Cash Out Betting: The Definitive Guide to Sportsbook Buyouts

Key Takeaways

- The Double Vig: Cashing out forces you to pay a second margin (fee) to the sportsbook, effectively compounding the cost of your wager and lowering long-term ROI.

- Fair Value Calculation: Always compare the cash out offer to the Fair Value (Potential Payout x True Win Probability). If the offer is lower, you are selling your ticket at a loss.

- Manual Hedging Superiority: Placing a bet on the opposing outcome at a different sportsbook almost always guarantees a higher profit than accepting a cash out offer.

- The Psychology Trap: Sportsbooks leverage 'loss aversion'—the fear of losing a winning position—to convince bettors to accept under-priced buyouts.

- Utility vs. EV: While mathematically suboptimal, cashing out can be rational if the payout represents a life-changing sum that cannot be effectively hedged due to betting limits.

Definition

A "cash out" is a sportsbook feature that allows a bettor to settle a wager for a guaranteed payout before the event has concluded. The payout amount fluctuates in real-time based on the current probability of the bet winning, minus a significant hidden margin charged by the bookmaker.

Table of Contents

Every bettor has faced the dilemma. You have a three-leg parlay, and the first two legs have hit. The third game is in the fourth quarter, your team is up by a field goal, but the momentum is shifting. The sportsbook app flashes a bright green button: Cash Out: $450.

The full payout is $800. If you let it ride, you risk walking away with nothing. If you click the button, you lock in a profit, but you leave significant value on the table.

For the recreational bettor, the "Cash Out" button is a safety net. For the sharp bettor, it is almost universally regarded as a tax on risk aversion—a mechanism designed by sportsbooks to improve their bottom line, not yours.

To act like a pro, you need to understand the mechanics under the hood. You need to know how the algorithm prices that offer, how to calculate the "Fair Value" of your position, and why manual hedging is almost always the mathematically superior option.

The Mechanics: How Cash Out Is Calculated#

At its core, a cash out offer is the sportsbook buying back your bet at a discounted rate. It is not a gift; it is a transaction. The algorithm uses live odds to determine the probability of your bet winning and offers you a payout based on that probability—after stripping out a hefty margin.

The formula generally looks like this:

The Current Win Probability is derived from the live odds. However, the Cash Out Margin is where the house wins. While the vigorish (vig) on a standard pre-match line might be 4.5%, the hidden vig on a cash out offer often exceeds 10% or even 20% depending on the volatility of the market.

The Double Vig Problem

The primary reason sharps avoid the cash out button is the concept of the "Double Vig."

- Entry Fee: When you placed the initial bet, you paid a theoretical fee (the vig) built into the odds (e.g., -110 lines).

- Exit Fee: When you cash out, the sportsbook charges a second fee to close the position.

By cashing out, you are essentially paying the sportsbook twice to handle one transaction. This erodes your long-term Expected Value (EV) drastically. A profitable sports betting strategy relies on minimizing the vig you pay, not compounding it.

Calculating Fair Value vs. The Offer#

To determine if a cash out is a "rip-off" or a viable option, you must calculate the Fair Value of your current position.

Let’s look at a concrete example.

The Scenario: You bet $100 on the Kansas City Chiefs at +200 (Decimal 3.00) to win the Super Bowl.

- Potential Payout: $300 ($100 stake + $200 profit).

- Current Status: The Chiefs have made the Super Bowl.

- Current Line: The Chiefs are now -150 (Decimal 1.67) favorites in the big game.

The sportsbook offers you a Cash Out of $180. Should you take it?

The Math: First, calculate the implied probability of the Chiefs winning based on the current live line of -150.

Next, calculate the Fair Value (or Expected Value) of your ticket. This is what your ticket is worth on the open market without the sportsbook's fee.

Wait, the offer matches the fair value? No.

In reality, the sportsbook's live line of -150 includes vig. The true probability is lower, or the line on the other side (the underdog) suggests a different story. If you look at a "No Vig" line, the true win probability might be 58%.

In this specific hypothetical, the offer seems close. But in practice, sportsbooks heavily shade these lines. If the Chiefs are -150, the fair cash out should be around $190-$200 based on market liquidity. If the book offers you $160, they are taking a massive cut.

Always compare the Cash Out Offer to the Fair Value. If the offer is significantly lower than (Payout True Win Probability), you are being shortchanged.

The Superior Alternative: Manual Hedging#

If you want to lock in profit, you don't need the cash out button. You can manufacture your own payout by hedging.

Hedging involves betting on the opposite outcome of your original wager. Because you locked in the Chiefs at +200, and they are now favorites, you have an arbitrage opportunity (or a "middle").

The Hedge Play:

- Original Bet: Chiefs to win (Payout $300).

- Opponent: 49ers.

- Current 49ers Line: +130 (Decimal 2.30).

You can bet on the 49ers to guarantee a profit regardless of who wins.

To guarantee equal profit:

Outcomes:

- Chiefs Win: You win $300 on the original bet, lose $130.43 on the hedge. Net Profit: $69.57.

- 49ers Win: You lose the $100 original bet, win $169.57 on the hedge ($130.43 1.30). Net Profit: $69.57.

Comparison:

- Manual Hedge Profit: ~$69.57

- Cash Out Offer Profit: $60.00 (Assuming a $160 offer minus $100 stake).

By taking a few minutes to shop for the best line on the opponent and hedging manually, you secure nearly 16% more profit than the easy button provided. This is where tools like a Line Shopper become essential—finding the best price for your hedge maximizes that guaranteed return.

Psychology: Why We Press the Button#

If the math is so clearly against it, why is the feature so popular?

Loss Aversion

Psychologically, the pain of losing a $300 potential payout that was "in your hand" is often twice as powerful as the joy of winning it. This cognitive bias, known as Loss Aversion, drives bettors to accept suboptimal offers to avoid the regret of a bad beat.

Immediate Gratification

The money hits your account instantly. You can use it to bet on the next game immediately. This velocity of money is appealing to recreational players but dangerous for bankroll management.

The "Sunk Cost" Fallacy

Bettors often look at their initial stake ($100) and think, "I just want my money back plus a little extra." They ignore the fact that the ticket is now an asset worth $180, not $100. Selling a $180 asset for $140 is a bad deal, regardless of what you paid for it originally.

When Is Cashing Out Correct? (+EV Scenarios)#

While rare, there are specific "Edge Cases" where cashing out is the correct move for a sharp bettor.

New Information (The Information Lag)

Sportsbook algorithms are fast, but they aren't omniscient. Occasionally, you may see something on the field—a star player limping, a shift in weather, or a tactical change—that the algorithm hasn't fully priced in yet. If you believe the actual probability of winning has dropped below the probability implied by the cash out offer, taking the money is +EV.

Bankroll Preservation (Utility Theory)

If you are a semi-pro with a $5,000 bankroll and you hit a 5000-1 longshot parlay that pays $50,000, the math says "hedge." But if you cannot get enough liquidity down on the other side to hedge (e.g., limits are too low), or if the cash out changes your life significantly, the Utility of the money outweighs the Expected Value.

For a multi-millionaire, $50k is just numbers. For a regular bettor, it pays off debt. In instances where the payout represents a massive multiple of your net worth, minimizing variance via cash out (even at a fee) acts as insurance.

Correlated Parlay Deadlocks

Sometimes you cannot hedge. If you have a Same Game Parlay (SGP) where legs are correlated, it is mathematically difficult to calculate a perfect hedge on the opposing outcomes because the variables are dependent. If the SGP pricing was loose to begin with, the cash out might actually be fair, though this is the exception, not the rule.

The Strategy: "Let It Ride" or "Shop the Hedge"#

For those serious about long-term profitability, the flowchart for decision-making should be:

- Do I need to reduce variance?

- No: Let the bet ride. You have a +EV position; realize that equity over the long run.

- Yes: Proceed to step 2.

- Can I hedge manually?

- Yes: Use an odds screen to find the best price on the opposing outcome. Execute a manual hedge to lock in profit without paying the "Cash Out Tax."

- No (Liquidity/Time constraints): Calculate the fair value of the cash out. If the fee is acceptable for the peace of mind (insurance cost), take it. If the fee is egregious, hold the ticket.

Conclusion#

The Cash Out button is a user experience feature, not a value feature. It is designed to increase sportsbook hold percentage and decrease variance for the house. By settling bets early, the bookmaker eliminates the risk of a "bad beat" for themselves—payouts on high-odds underdogs that actually hit.

As a data-driven bettor, your goal is to acquire value. Cashing out usually means surrendering value. Unless you are correcting a mistake, reacting to information faster than the market, or securing life-changing money that cannot be hedged elsewhere, the most profitable move is usually the hardest one: Do nothing.

Frequently Asked Questions

Is cashing out ever a good idea mathematically?▼

How do sportsbooks calculate the cash out amount?▼

What is the difference between cashing out and hedging?▼

Why is the cash out button suspended or unavailable?▼

Does cashing out count toward bonus rollover requirements?▼

Related Articles

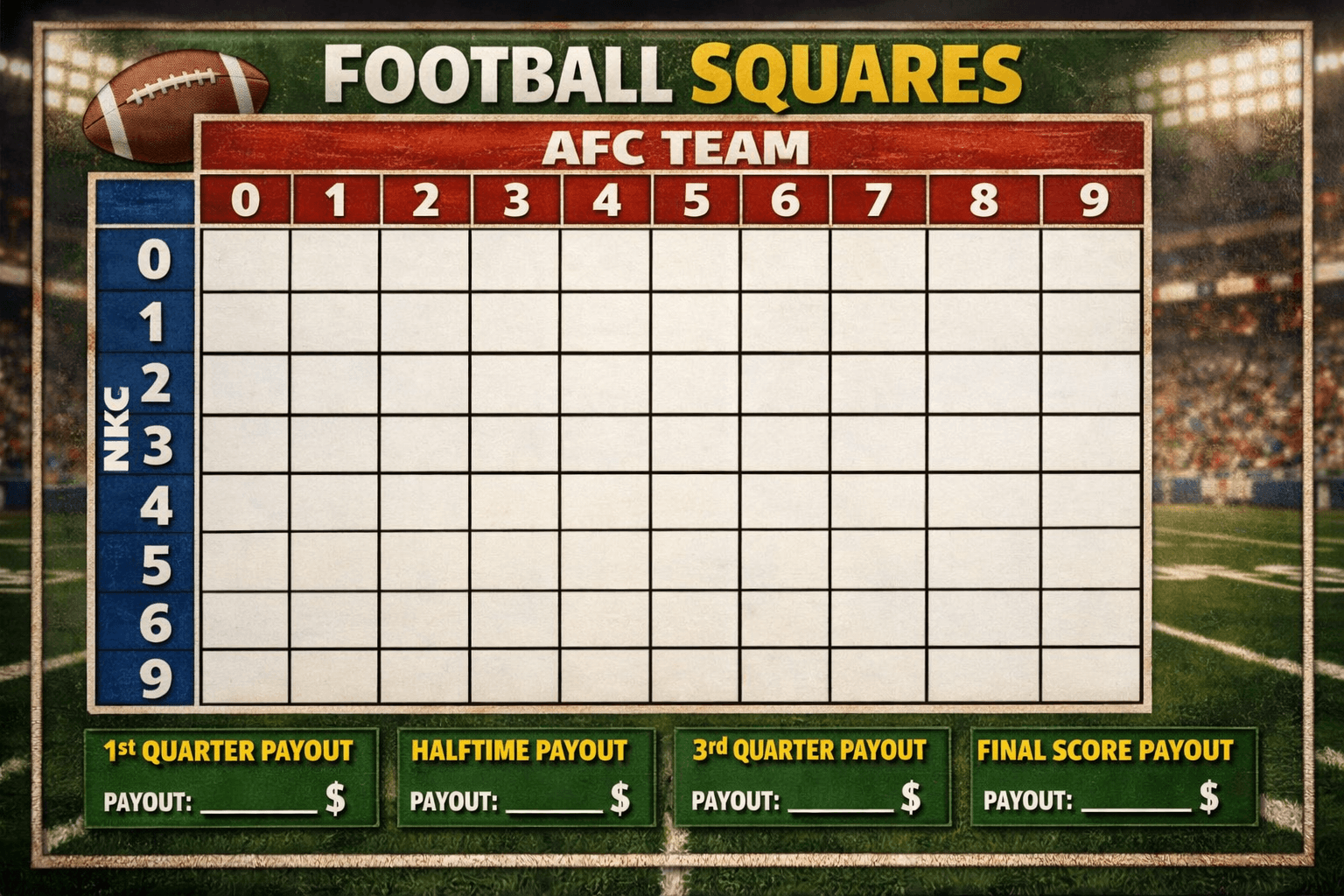

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

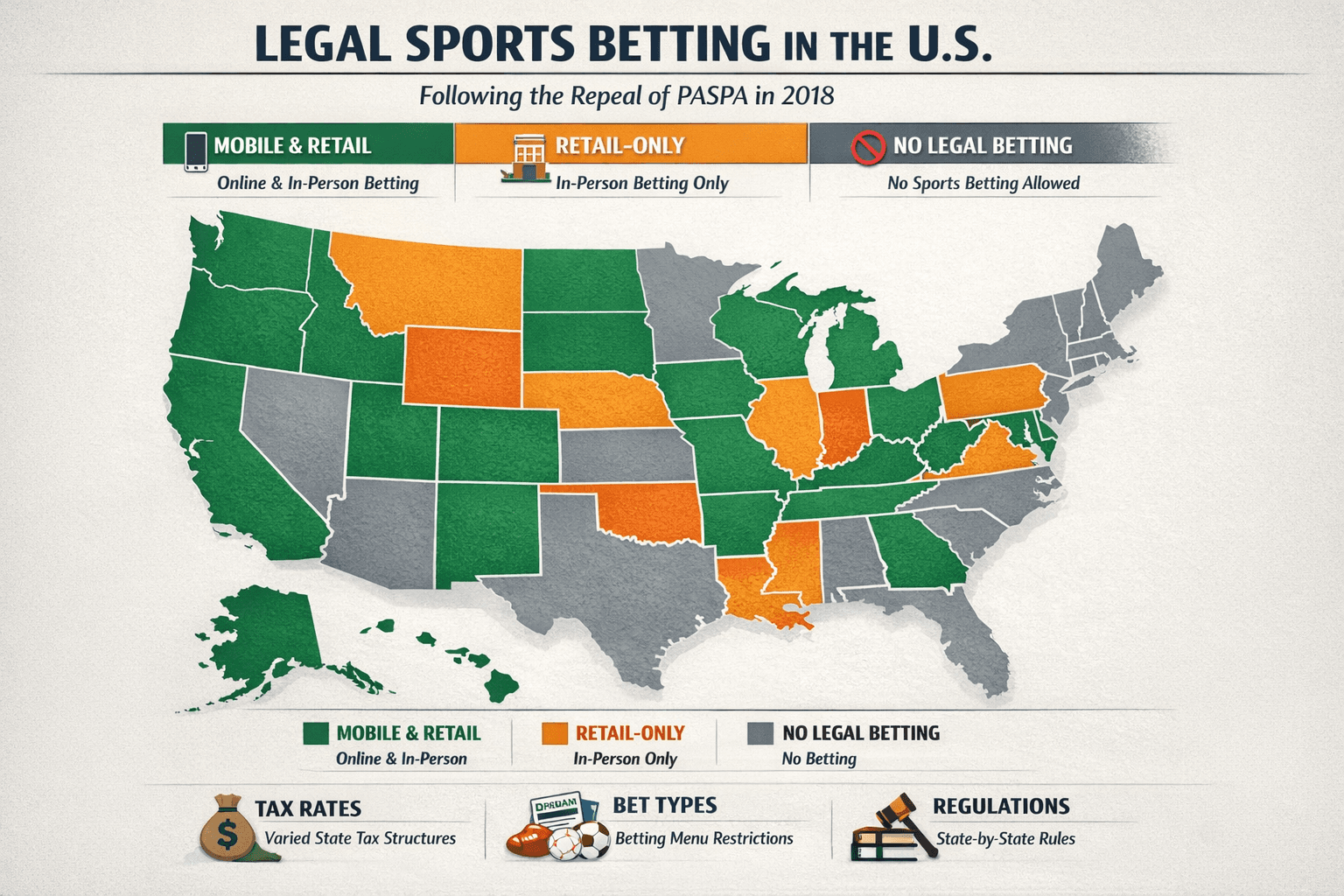

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.