Bonus Bets Explained: Math, Strategy & EV Conversion

Key Takeaways

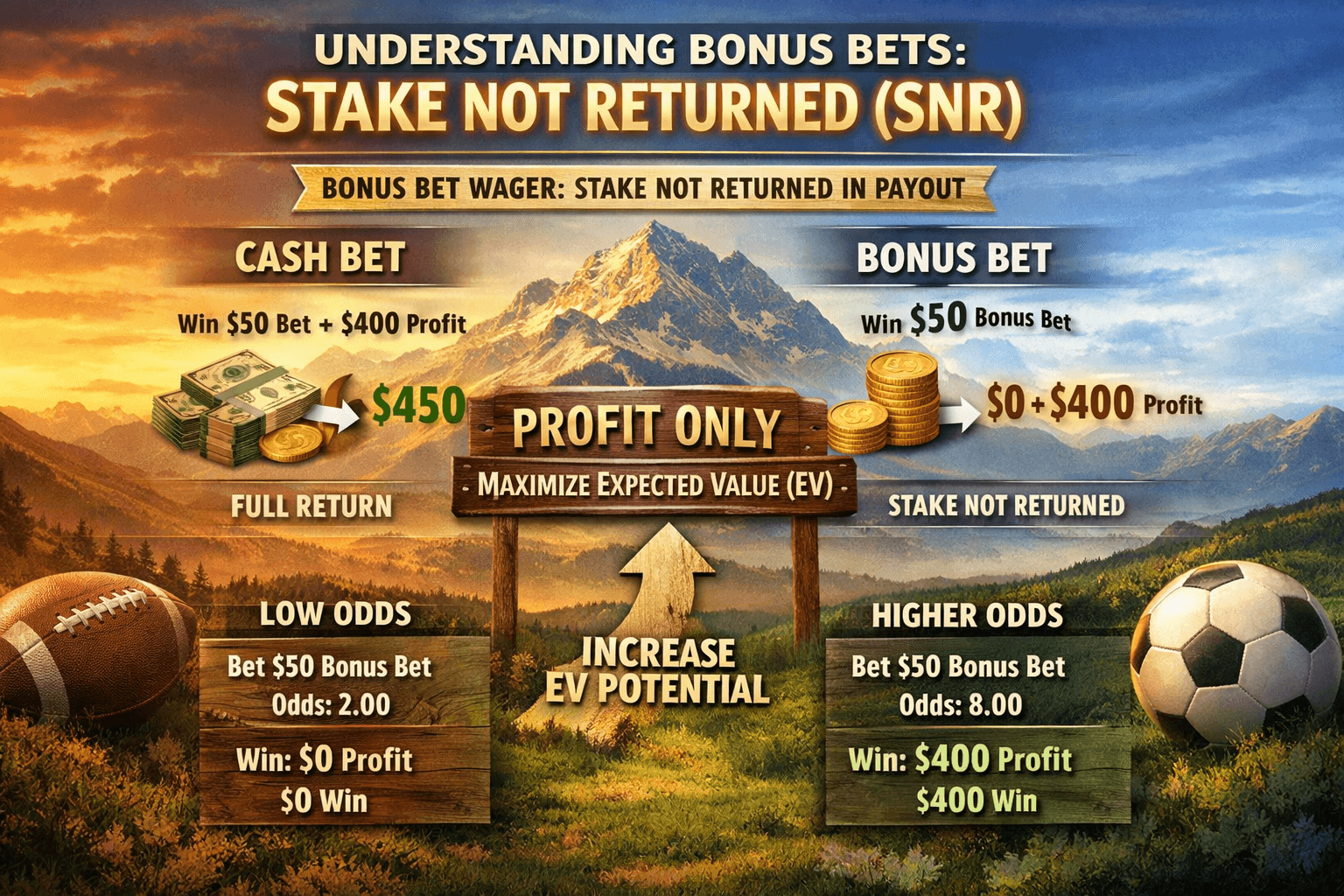

- The SNR Factor: Bonus bets are 'Stake Not Returned' wagers; because you don't keep the principal, the math dictates you must bet on long odds to retain equity.

- The +300 Threshold: Betting on favorites (-200) converts only ~33% of a bonus bet's value, while betting on underdogs (+300) converts ~75%.

- Hedging for Cash: By backing the bonus bet and laying the opposite side at a sharp book, you can guarantee a risk-free profit of roughly 70-80% of the bet's face value.

- Variance vs. Value: Hedging guarantees profit but pays extra juice; 'naked' betting on +EV longshots yields higher long-term returns but requires enduring losing streaks.

Definition

A bonus bet is a sportsbook promotional currency where the stake amount is not returned in the winning payout, known technically as "Stake Not Returned" (SNR). Unlike cash wagers, the bettor's equity exists solely in the profit potential, necessitating a strategy focused on longer odds to maximize Expected Value (EV).

Table of Contents

In the ecosystem of sports betting, most recreational players view "bonus bets" (formerly often called "free bets") as a chance to take a risk-free shot at a parlay or to "lock in" a small win on a heavy favorite. This is a fundamental misunderstanding of the asset.

For the sharp bettor, a bonus bet is a financial derivative with a specific valuation model. It is not free money; it is a restricted currency with a quantifiable expiration date and a distinct payout structure known as Stake Not Returned (SNR).

Optimizing this asset requires abandoning gut feelings and adhering to strict mathematical principles. If you are using bonus bets on favorites (-150, -200), you are mathematically lighting equity on fire. This guide breaks down the math of SNR wagers, the mechanics of high-conversion strategies, and how to execute strictly +EV (Positive Expected Value) maneuvers.

The Mechanics: Stake Not Returned (SNR)#

The defining characteristic of a bonus bet is that you do not own the principal.

- Cash Bet: You bet $100 at +100 odds. You win. You receive $100 profit + $100 stake = $200 Total.

- Bonus Bet: You bet $100 at +100 odds. You win. You receive $100 profit + $0 stake = $100 Total.

This structural difference fundamentally shifts the Expected Value (EV) equation. Because the stake is effectively "lost" regardless of the outcome (it is never paid to you), the cost of the wager is zero, but the payout curve is steeper.

To maximize the value of an asset where the principal is always forfeited, you must maximize the Profit-to-Win-Probability ratio. This is only achieved by targeting longer odds.

The Mathematical Imperative: Why You Must Bet Underdogs#

The single most common mistake intermediate bettors make is using bonus bets on "safe" plays to "build a bankroll." Let’s look at the math to see why this is catastrophic for your bottom line.

Scenario A: The Safe Play (Betting a Favorite)

You have a $100 Bonus Bet. You wager on an NFL favorite at -200 (Implied Probability: 66.7%).

- If you win: You profit $50.

- If you lose: You get $0.

- EV Calculation:

Result: You have converted a $100 asset into $33.35 of expected equity. This is a 33% conversion rate. You have voluntarily surrendered 67% of the asset's value to the sportsbook.

Scenario B: The Sharp Play (Betting a Longshot)

You have a $100 Bonus Bet. You wager on an underdog or long-odds prop at +300 (Implied Probability: 25%).

- If you win: You profit $300.

- If you lose: You get $0.

- EV Calculation:

Result: You have converted a $100 asset into $75.00 of expected equity. This is a 75% conversion rate.

The Curve of Conversion

As odds increase, the retention of EV increases asymptotically toward 100% (minus the vig). As odds decrease into negative territory, EV retention plummets.

The Golden Rule: Never use a bonus bet on odds shorter than +300 unless absolutely necessary. The sweet spot for maximization is typically between +300 and +500.

Strategy 1: The "Hedge and Convert" (Guaranteed Profit)#

For those building a bankroll who cannot tolerate variance, the optimal use of a bonus bet is Matched Betting. This involves betting the bonus on a sportsbook and betting against that same outcome on a different book (or exchange).

Because you are betting on long odds (as per the math above), your hedge bet (the "No" side) will likely be a heavy favorite, requiring a large bankroll float.

The Execution

- Find the Line: Identify a market with a tight spread. You want the "Yes" odds on the bonus book to be close to the "No" odds on the hedge book.

- Place the Bonus: Bet your $100 bonus on the Underdog at +300.

- Calculate the Hedge: You need to calculate the exact amount to bet on the favorite (e.g., -320) to ensure you make the exact same profit regardless of who wins.

Note: You should use a dedicated Hedge Calculator to determine the precise stake size to ensure equal payout.

If done correctly, a "Hedge and Convert" strategy should yield approximately 70% to 80% of the face value of the free bet in liquid cash. If you are converting at 60% or below, you are taking bad lines and paying too much "vig" (vigorish) to the sportsbooks.

Strategy 2: Pure EV (The Variance Approach)#

If you have a sufficiently large bankroll to absorb swings, hedging is actually suboptimal. Hedging involves paying vig to a second sportsbook, which eats into your EV.

The highest EV approach is naked betting on +EV lines with long odds.

By using our Live +EV Feed, you can identify spots where a sportsbook is offering +400 on a line that the rest of the market has priced at +350. Using a bonus bet here provides a "double edge":

- Structural Edge: You are using the SNR mechanic on long odds (high conversion).

- Market Edge: You are betting into a line that is mispriced relative to the market consensus.

Over a sample size of 100 bonus bets, the "Pure EV" strategy will return more profit than the "Hedge and Convert" strategy, but it will come with significant variance (losing streaks).

Common Pitfalls to Avoid#

1. The Parlay Trap

While parlays offer the long odds required for high EV conversion (e.g., +400 or higher), they introduce compounded vig. If you parlay three legs, you are paying the sportsbook's fee three times.

- Exception: If you can find a Same Game Parlay (SGP) or standard parlay where the legs are correlated or neutral-EV, it can be a viable vehicle to reach the +300 threshold. However, straight bets on underdogs are generally superior due to lower market hold.

2. Ignoring Market Width

When converting bonuses, the "hold" (the margin the book charges) is your enemy. A market priced at +300 / -350 has a lower hold than a market priced at +300 / -400. Always use a Line Shopper to ensure the book where you have the bonus isn't shading the line against you.

3. "Saving" for a Lock

Waiting for a "lock" usually means waiting for a heavy favorite. As established, this destroys value. Furthermore, bonus bets have expiration dates (usually 7 days). The decay of opportunity cost suggests you should deploy them on the first available +EV high-odds opportunity rather than waiting for a "perfect" game that forces you into a low-odds wager.

Summary: The Protocol#

To treat sports betting as an investment, you must treat bonus bets as a distinct asset class.

- Check Terms: Ensure the bet is SNR (standard) and note the expiration.

- Target Odds: Filter for lines +300 or longer.

- Cross-Reference: Check the Live +EV Feed or Arbitrage Finder to see if the line is competitive with the broader market.

- Execute:

- Risk-Averse: Hedge on an opposing book to convert 70-75% to cash instantly.

- Risk-Tolerant: Let it ride on the high-odds play to realize 100% of the EV over the long run.

Stop treating bonus bets as free lottery tickets. They are your highest ROI opportunities—if you do the math.

Frequently Asked Questions

What is the difference between a bonus bet and a risk-free bet?▼

What is the best odds range for bonus bets?▼

Can you withdraw a bonus bet as cash?▼

Do bonus bets expire?▼

Should I use bonus bets on parlays?▼

Related Articles

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

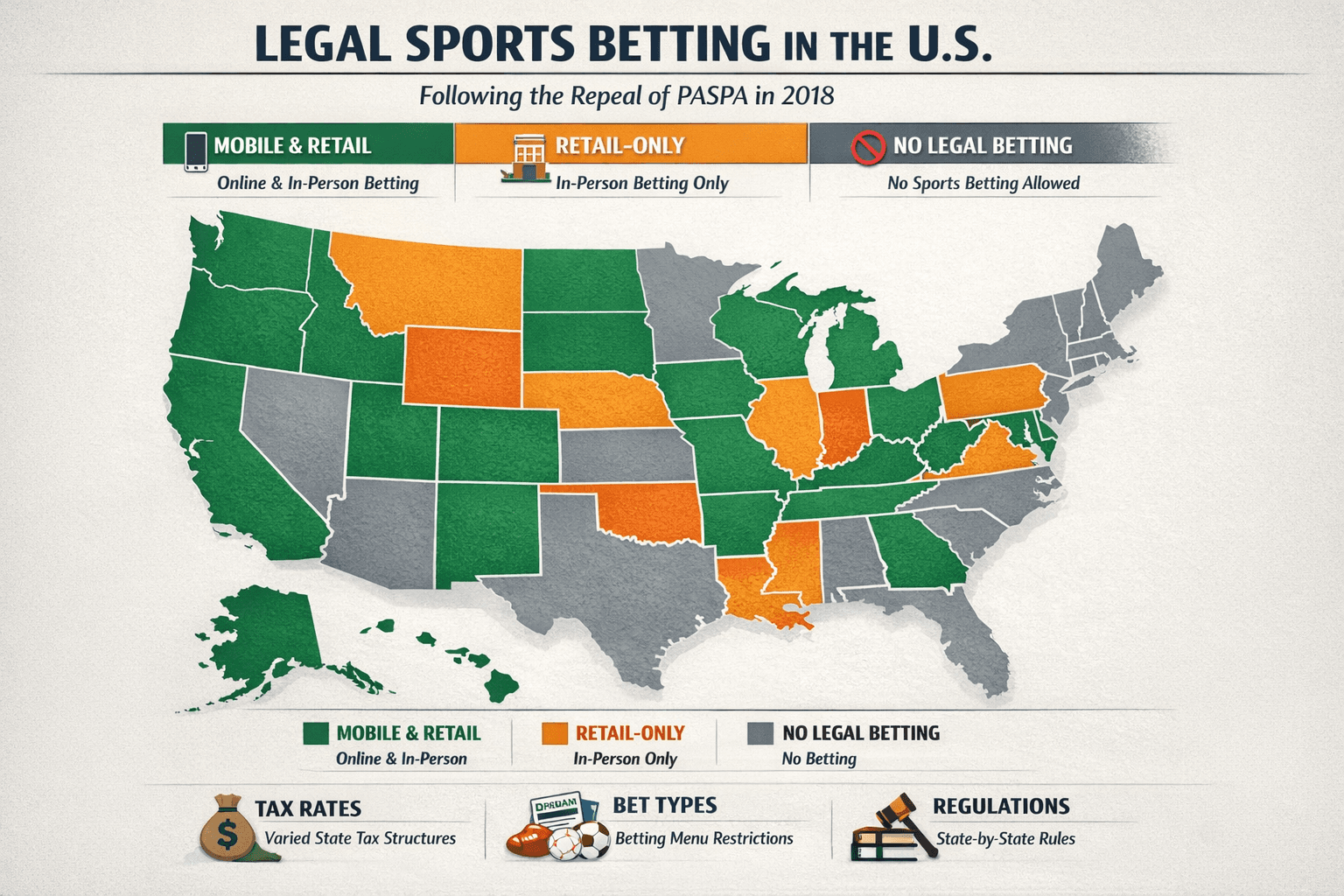

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.