Hedge Betting Explained: The Math, Strategy, and EV Impact

Key Takeaways

- The Cost of Hedging: Hedging acts as insurance, but it is rarely free; you typically pay 'vig' (juice) on the second bet, which reduces your long-term Expected Value (EV).

- Cash Out vs. Manual Hedge: Never use the sportsbook's 'Cash Out' button, which applies a heavy tax on the fair value of your ticket; always manually bet the other side at the best available odds.

- The Middle Strategy: The most profitable form of hedging is 'middling,' where you bet opposite sides at different lines (e.g., -3.5 and +7.5) to create a window where both bets can win.

- Variance Management: While hedging lowers ROI, it is a valid tool for bankroll management when a single potential payout represents a disproportionately large percentage of your total funds.

- Futures Ladders: Hedging is most effective in futures markets where massive line movement (CLV) allows you to lock in profit while still retaining significant upside.

Definition

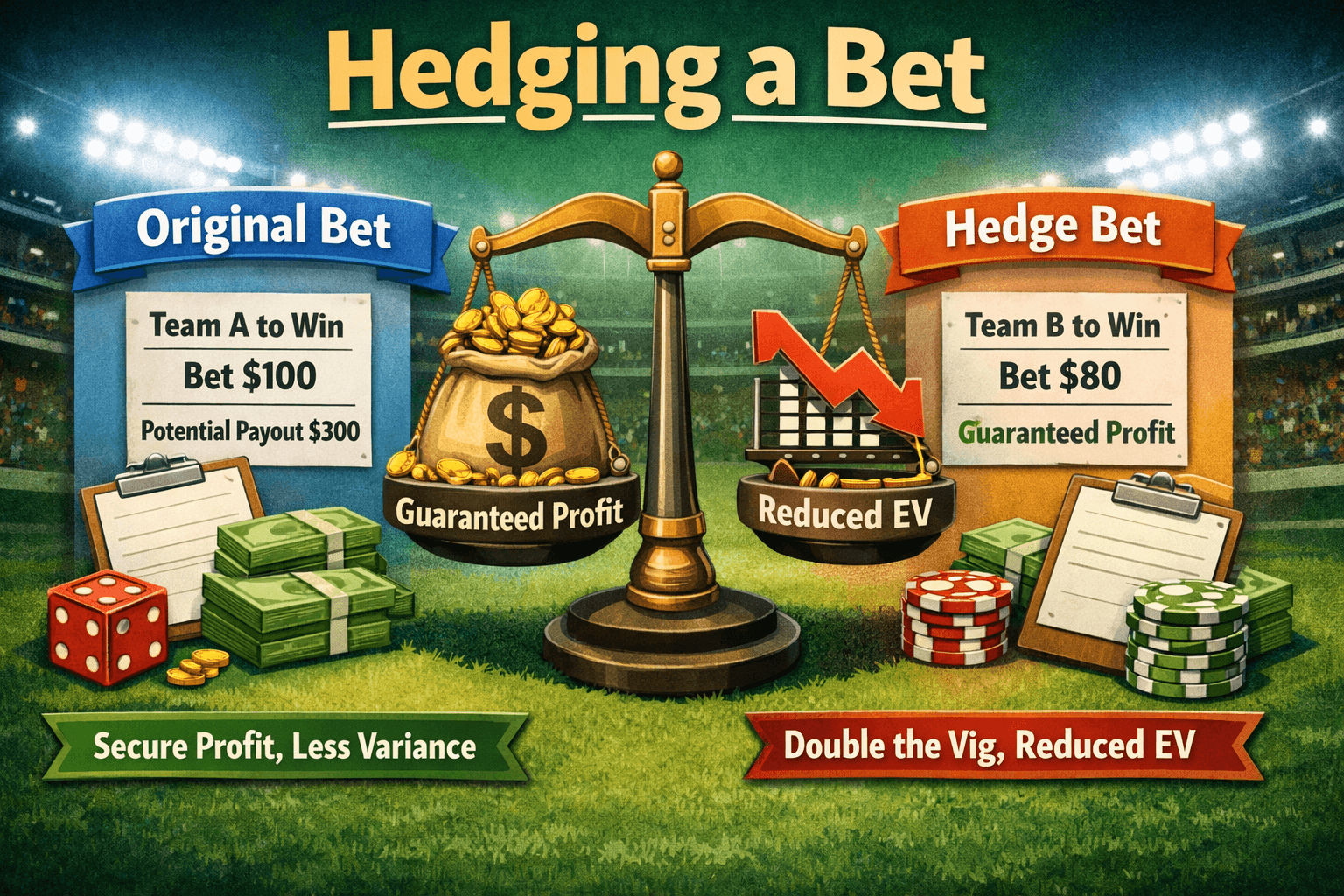

A hedge bet is a secondary wager placed on the opposite outcome of an original bet to guarantee a profit or reduce exposure, regardless of the event's result. While it serves as a variance reduction tool, it typically requires paying "vig" twice, potentially lowering long-term expected value (EV).

Table of Contents

In the world of high-stakes sports betting, few concepts are as polarized as the hedge bet. To the recreational bettor, hedging is a magic safety net—a way to turn a nervous sweat into a guaranteed payday. To the sharp bettor, however, hedging is a mathematical concession—a willingness to pay a premium (in the form of extra vigorish) to purchase insurance against variance.

If you are treating sports betting as an asset class, you must understand the mechanics, the mathematics, and the distinct opportunity costs of hedging. It is not simply about "locking in a win." It is about understanding the price of that certainty and determining if the market offers enough value to justify the cost.

This guide moves beyond the basics. We aren't just calculating how much to bet on the other side; we are analyzing the impact of hedging on your long-term ROI, comparing manual hedges to the sportsbook "Cash Out" trap, and identifying the specific scenarios where sacrificing Expected Value (EV) for liquidity makes strategic sense.

The Mechanics of a Hedge#

At its core, a hedge is an arbitrage position created artificially over time.

In a traditional arbitrage scenario, you bet on Team A at Sportsbook X and Team B at Sportsbook Y simultaneously because the lines are disparate enough to guarantee profit. In a hedge scenario, you bet on Team A, and then—due to line movement, game state changes, or a futures team advancing in a tournament—the odds on Team B lengthen enough that you can bet on them effectively to lock in a profit.

The Two Primary Objectives

- Profit Locking: Constructing a "Green Book" where every outcome results in a positive return.

- Exposure Reduction: Accepting a small loss or a break-even scenario to eliminate the risk of a total loss on the original stake.

While the mechanics are simple, the execution requires precision. You are essentially buying out of your position. The cost of this buyout is the vig (vigorous) on the second bet.

The Mathematics of Hedging: EV vs. Variance#

This is where the sharp bettor separates from the casual. To understand if a hedge is "correct," you must weigh Expected Value (EV) against Variance.

The Cost of Insurance

When you place a bet, you are ideally betting into a market with a positive expected value (+EV). When you hedge, you are placing a second bet. Unless that second bet is also +EV (which is rare, though possible in live betting), you are essentially paying a fee to reduce your variance.

Let's look at the math.

Suppose you have a $100 Future on the Detroit Lions to win the Super Bowl at +1000.

- Scenario: The Lions reach the Super Bowl.

- Opponent: The Chiefs, favored at -150.

- Lions Current Odds: +130.

- Potential Payout: $1,100 ($1,000 profit + $100 stake).

You have a ticket worth $1,100 if it hits, but $0 if it loses. To hedge, you bet on the Chiefs (Moneyline -150).

If you want to lock in an equal profit regardless of the winner, you solve for a stake that equalizes returns. However, by betting on the Chiefs at -150, you are paying the sportsbook's hold (margin) on that specific wager.

The EV Argument Against Hedging: If your model suggests the Lions actually have a 45% chance to win, your ticket has a current theoretical value.

If you hedge, you are effectively selling this ticket for a fixed amount (say, $450 guaranteed). You are voluntarily surrendering $45 of expected value to the sportsbook in exchange for zero risk. Over a sample size of 1,000 such bets, "insuring" your tickets will cost you $45,000 in lost potential profit.

The Utility Argument For Hedging: While mathematically suboptimal in a vacuum, hedging becomes rational when:

- Bankroll Management: The potential variance ($1,100 swing) represents a dangerous percentage of your total bankroll.

- Life Utility: The psychological ease or real-world utility of the guaranteed cash outweighs the theoretical math of the long run.

When to Hedge: The Sharp Perspective#

Sophisticated bettors rarely hedge day-to-day wagers. You don't hedge a Tuesday night NBA moneyline. The vig eats you alive. However, there are specific market conditions where hedging is part of the strategy.

1. The Futures Ladder

The most common sharp hedge occurs in futures markets. If you bought a team at +5000 odds and they reach the championship, the market has moved massively in your favor.

Here, you aren't just hedging; you are monetizing Closing Line Value (CLV). If the liquidity in the market allows, you can bet the opponent to guarantee a return that exceeds the original investment by a massive multiple.

2. The "Middle" Opportunity

This is the holy grail of hedging. A "Middle" occurs when you bet on the underdog, the line moves, and you bet on the favorite, creating a window where both bets can win.

- Original Bet: Lakers +7.5 (-110)

- Line Moves: Lakers are now +3.5 / Heat -3.5.

- Hedge/New Position: Heat -3.5 (-110).

If the Heat win by 4, 5, 6, or 7 points, you win BOTH bets. If the score falls outside this range, you win one and lose one, only losing the cost of the juice (roughly 4.5%). The risk is low, but the payout (winning 2x units) is high.

3. Live Betting Arbitrage

Using tools like a Live +EV Feed, you may find instances where a pre-game bet and a live in-game line create a risk-free arb. This requires lightning-fast execution and is often automated by syndicates, but manual bettors can occasionally catch these during timeouts or quarter breaks.

The "Cash Out" Trap: Why You Must Avoid It#

Every major sportsbook now features a shiny "Cash Out" button. Never use it.

The Cash Out button is a proprietary algorithm designed to offer you a buyout at a massive discount.

- Manual Hedge Fair Value: $450

- Sportsbook Cash Out Offer: $390

The sportsbook builds an additional margin into the Cash Out offer, often taking 10% to 20% off the top of the fair market value of your ticket. If you need to get out of a position, always manually hedge by betting the opposite side at a different sportsbook. This allows you to line shop for the best odds, reducing the cost of the hedge, rather than accepting the lowball offer from the book holding your original ticket.

Strategic Hedging for Parlays#

Hedging is frequently discussed regarding the "last leg" of a parlay.

The Scenario: You hit 4 legs of a 5-leg parlay. The payout is $5,000. The final game is Monday Night Football. The Dilemma: Do you let it ride or hedge?

From a mathematical standpoint, you should never have placed the 5th leg if you intended to hedge it. By adding the 5th leg, you increased the variance. If you hedge now, you are paying vig to undo the decision you made when placing the parlay.

The Exception: If the parlay was placed to bypass betting limits (since parlays often have higher potential payouts than straight bets allowed on niche markets), hedging the final leg effectively allows you to get more money down on the first 4 legs than the book would have originally accepted.

Execution: How to Calculate the Hedge#

Do not guess the amount. Precision is required to ensure you don't accidentally leave yourself exposed to a loss if the "hedge" side wins.

You need to calculate the Hedge Stake based on the odds available for the opposing outcome.

The Formula for Equal Profit

Once you determine the Hedge Stake:

- If Original Bet Wins: Payout - Hedge Stake = Profit.

- If Hedge Bet Wins: (Hedge Stake x Hedge Odds) - Hedge Stake - Original Stake = Profit.

If done correctly, these two profit figures should be identical.

Conclusion: Discipline Over Fear#

Hedging is a tool, not a crutch. Novice bettors hedge out of fear—they watch a game, get nervous, and pay the sportsbook to relieve their anxiety. That is a losing long-term strategy.

Sharp bettors hedge out of necessity or opportunity. They hedge when the bankroll implications dictate it, or when a "middle" presents a high-upside, low-risk shot.

Before you place that hedge, ask yourself: Am I maximizing my EV, or am I just buying expensive peace of mind?

For those looking to calculate exact hedge sizing or find the best lines to execute a counter-bet, utilize the Hedge Calculator and ensure you are always getting the best price on your insurance.

Frequently Asked Questions

Is hedging a bet profitable in the long run?▼

What is the difference between hedging and the Cash Out button?▼

When is the best time to hedge a parlay?▼

What is 'middling' in sports betting?▼

Can you hedge a bet with a different sportsbook?▼

Related Articles

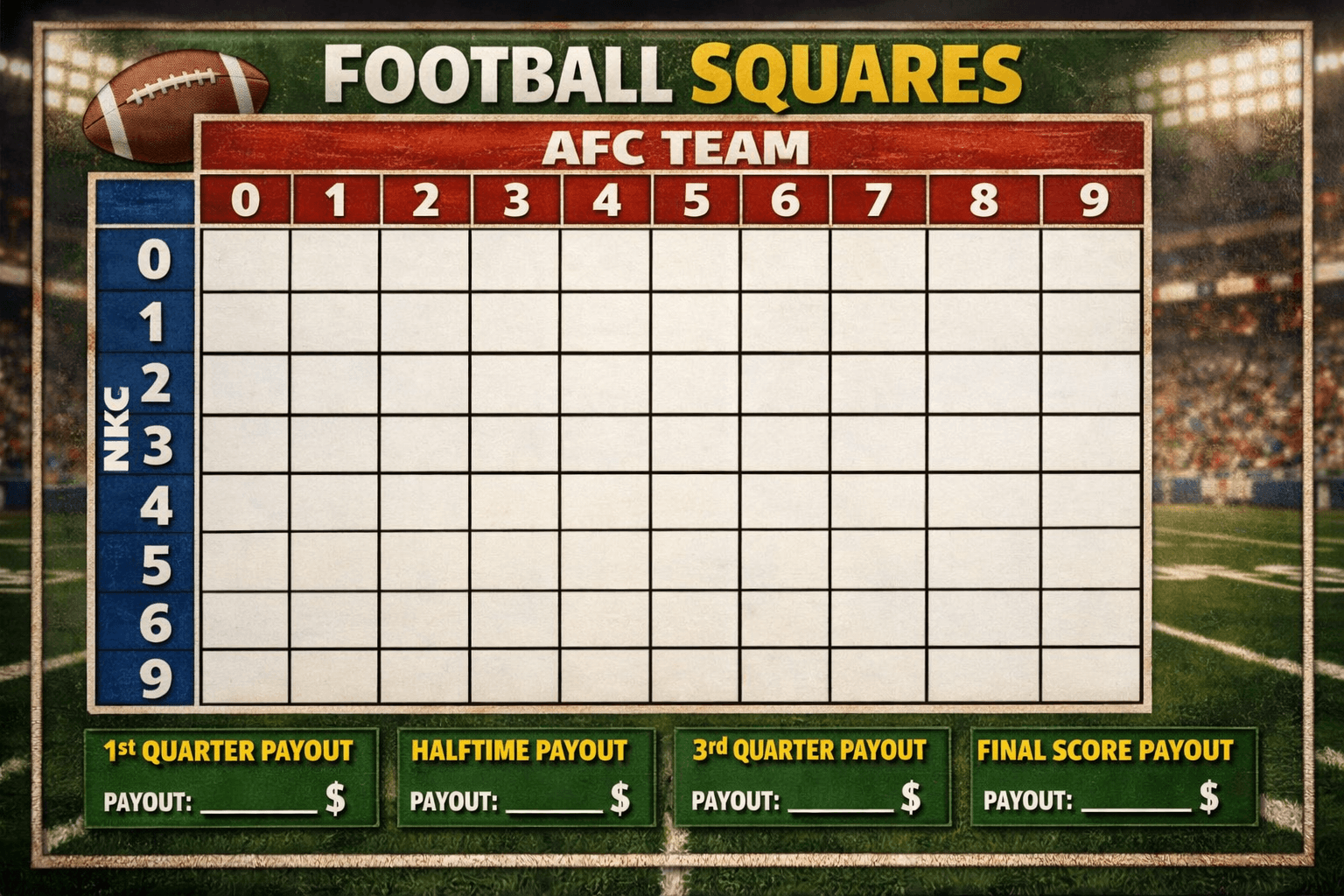

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

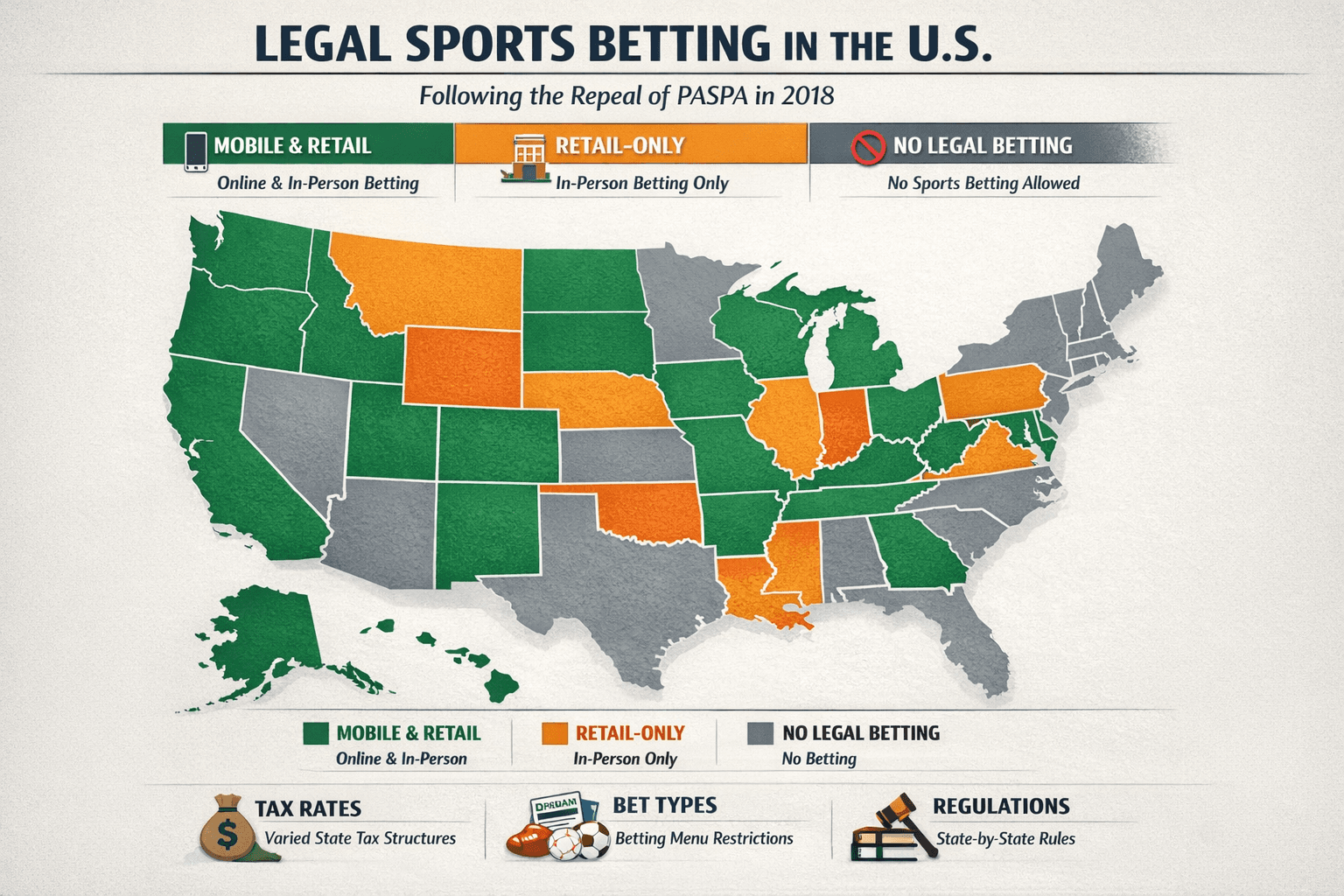

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.