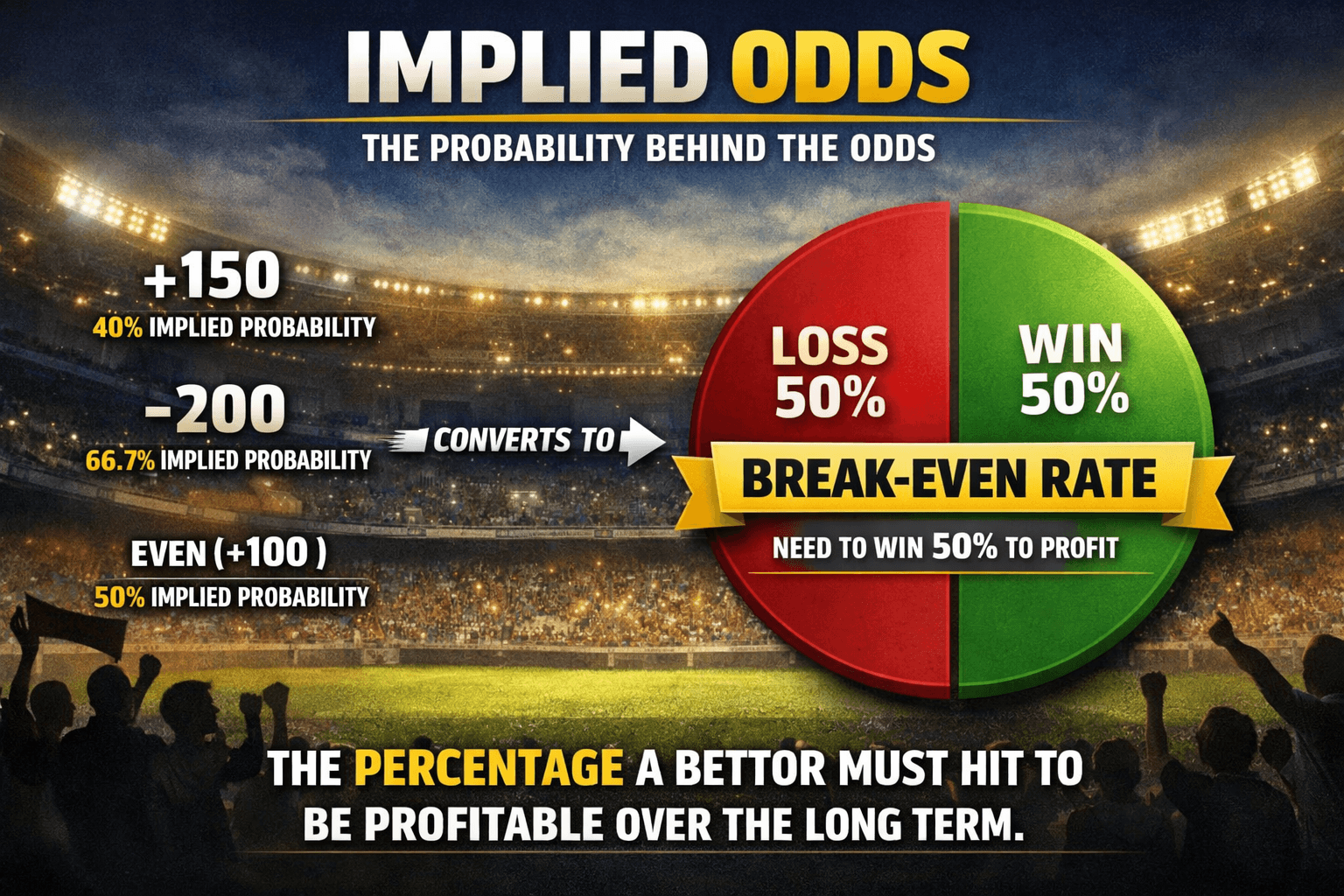

Implied Odds Explained: The Math Behind Break-Even Betting

Key Takeaways

- Price is Probability: Every odds format (American, Decimal, Fractional) is simply a different way of expressing a percentage chance of an outcome occurring.

- The Break-Even Benchmark: Implied probability defines the exact win rate you must achieve to be profitable. For standard -110 odds, this is 52.38%.

- Identify the Vig: The sum of implied probabilities in a market will always exceed 100%. The excess is the bookmaker's fee (vigorish).

- De-Vigging is Essential: To find the 'true' probability of an event, you must remove the vig from the market lines to calculate the fair price.

- Value is Mathematical: A bet only has Positive Expected Value (+EV) if your assessed probability of winning is higher than the implied probability of the odds.

Definition

Implied odds represent the conversion of sportsbook odds into a percentage probability, indicating the likelihood of an outcome as suggested by the market price. In sports betting, this percentage establishes the "break-even" rate a bettor must achieve to be profitable over the long term.

Table of Contents

Every wager you place is a negotiation between your perception of reality and the sportsbook’s price. While most casual bettors speak in terms of "favorites," "underdogs," or potential payouts, professional bettors (sharps) speak a different language entirely: probability.

To a sharp, American odds (e.g., -110, +240) are merely a disguise. They are a pricing mechanism that obfuscates the most critical metric in betting: Implied Probability.

Understanding implied odds is not just a prerequisite for sports betting; it is the fundamental mechanism of finding an edge. If you do not know the implied probability of your ticket, you do not know your break-even point. And if you do not know your break-even point, you cannot mathematically determine if a bet has value.

This guide will dismantle the concept of implied odds, moving from basic conversions to advanced "de-vigging" methods used to find true market prices.

The Core Concept: Price as Probability#

Implied odds are the probability of an outcome occurring according to the sportsbook’s price.

If a sportsbook prices a coin flip at -110 on both sides, they are not suggesting the coin has a 50% chance of landing on heads. They are suggesting that, to break even on that bet, you must win 52.38% of the time. This discrepancy—the difference between the true probability (50%) and the implied probability (52.38%)—is the "vig" or the "juice."

To beat the book, your assessment of the True Probability must be higher than the Implied Probability.

If the result is positive, you have Positive Expected Value (+EV). If it is negative, you are burning money.

Converting Odds to Implied Probability#

Different regions use different odds formats, but they all represent the same mathematical reality. Here is how to translate the three major formats into implied percentages.

1. American Odds

American odds are centered around the number 100.

- Minus (-) Odds: The amount you must wager to win $100.

- Plus (+) Odds: The amount you win for every $100 wagered.

Formula for Negative Odds (Favorites):

Example: New York Knicks at -150

Formula for Positive Odds (Underdogs):

Example: Detroit Pistons at +200

2. Decimal Odds

Decimal odds (popular in Europe and Australia) represent the total return (stake + profit). This is often the easiest format for sharps to use when calculating parlay probabilities.

Formula:

Example: 2.50 Odds

3. Fractional Odds

Common in the UK and horse racing, fractional odds represent profit relative to the stake.

Formula:

Example: 5/2 Odds

The Break-Even Analysis#

Why does this matter? Because the implied probability tells you exactly how often you need to be right to avoid losing money.

If you exclusively bet NBA point spreads at standard -110 odds, the implied probability of every single bet is 52.38%.

- If you hit 51% of your bets, you are losing money.

- If you hit 52.38% of your bets, you are strictly breaking even.

- If you hit 53% of your bets, you are a profitable handicapper.

The margin for error in sports betting is razor-thin. The difference between a losing bettor and a sharp is often less than 2% in win rate.

The Vigorish: Why Percentages Don't Add Up#

If you calculate the implied probability for both sides of a game, you will notice they sum to more than 100%.

Example: NFL Spread

- Team A -110: 52.38%

- Team B -110: 52.38%

- Total: 104.76%

That extra 4.76% is the Overround (or hold). It is the mathematical edge the sportsbook builds into the market to ensure profit regardless of the game's outcome, assuming balanced action.

As a bettor, your goal is to remove this vig to find the "Fair Odds" or "No-Vig Probability."

De-Vigging the Line

To find the true market consensus of a probability, you must remove the juice. The simplest method is the Multiplicative Method, which assumes the juice is applied equally to both sides proportional to their odds.

Using the -110 / -110 example with a 104.76% total implied probability:

- Calculate Total Implied Prob: 104.76%

- Divide Implied Prob by Total:

Now, consider a moneyline where the juice is often higher or distributed unevenly:

- Favorite (-200): 66.67% Implied

- Underdog (+170): 37.04% Implied

- Total: 103.71%

Fair Probability for Favorite:

Fair Probability for Underdog:

Once you have the "Fair Probability," you can convert it back to "Fair Odds." In this case, 64.28% converts to roughly -180, and 35.72% converts to roughly +180. If you can find the Favorite at -170 elsewhere, or the Underdog at +190, you have found value relative to this specific market.

To automate this process and find discrepancies across multiple books instantly, sophisticated bettors use our Live +EV Feed, which calculates fair lines in real-time against market-making sportsbooks.

Advanced Usage: Synthetic Hold and Market Efficiency#

Implied odds are not static. They fluctuate based on news, sharp action, and public money. A deep understanding of implied odds allows you to analyze Market Efficiency.

1. Identifying Soft Lines

Market-making books (like Pinnacle or Circa) often have higher limits and sharper lines. If a sharp book has a player prop implied at 55% (priced at -122), but a recreational book has the same prop implied at 48% (priced at +108), the difference represents a massive edge. You are buying an asset for 48 cents that the most efficient market values at 55 cents.

2. The Correlation with Closing Line Value (CLV)

The implied probability of the "Closing Line" (the odds just before the game starts) is generally considered the most accurate prediction of the event's true probability.

If you bet the Kansas City Chiefs at -130 (56.5% implied) and the line closes at -150 (60% implied), you beat the closing line. You purchased a ticket requiring a 56.5% win rate for a coin that—according to the collective wisdom of the market—actually lands on heads 60% of the time. Over a large sample size, beating the implied odds of the closing line is the surest indicator of long-term profit.

Common Pitfalls#

Confusing Confidence with Probability

A common mistake is conflating "I think this will happen" with value. You might be 90% confident the Celtics will win. But if the sportsbook has them at -1000, the implied odds are 90.91%. Even if you are right, the bet has negative expected value because the price is too expensive for the risk.

Ignoring the Push

In 3-way markets (like Soccer 1X2), implied odds calculations are straightforward. However, in 2-way markets (like NFL spreads), the possibility of a "push" (tie) slightly alters the math. While the standard -110 / 52.38% calculation is the industry standard heuristic, accurate modeling requires accounting for push rates, which vary by sport and number (e.g., an NFL spread of -3 pushes far more often than -6.5).

Conclusion: The First Step in Origination#

Implied odds are the litmus test for every wager. Before checking injury reports or analyzing trends, the first question must always be: What is the price asking me to believe?

If the price implies a 60% win rate, and your model projects a 55% win rate, it doesn't matter how much you like the team—it’s a bad bet. By rigorously translating every line into a percentage, you strip away the emotion of the game and view sports betting for what it truly is: a market of competing probabilities.

Frequently Asked Questions

What are implied odds in sports betting?▼

How do you calculate implied probability from American odds?▼

What is the implied probability of -110 odds?▼

Why do implied probabilities add up to more than 100%?▼

How do you use implied odds to find value?▼

Related Articles

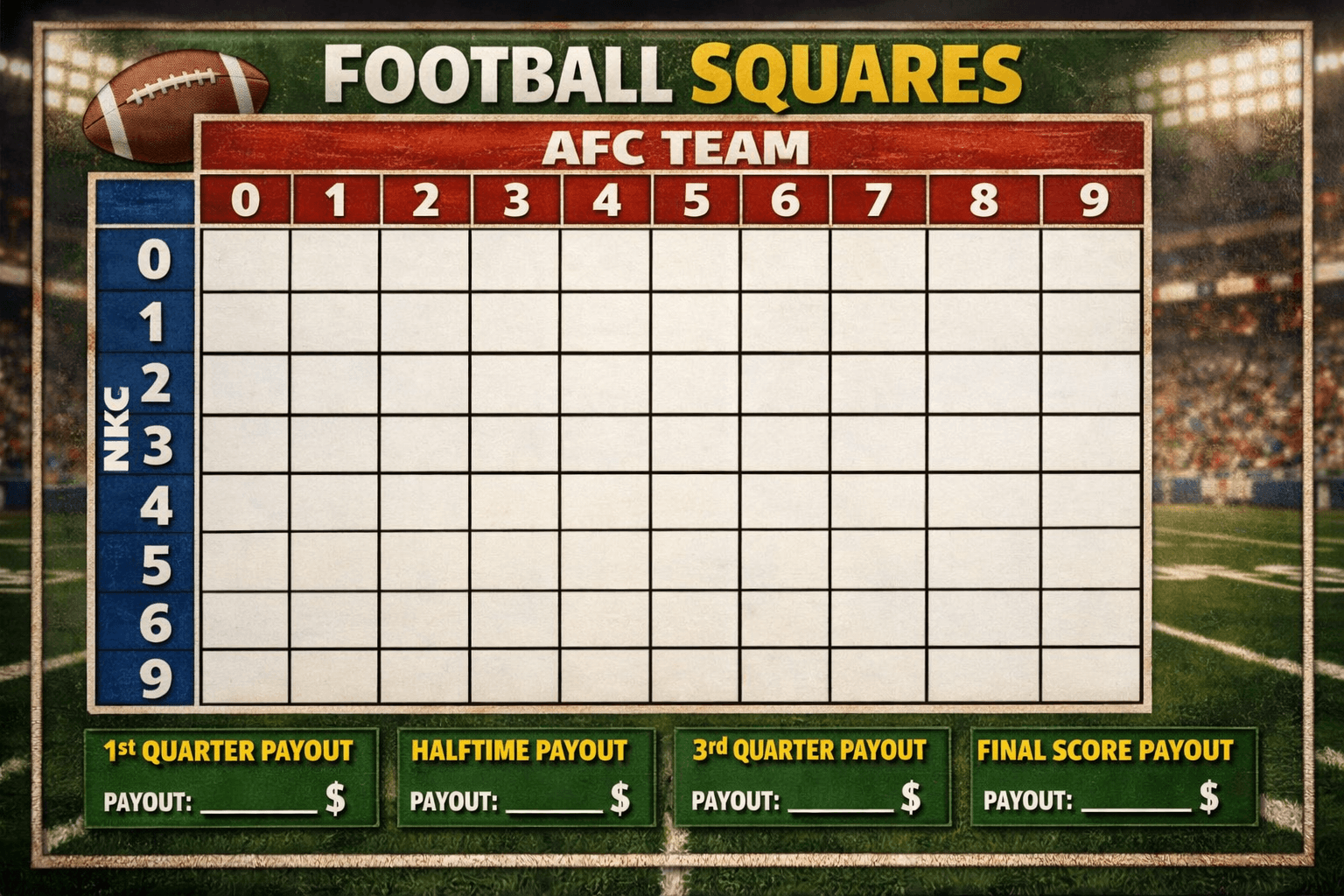

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

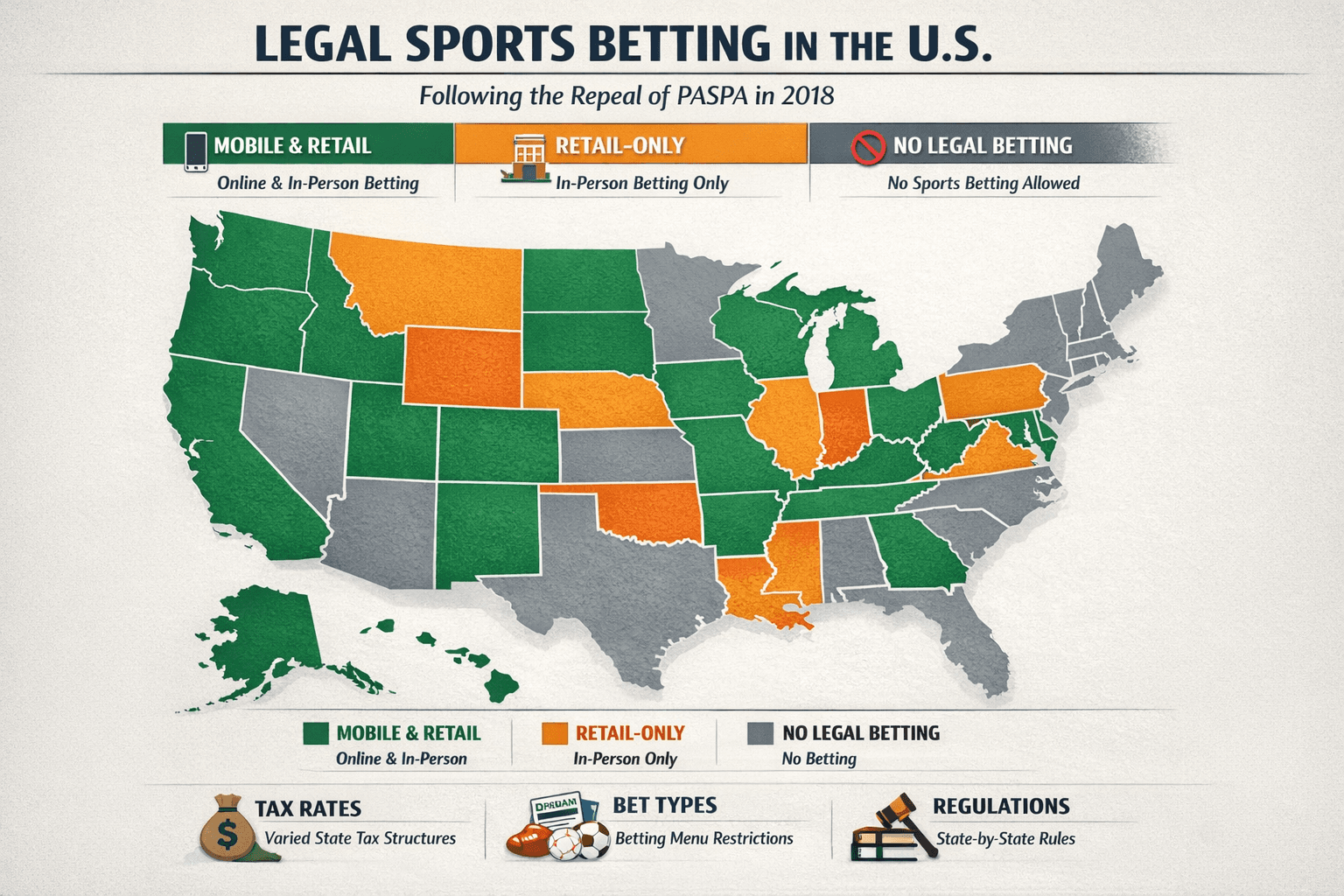

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.