bookmakers spend millions of dollars and computing power to ensure the main line (e.g., Chiefs -3.5) is perfect, the pricing curve that determines the odds for Chiefs -7.5, -10.5, or -14.5 is often algorithmic, static, and exploitable.

For the data-driven bettor, understanding "what are alt markets" is not about knowing you can bet a different number; it is about understanding volatility, distribution shapes, and correlation. This guide will move beyond the basics and dissect how to mathematically exploit alternative lines.

Defining the Alt Market Landscape#

In technical terms, an alt market is any wager where the bettor chooses a specific strike price (spread or total) different from the bookmaker's equilibrium line, accepting adjusted odds in return.

If the main line for an NBA game is Celtics -4.5 (-110), the alt markets might look like this:

- Selling Points (Increasing Risk/Reward): Celtics -8.5 (+180)

- Buying Points (Decreasing Risk/Reward): Celtics +1.5 (-220)

While recreational bettors use alts to "play it safe" (buying points to turn a loss into a push), sharps use alts to attack pricing errors in the probability distribution.

The Mathematics of "Buying" vs. "Selling"#

The most common misconception in sports betting is that buying points is a safety mechanism. Mathematically, buying points is expensive insurance that rarely pays out at fair value.

The "Hook" Premium

Bookmakers charge a premium for key numbers (like 3 and 7 in the NFL). Buying a line from -3.5 to -2.5 might cost you 25 to 30 cents of juice (moving from -110 to -140).

- The Math: To justify that price, the game must land exactly on 3 roughly 10-12% of the time. If the actual frequency of landing on 3 is lower than the implied probability cost of the juice, you are making a -EV (negative expected value) bet.

Selling Volatility (The Sharp Play)

Conversely, "selling" points—taking a worse number for better odds—is often where the edge lies, particularly in high-variance sports like the NBA or in player props.

Consider an NBA player prop:

- Main Line: Luka Dončić Over 32.5 Points (-110)

- Alt Line: Luka Dončić Over 39.5 Points (+260)

If your model suggests Dončić has a "boom/bust" profile for this matchup (e.g., weak rim protection but a high blowout risk), the probability of him scoring 40+ might be higher than the linear degradation of the odds suggests. Sportsbooks often use a standard decay curve for these alt prices. If a player's actual scoring distribution has a "fatter tail" (higher probability of extreme outcomes) than the book's algorithm assumes, the +260 on the alt line offers significantly more expected value than the -110 on the main line.

Exploiting Derivative Inefficiencies#

Alt markets are "derivatives" because their price is derived from the main market. However, the update mechanism is not always instant or accurate.

The Lag Effect

When a main line moves due to sharp money (e.g., a total moves from 220.5 to 223.5), the alt markets often lag behind. A sportsbook's main screen is manually traded; their alt markets are often automated feeds.

- The Play: If you miss a steam move on the main line, check the deep alt markets. You might find an "Alt Total Over 222.5" that hasn't fully adjusted to the new main line price, effectively letting you bet a stale number.

Correlated Parlays and Alt Lines

This is the frontier of modern sharp betting. Correlation occurs when the outcome of one bet influences the likelihood of another.

- Example: If a heavy underdog covers an alternate spread (e.g., +14.5 to +7.5), it is highly correlated with the Under. If the underdog is keeping it close, they are likely slowing the pace and limiting the favorite's scoring.

- The Edge: Many sportsbooks effectively block you from parlaying Main Line Spread + Main Line Total if the correlation is too obvious. However, they often have looser restrictions on Alt Spreads + Alt Totals.

- Strategy: Using a Correlation Matrix, you can identify pairs of events that occur together more often than the implied parlay odds suggest. A "Same Game Parlay" (SGP) combining an Alt Under and an Alt Underdog spread can sometimes yield massive +EV if the book's correlation coefficient is too low.

The Hidden Costs: Limits and Vig#

You cannot discuss alt markets without addressing the liquidity constraint. Because these markets are softer (easier to beat), sportsbooks protect themselves in two ways:

Higher Theoretical Hold (Vig): The "vig" on a main line is typically 4.5%. On alt markets, the vig can explode to 8% or 10%. This means you need a significantly higher win rate to break even. Lower Limits: You might be able to get $5,000 down on an NFL spread, but only $500 on an alternate spread.

Pro Tip: Use an Odds Converter to strip the vig from alt lines and compare the "fair odds" to your model's projections. If the vig-free probability of the alt line is significantly different from your model, you have an edge that overcomes the higher hold.

Alt Markets in Specific Sports#

NFL: The Key Number Game

In the NFL, alt markets are almost exclusively about key numbers (3, 7, 10, 14, 17).

- Strategy: "Teasers" are essentially a form of parlayed alt lines. A "Wong Teaser" involves crossing key numbers (e.g., taking a favorite from -8.5 down to -2.5). This is strictly a mathematical play based on the frequency of margins of victory falling between 3 and 7.

NBA: The Blowout Hedge

NBA spreads are volatile. A team favored by 6 can easily win by 25.

- Strategy: Instead of betting the spread (-6 at -110), split your unit. Put 0.7u on the main line and 0.3u on an Alt Spread of -14.5 at +350. If the favorite crushes, your ROI skyrockets compared to a flat bet. This captures the "fat tail" of the distribution.

MLB: The Run Line Ladder

Baseball is unique because the "main" alt market—the Run Line (-1.5)—is standard. However, "Alt Run Lines" (-2.5, -3.5) offer massive payouts.

- Strategy: In matchups with a top-tier Ace pitcher against a bottom-tier bullpen, "laddering" is effective. You bet the Run Line (-1.5), and smaller amounts on -2.5 and -3.5. If the Ace shuts them down, the bullpen disparity often leads to a multi-run victory margin that main line bettors miss out on.

Integrating Tools for Alt Market Success#

To systematically beat alt markets, you cannot rely on gut feel. You need infrastructure.

Price Discovery: You need to know which book is offering the best price on an alt line. One book might have the Alt Over 25.5 at +150, while another has it at +165. This discrepancy is pure profit margin. A Line Shopper is non-negotiable here. EV Identification: Manually calculating the expected value of an alt line requires complex distribution modeling (Poisson for soccer/hockey, Normal for spreads). Using an automated Live +EV Feed handles this heavy lifting, scanning thousands of derivative markets to flag when an alt price has drifted too far from the true probability. Arbitrage: Occasionally, the difference between Book A's Alt Over and Book B's Alt Under is so wide that you can guarantee a profit. An Arbitrage Finder can spot these rare "risk-free" windows, which are far more common in alt markets than main lines due to the lower liquidity and faster movement.

Conclusion: The Sharp's Portfolio#

Treat alt markets as the "high yield" bond section of your betting portfolio. They carry higher variance and higher transaction costs (vig), but they offer returns that main lines simply cannot match.

Don't just bet on who will win. Bet on how they will win. By analyzing the distribution of outcomes and attacking the tails via alt markets, you stop gambling on a game and start trading on a probability surface.

Frequently Asked Questions

What is the difference between a main line and an alt line?▼

Is buying points in sports betting a good strategy?▼

How do sharps use alternate markets?▼

What is an alternate player prop?▼

Why are limits lower on alternate markets?▼

Related Articles

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

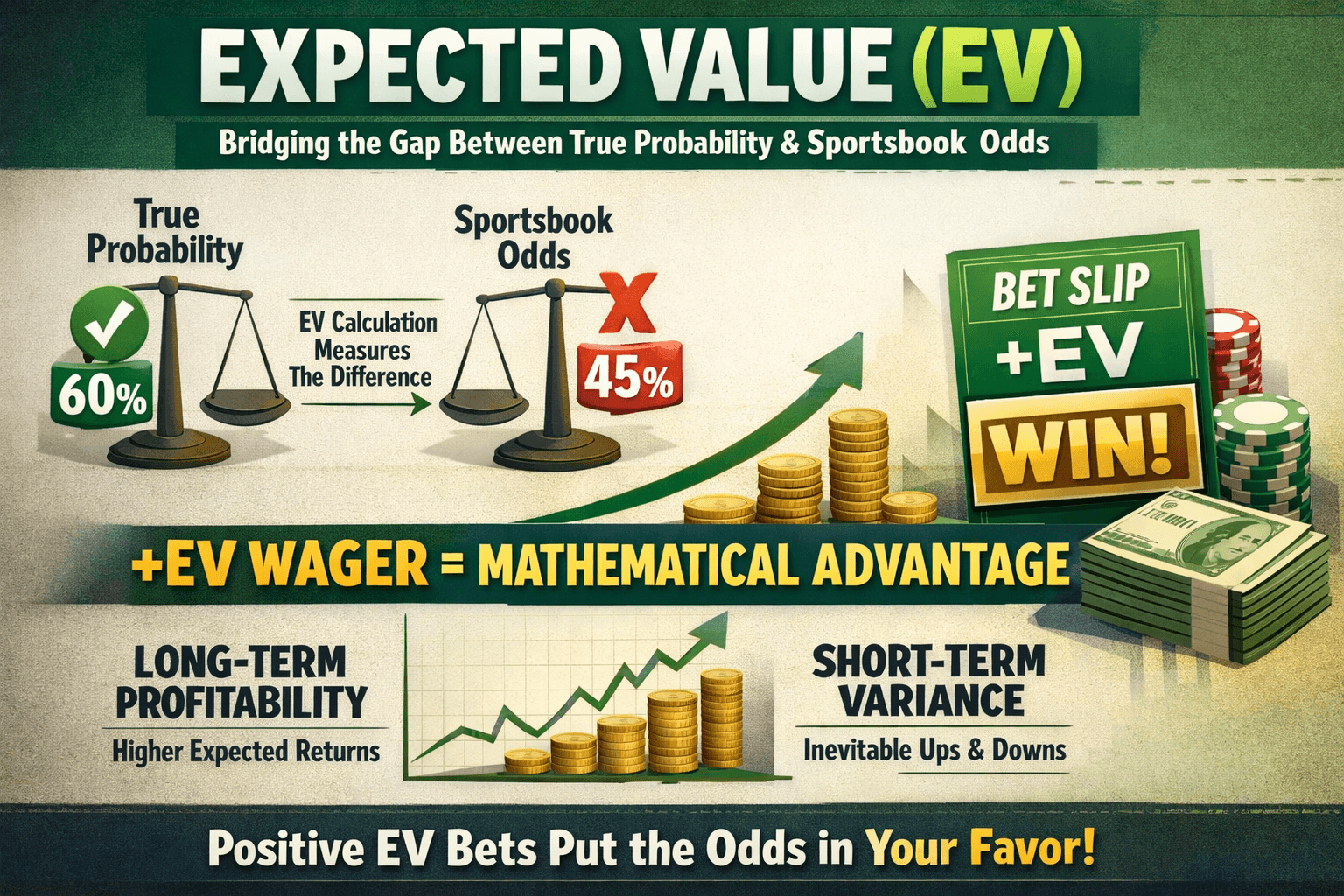

How to Find Expected Value (+EV): The Mathematical Edge

Stop guessing and start trading. Learn how to find Expected Value (+EV) in sports betting using probability theory, market de-vigging, and line shopping.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.