Betting Odds Explained: The Definitive Guide to Implied Probability

.png&w=3840&q=75)

Key Takeaways

- The Definition: Betting odds represent the price of a wager and the implied probability of the outcome, not just a prediction of the winner.

- The Format Hierarchy: Decimal odds are mathematically superior for calculating parlays and total returns, while American odds focus on the $100 baseline.

- The Vigorish: The sum of implied probabilities in a market always exceeds 100%; the difference is the 'vig' or fee charged by the sportsbook.

- Implied Probability: To find value, bettors must convert odds into percentages (e.g., -110 = 52.4%) and compare this against the true probability of the event.

- Breakeven Analysis: Every odd dictates a specific win rate required to be profitable; knowing these thresholds is essential for bankroll management.

Definition

Betting odds are the numerical price required to purchase a position in a sports market, representing the inverse relationship between risk and reward. They explicitly dictate the payout of a winning wager and implicitly reveal the bookmaker's estimated probability of that outcome occurring, adjusted for market vigorish.

Table of Contents

To the casual observer, betting odds are simply predictions—a sportsbook's estimation of who will win a game. To the professional bettor, odds are something entirely different: they are a price.

Just as a stock trader analyzes the P/E ratio to determine if a company is undervalued, a sharp bettor analyzes odds to determine if a market outcome is mispriced. Understanding how to read betting odds is merely the prerequisite; understanding how to deconstruct them into implied probabilities and breakeven rates is where the edge is found.

This guide moves beyond the basics of "plus and minus" signs. We will dissect the mathematical architecture of the three major odds formats, analyze the impact of the "vigorish" (bookmaker fee), and demonstrate how to convert raw numbers into actionable data.

The Core Concept: Odds as Price and Probability#

Before memorizing conversion formulas, it is vital to internalize the relationship between the odds on the screen and the probability they represent.

In an efficient market, the probability of an event occurring is inversely related to the potential return. High probability events offer low returns; low probability events offer high returns.

However, sportsbooks do not offer "true" odds. They offer "market" odds.

- True Odds: The exact statistical probability of an event (e.g., a coin flip is 50/50, or +100).

- Market Odds: The true odds shaded by the bookmaker's commission (vig). A coin flip at a standard sportsbook is priced at -110 on both sides, not +100.

Your goal as a bettor is not to pick winners. It is to identify when the implied probability of the market odds is lower than the true probability of the outcome. This discrepancy is known as Positive Expected Value (+EV).

American Odds (The Moneyline)#

American odds are the standard format used in North America. They are centered around the number 100 and use positive (+) and negative (-) integers to denote the underdog and the favorite, respectively.

Reading the Lines

- Negative Odds (The Favorite): The number indicates how much you must bet to win $100.

- Example:

-150means you must risk $150 to profit $100.

- Example:

- Positive Odds (The Underdog): The number indicates how much you will profit on a $100 wager.

- Example:

+130means a $100 wager yields $130 in profit.

- Example:

The Math: Calculating Payouts

While the $100 baseline is useful for quick mental math, professional bettors often bet irregular amounts based on the Kelly Criterion. You need the formulas to calculate payouts for any stake size.

For Negative Odds (Favorites):

Profit = (Stake / (Odds / 100))

Total Payout = Stake + Profit

Scenario: You bet $550 on the Chiefs at -220.

Profit = 550 / (220/100) = \$250

Total Return = \$800

For Positive Odds (Underdogs):

Profit = Stake * (Odds / 100)

Total Payout = Stake + Profit

Scenario: You bet $50 on the Pistons at +240.

Profit = 50 * 2.40 = \$120

Total Return = \$170

Implied Probability (American)

This is the most critical calculation for your database. To find an edge, you must know what percentage chance the bookmaker is assigning to the bet.

- Negative Odds:

Implied Probability = Odds / (Odds + 100)- (-150):

150 / (150 + 100) = 0.60(60.0%)

- (-150):

- Positive Odds:

Implied Probability = 100 / (Odds + 100)- (+130):

100 / (130 + 100) = 0.4348(43.5%)

- (+130):

Decimal Odds (The Global Standard)#

Decimal odds are the preferred format for professional bettors and betting syndicates globally, as well as in Europe, Australia, and Canada.

They are mathematically superior to American odds because they represent the Total Return (Stake + Profit) rather than just the profit. This makes calculating parlays and compound returns significantly easier.

Reading the Lines

A decimal odd represents the total amount returned for every $1 wagered.

- Example:

1.91means for every $1 bet, you get $1.91 back ($0.91 profit + $1.00 stake). - Example:

2.50means for every $1 bet, you get $2.50 back ($1.50 profit + $1.00 stake).

The Math: Calculating Payouts

The formula for decimal odds is remarkably clean:

Total Return = Stake * Decimal Odds

Profit = Stake * (Decimal Odds - 1)

Scenario: Betting $200 at 2.10.

Total Return = 200 * 2.10 = \$420

Implied Probability (Decimal)

Converting decimals to probability is the simplest operation in betting math:

Implied Probability = (1 / Decimal Odds) * 100

- Odd 2.00:

1 / 2.00 = 50% - Odd 1.50:

1 / 1.50 = 66.67%

Pro Tip: If you are serious about arbitrage or synthetic hold calculations, switch your sportsbook settings to Decimal. It removes the mental friction of converting American "plus/minus" lines.

Fractional Odds (The Traditionalist)#

Primarily found in the UK and Ireland, particularly in horse racing and futures markets. You will rarely see these in US sportsbooks, but understanding them is necessary for navigating global exchanges like Betfair.

Reading the Lines

Fractional odds are displayed as Profit / Stake.

- Example:

5/2(read "five to two"). For every $2 you bet, you win $5. - Example:

1/4(read "one to four"). For every $4 you bet, you win $1.

The Math: Calculating Payouts

Profit = Stake * (Numerator / Denominator)

Total Return = Stake + Profit

Scenario: Betting $100 on a horse at 9/2.

Profit = 100 * (9/2) = \$450

Implied Probability (Fractional)

Implied Probability = Denominator / (Numerator + Denominator)

- Odd 5/2:

2 / (5 + 2) = 2 / 7 = 28.57%

The Invisible Tax: Understanding The Vigorish (Vig)#

If you sum the implied probabilities of all possible outcomes in a single game, you will notice they do not equal 100%. They usually equal somewhere between 104% and 110%.

This excess percentage is the Overround, also known as the Vig, Juice, or Margin. It represents the sportsbook's theoretical hold if they balance the action perfectly on both sides.

Calculating the Overround

Let's look at a standard NFL spread:

- Team A: -110 (Implied Prob: 52.38%)

- Team B: -110 (Implied Prob: 52.38%)

Total Market Probability = 52.38% + 52.38% = 104.76%

Overround = 4.76%

To beat this market, you don't just need to be right >50% of the time. You must cross the Breakeven Rate. For a standard -110 bet, the breakeven rate is 52.38%. If your handicapping model suggests a team wins 53% of the time, and the line is -110, you have a +EV edge.

Removing the Vig (Fair Odds)

To find the "Fair Odds" (or No-Vig Odds), you must remove the overround to determine what the line would be without the bookmaker's fee. This is essential for comparing your projections against the market.

Using the -110/-110 example:

- Total Implied Prob = 104.76%

- Fair Prob Team A = 52.38 / 104.76 = 50%

- Fair Prob Team B = 52.38 / 104.76 = 50%

- Fair Odds = +100 (Decimal 2.0)

For complex multi-way markets, manually removing the vig is difficult. Sophisticated bettors use automated tools like our Live +EV Feed, which instantly strips the vig from thousands of lines across major sportsbooks to reveal the true "No-Vig" price in real-time.

Advanced Mechanics: Push Probabilities and Asian Lines#

While standard Moneyline odds are binary (Win/Loss), many markets involve a third outcome: the Push (Tie), or they utilize Asian Handicaps to manipulate the odds.

3-Way Markets (1X2)

In soccer (and NHL regulation time lines), there are three outcomes: Home Win, Draw, Away Win.

- Home: +150 (40%)

- Draw: +220 (31.25%)

- Away: +180 (35.71%)

- Total Implied: 106.96%

When betting these odds, it is crucial to recognize that the "Draw" eats a massive portion of the probability equity. A common mistake by novice bettors is comparing a 2-Way Moneyline (where a Draw = Push/Refund) to a 3-Way line (where Draw = Loss) without adjusting the price expectation.

Converting Odds to Break-Even Percentages#

The ultimate utility of understanding betting odds is the ability to instantly assess risk. Every set of odds dictates a specific win rate required to stay profitable.

| American Odds | Decimal Odds | Implied Probability (Break-Even) |

|---|---|---|

| -200 | 1.50 | 66.7% |

| -150 | 1.67 | 60.0% |

| -110 | 1.91 | 52.4% |

| +100 | 2.00 | 50.0% |

| +150 | 2.50 | 40.0% |

| +200 | 3.00 | 33.3% |

| +500 | 6.00 | 16.7% |

How to use this: If you see a prop bet at +200, ask yourself: "Does this happen more than 1 out of 3 times?" If the answer is yes, the bet has value. If you believe it happens exactly 33.3% of the time, the bet is neutral. If less, it is negative EV.

Why Odds Vary Between Sportsbooks#

You will often see the Chiefs listed at -120 on one app and -115 on another. This is market inefficiency, and it is the lifeblood of the sharp bettor.

Odds vary for three main reasons:

- Liability Management: Bookmaker A took a massive bet on the Chiefs and needs to move the line to -125 to discourage further betting on them, while Bookmaker B has balanced action and stays at -115.

- Opinion: Bookmaker A's originators (oddsmakers) believe the Chiefs are stronger than Bookmaker B believes.

- Copying Lag: Bookmaker B is slow to update their odds after a sharp syndicate hit the market at a leading book like Pinnacle or Circa.

Consistently betting the best available odds (Line Shopping) is mathematically equivalent to increasing your payout without increasing risk. Over a sample of 1,000 bets, betting -110 when the market average is -115 can be the difference between a losing year and a profitable one.

Summary: Thinking Like a Market Maker#

To master betting odds, you must stop viewing them as the likelihood of a team winning, and start viewing them as the cost of buying a position.

- -110 isn't a prediction; it's a price tag of $110.

- +250 isn't a gamble; it's a price tag of $100 with a high yield.

By converting every odd you see into its implied probability and comparing it to your own probability models (or the sharpest lines in the world), you transition from a gambler hoping for luck to a trader executing an edge.

Frequently Asked Questions

How do you convert American odds to implied probability?▼

What is the difference between decimal and fractional odds?▼

What does -110 mean in betting odds?▼

How do sportsbooks make money on odds?▼

Why do odds change leading up to a game?▼

Related Articles

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

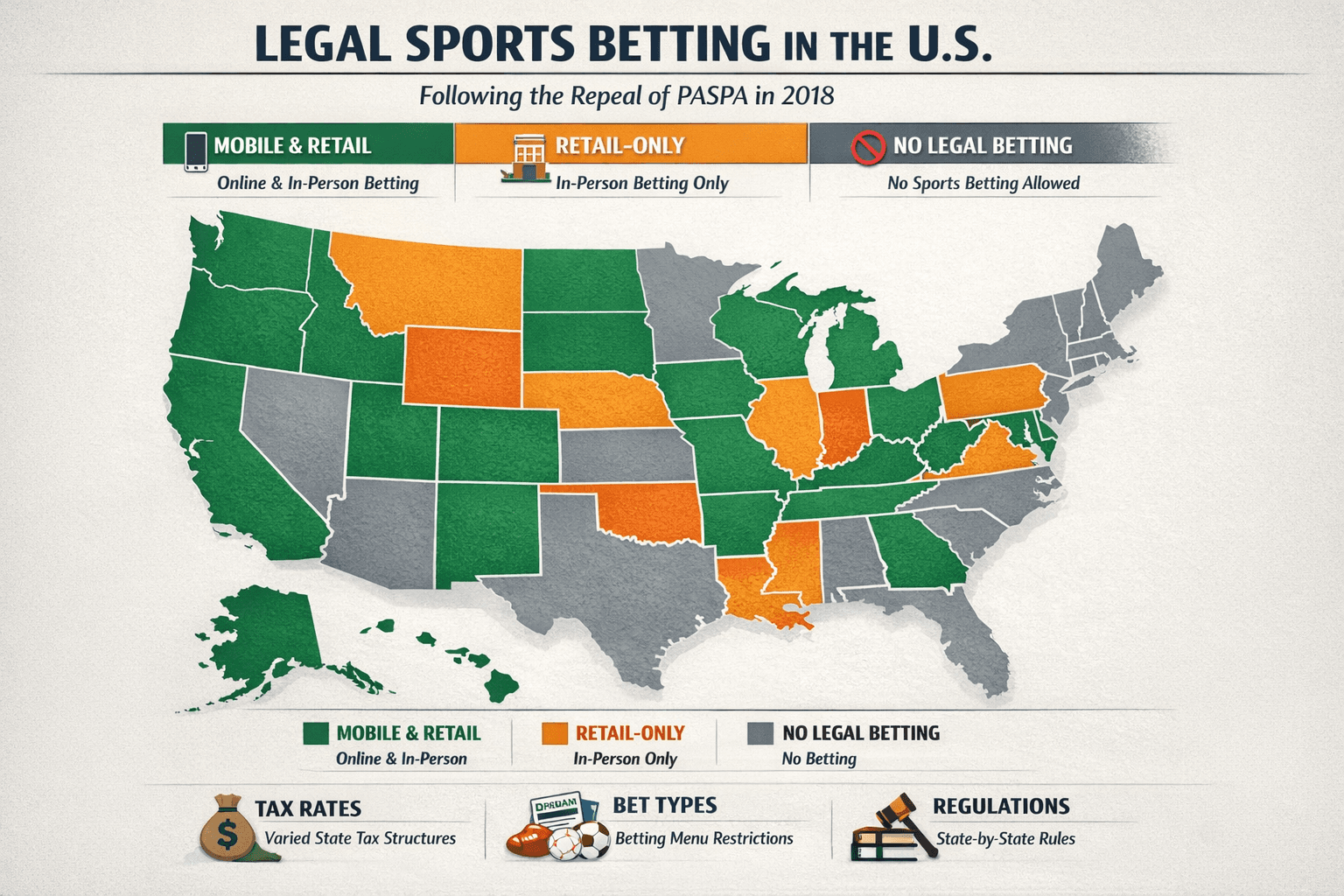

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.