CLV Betting: The Definitive Guide to Closing Line Value and ROI

Key Takeaways

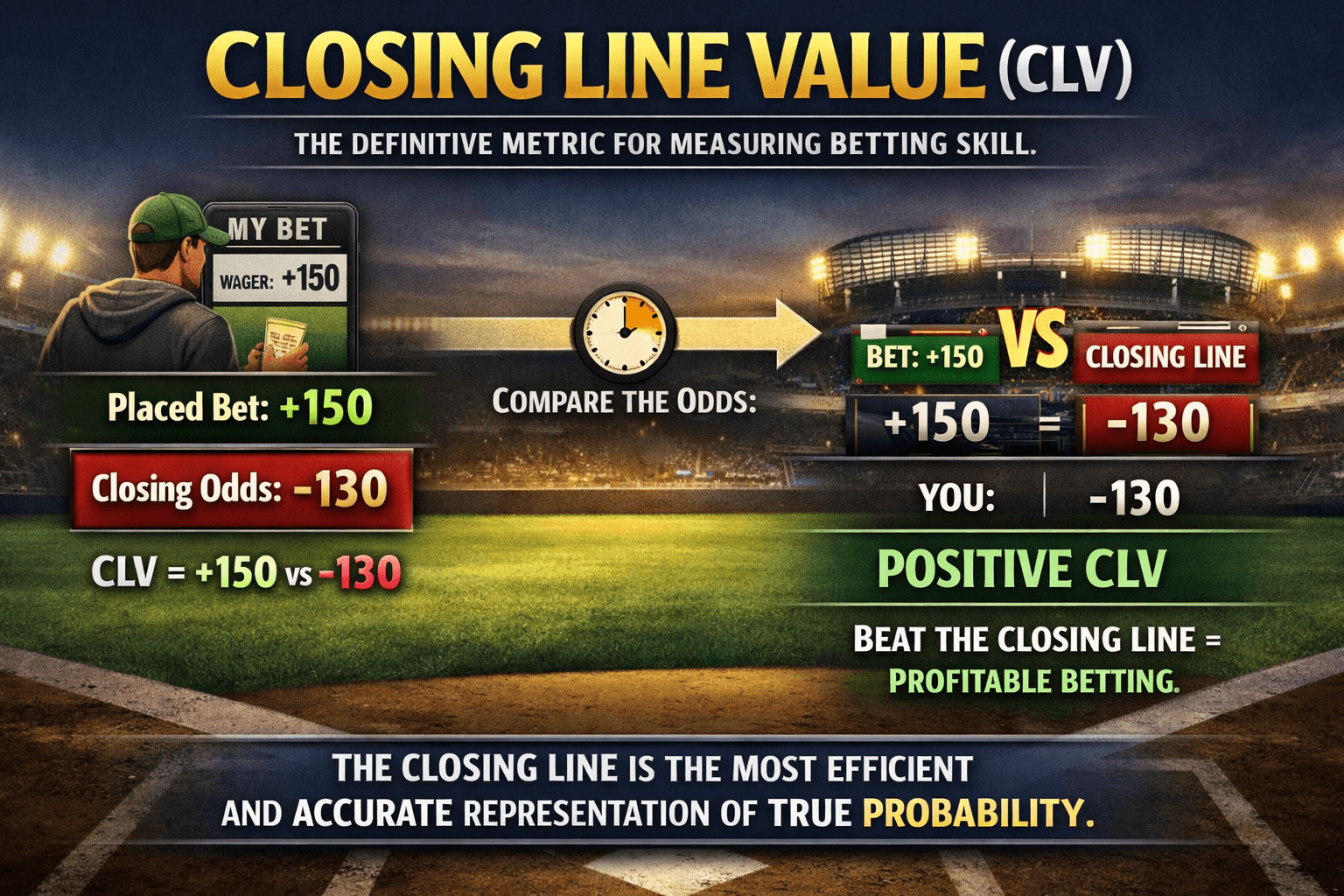

- The Definition: CLV compares the odds you bet against the closing odds at game time, serving as a proxy for the 'true' probability of an event.

- The Signal: CLV is a better predictor of future betting success than ROI or win/loss record because it strips away short-term variance.

- The Strategy: Generating CLV is achieved through betting opening lines, identifying market lag (steam chasing), and rigorous line shopping.

- The Math: A positive CLV indicates you have beaten the 'vig' and are holding a wager with positive expected value (+EV) over the sportsbook.

- The Limitation: CLV is most accurate in high-liquidity markets (NFL, NBA spreads) and less reliable in low-limit prop markets where price discovery is inefficient.

Definition

Closing Line Value (CLV) is the definitive metric for measuring betting skill, calculated by comparing the odds of a placed wager against the "closing" odds at the exact moment a game begins. It operates on the principle that the closing line is the most efficient and accurate representation of true probability.

Table of Contents

If you are still judging your betting success solely by your win/loss record over the last week or month, you are looking at the wrong metric. In the world of high-stakes sports betting, short-term results are noisy, deceptive, and often statistically meaningless.

The professional bettor—the "sharp"—does not obsess over whether a single bet won or lost. They obsess over the price they bought compared to the price the market settled at. They obsess over Closing Line Value (CLV).

CLV is the holy grail of sports betting analytics. It is the only reliable predictor of future success and the truest measure of your edge against the sportsbook. If you consistently beat the closing line, you will win in the long run. If you don't, you will eventually bleed out. This guide cuts through the noise to explain the math, the theory, and the application of CLV for the serious bettor.

The Theory: Why the Closing Line is "God"#

To understand CLV, you must accept the premise of the Efficient Market Hypothesis (EMH) as it applies to sports betting.

When a line opens (e.g., Kansas City Chiefs -3), it is a theoretical price set by a handful of originators. It is vulnerable. As the week progresses, information enters the market. Injuries are revealed, weather forecasts clarify, and most importantly, sharp money enters the pool.

Every time a sharp bettor wagers the maximum limit on a line, the sportsbook adjusts the odds. This process repeats thousands of times. By the time the referee blows the whistle for kickoff, the line reflects the aggregate knowledge of the entire betting ecosystem. The "Closing Line" is the equilibrium point where the sharpest opinions on both sides have canceled each other out.

Historically, the closing line has been proven to be more accurate at predicting the final score than any individual handicapper. It is the "true" price.

The core thesis of CLV is simple: If you bet the Chiefs at -3, and the line closes at -5.5, you have obtained a wager that is mathematically superior to the market's final assessment. You bought a stock for $10 that is trading at $15 at the bell. Whether the Chiefs cover the spread in that specific game is a matter of variance; the fact that you hold a +EV (Positive Expected Value) ticket is a matter of skill.

Calculating CLV: The Math Behind the Metric#

Calculating CLV is not as simple as looking at the spread difference, though that is a good heuristic. To truly measure your edge, you must calculate the difference in Implied Probability between your bet and the closing line, adjusted for the "vig" (vigorish).

Step 1: Convert Odds to Implied Probability

First, convert American odds to implied probability.

- Formula for Negative Odds (e.g., -110):

Odds / (Odds + 100) - Formula for Positive Odds (e.g., +130):

100 / (Odds + 100)

Step 2: Remove the Vig from the Closing Line

The closing line at a sportsbook includes a fee. To get the "fair" probability, you must remove this fee to find the "No-Vig" line.

- Example:

- Your Bet: NY Giants +4 at -110.

- Closing Line: NY Giants +4 at -135 / Dallas Cowboys -4 at +115.

The sportsbook is charging a margin here. Using a No-Vig Calculator, we find the fair closing probability of the -135 side is roughly 55.4%.

Step 3: Compare Your Edge

- Your Bet (-110) implies a break-even probability of 52.38%.

- The Fair Closing Line implies the bet wins 55.4% of the time.

Your CLV: (Fair Win Probability / Break Even Probability) - 1

In this scenario, you have a roughly 5.7% edge. If you make this bet 1,000 times, you are mathematically guaranteed to profit, regardless of the individual outcomes of the games.

CLV vs. ROI: The Signal and The Noise#

Why do we prefer CLV over ROI (Return on Investment) for analyzing performance?

ROI is results-oriented. It tells you what happened. CLV is process-oriented. It tells you what should have happened.

In a sample size of 500 bets, luck plays a massive role. A bad bettor can run hot and show a 15% ROI. A sharp bettor can run cold and show a -5% ROI. However, if the sharp bettor consistently generates 3% CLV, their ROI will inevitably converge with that 3% figure as the sample size grows to 2,000 or 5,000 bets.

If your CLV is negative but your ROI is positive, you are a "winning bettor" only in name. You are statistically lucky, and the regression monster is coming for your bankroll. If your CLV is positive but your ROI is negative, stay the course. The math is on your side.

Strategies to Generate Consistent CLV#

Getting down money at a better number than the close is the primary job of a bettor. Here is how the pros do it.

1. Betting Openers (Origination)

The lines are weakest when they are first released. Sportsbooks often copy lines from a market maker and put them up with lower limits. If you have a model or a strong intuition that a line is wrong, betting the opener allows you to capture value before the market corrects it. This requires speed and confidence in your own handicapping.

2. Steam Chasing (Top-Down Betting)

This is the most common method for semi-pros. When a sharp syndicate hammers a line at a market-making book (like Circa or Pinnacle), that book moves its line immediately. "Recreational" books (like DraftKings, FanDuel, or BetMGM) often lag behind by 30 seconds to a few minutes.

By watching the screen, you can see the move happen at the sharp book and bet it at the recreational book before they adjust. This is pure arbitrage of information latency.

3. Line Shopping

This is the lowest hanging fruit. If five books have the line at -3 (-110) and one book is asleep at the wheel with -2.5 (-110), taking the -2.5 gives you an immediate mathematical advantage. You don't need to be a handicapping genius; you just need to be observant.

This is where tools like the EdgeSlip Line Shopper become essential. Manually checking 15 sportsbooks is impossible; automating the search for outliers is how you scale your edge.

The Nuance: When is CLV Less Important?#

While CLV is the gold standard, it is not without nuance. There are specific scenarios where CLV becomes a "softer" metric.

Low Liquidity Markets (Props and Derivatives)

The Efficient Market Hypothesis relies on volume and liquidity. The NFL spread market is highly efficient because millions of dollars shape the line.

However, the "Player to record a block" market in the WNBA is illiquid. The closing line on a niche prop may not be "efficient" because the limits were too low to attract enough sharp money to correct the price. In these markets, it is possible to beat the closing line and lose, or lose to the closing line and win, because the closing line itself isn't fully sharpened.

Late Information

If you bet the Over on a total on Tuesday, and on Sunday morning the starting Quarterback is ruled out, the line will crash. You will have massive negative CLV.

Does this mean you made a bad bet? Not necessarily. Unless you had information that the QB was injured that the market didn't, this is simply bad variance. Conversely, getting positive CLV because the opposing star player was scratched 10 minutes before game time is lucky CLV, not skill-based CLV.

Analyzing Your Database#

To become a pro, you must track your bets with rigorous detail. Your spreadsheet should not just have "W/L" columns. It must include:

- Date/Time of Bet

- Bet Price/Odds

- Closing Price/Odds

- Closing Line Variance (The difference)

Review this monthly. If you are betting NFL sides and your average CLV is 0.0% or negative, your strategy is failing, regardless of your bankroll balance. You are paying the vig and flipping coins.

However, if you are averaging +2.5% CLV on sides and +4% CLV on totals, you have a license to print money. It is simply a matter of volume.

Conclusion: The Long Game#

Sports betting is not a get-rich-quick scheme; it is a battle for basis points. It is about purchasing probability cheaper than it sells for.

The closing line is the receipt that proves you got a discount. Stop celebrating wins that had negative CLV—those are bad habits rewarded by luck. Start celebrating losses that had positive CLV—those are good decisions punished by variance. In the end, the math always wins.

Frequently Asked Questions

What is a good CLV percentage in sports betting?▼

Does beating the closing line guarantee a profit?▼

How do you calculate Closing Line Value?▼

Why is the closing line considered accurate?▼

Can you win long term without positive CLV?▼

Related Articles

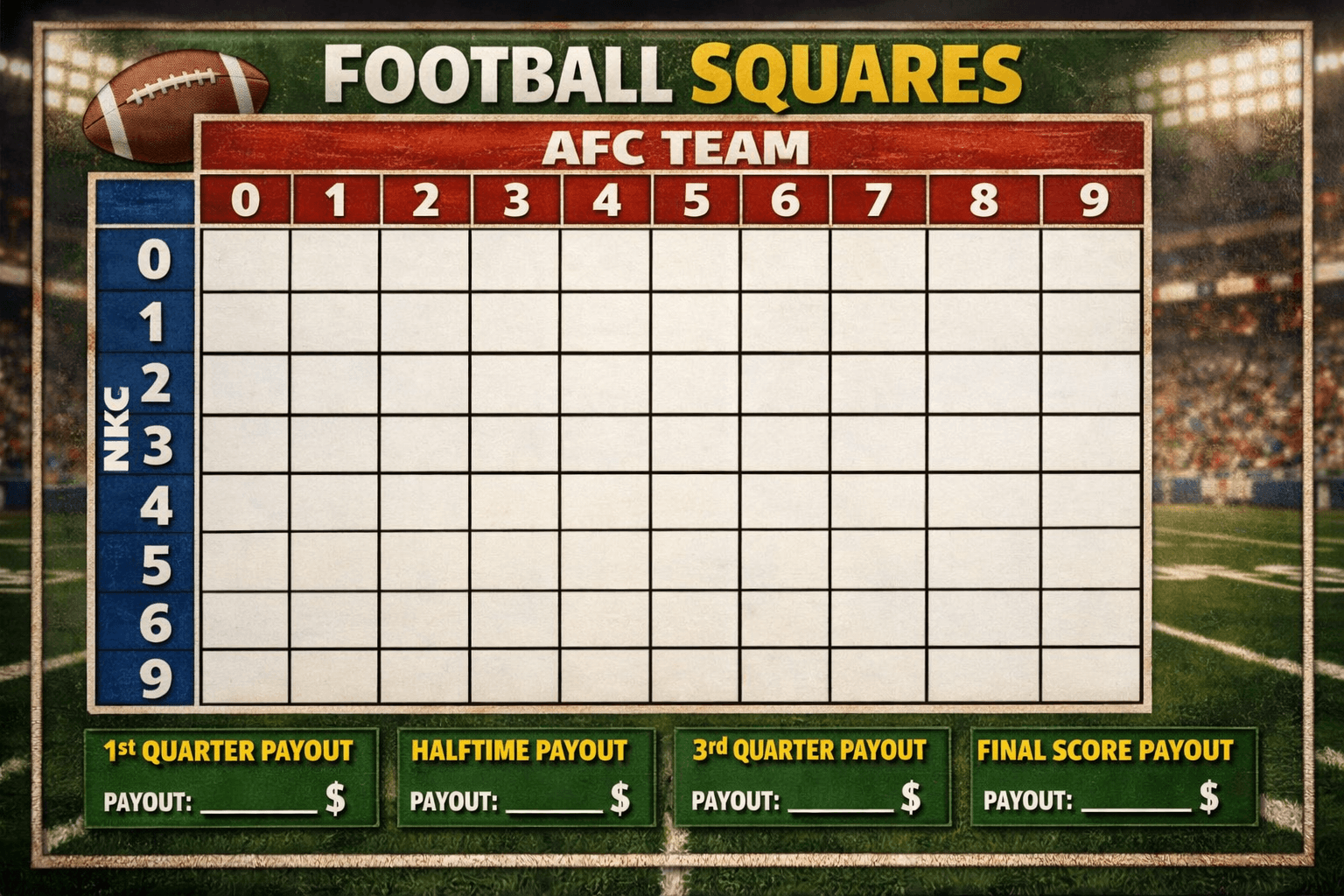

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

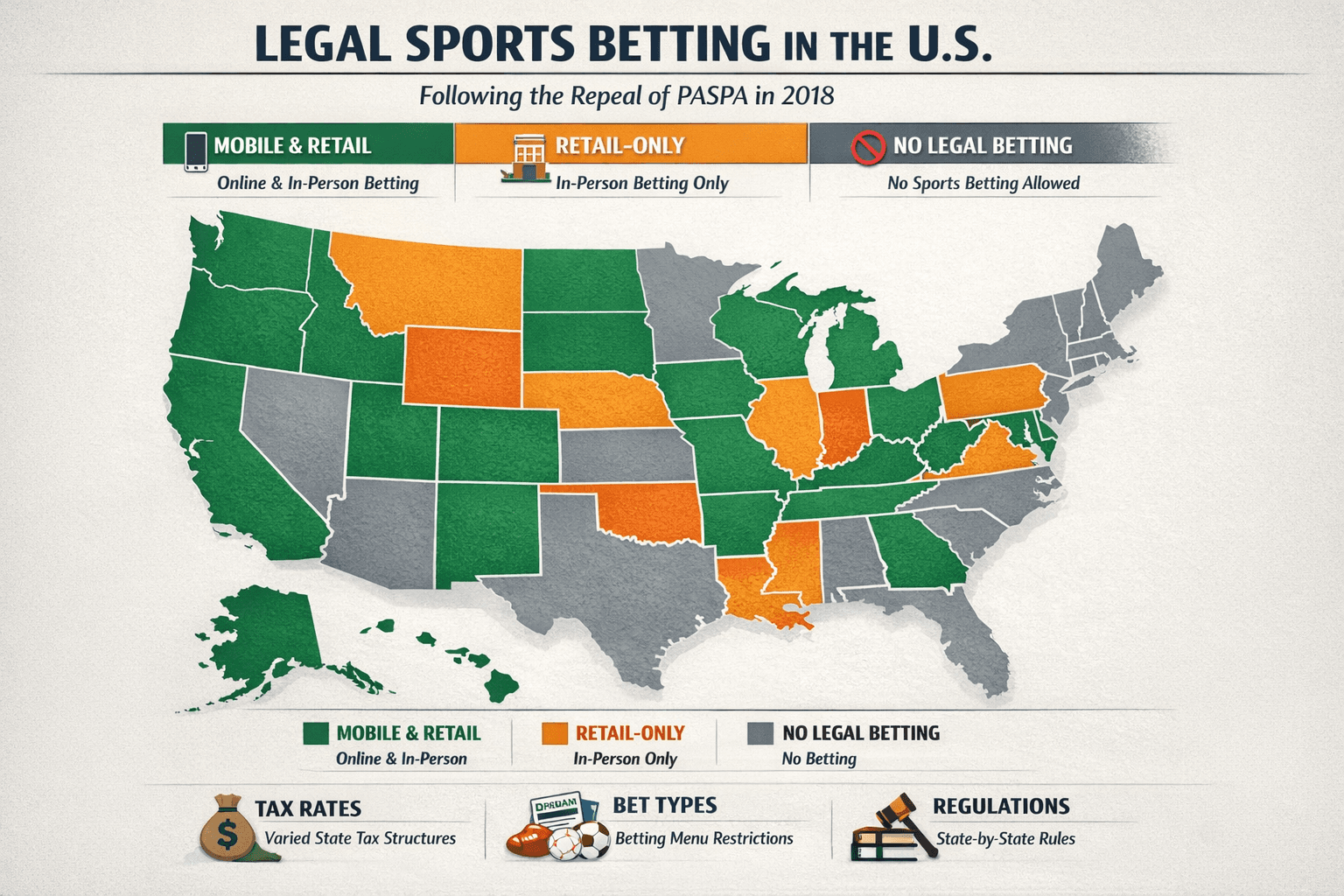

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.