Implied Probability: The Math Behind Finding Edge and Value

Key Takeaways

- Price is Probability: Odds are not just predictions; they are prices representing the percentage of time you need to win the bet to break even.

- The Vig Distortion: Sportsbook odds always sum to over 100%. This 'overround' is the fee you must overcome to be profitable.

- Devigging is Essential: To find the 'True Probability,' you must remove the sportsbook's hold from the implied percentages, using sharp books as a baseline.

- The Value Equation: Positive Expected Value (+EV) exists only when your assessed True Probability is greater than the Implied Probability of the odds.

- Thinking in Gradients: Professional bettors pass on teams they believe will win if the implied probability (price) is higher than the actual likelihood of victory.

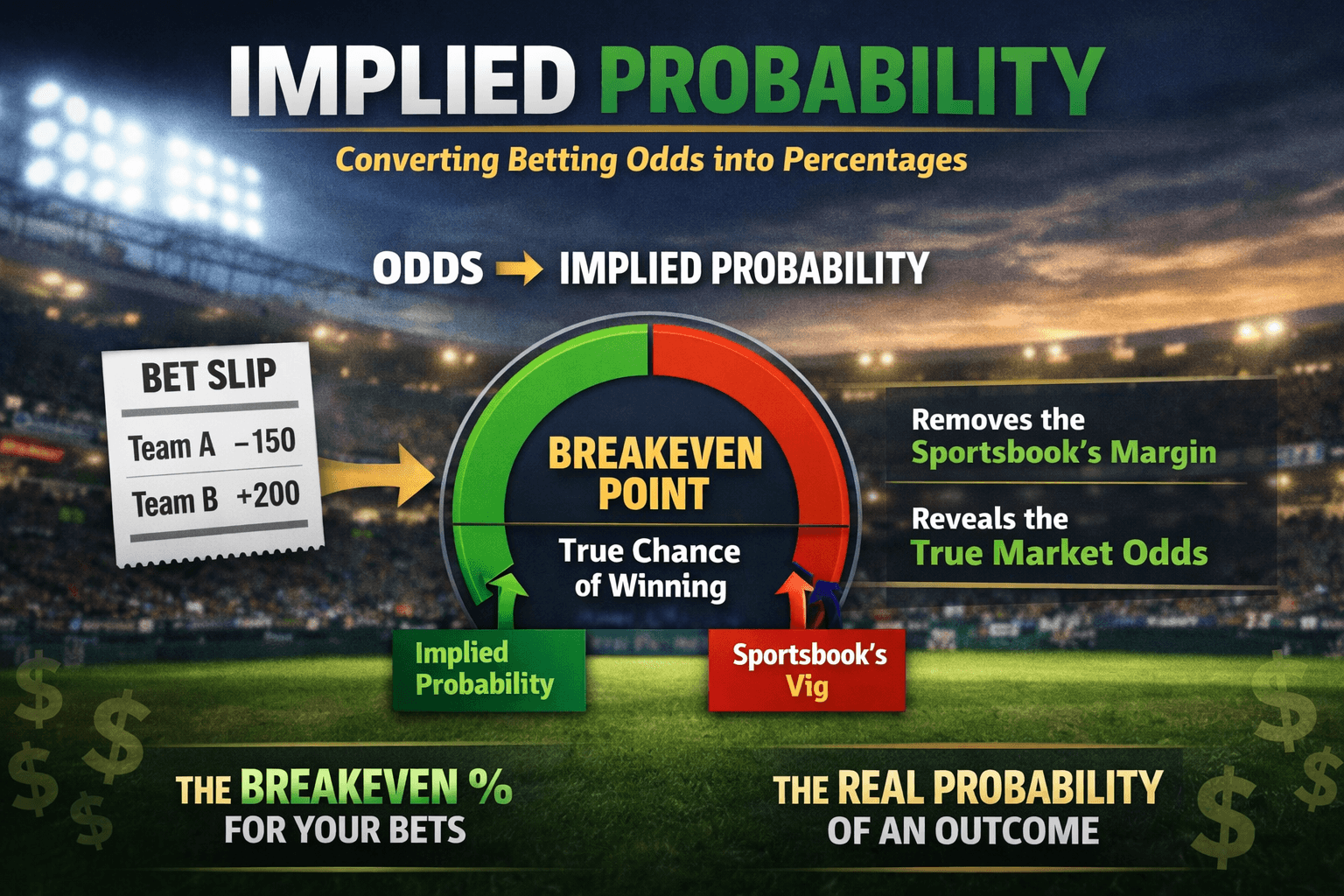

Definition

Implied probability is the conversion of betting odds into a percentage representing the likelihood of an outcome as priced by a sportsbook. It serves as the breakeven point for a wager and is the foundational metric used to strip away sportsbook margins ("vig") to reveal the true market probability of an event.

Table of Contents

If you do not understand implied probability, you are not investing; you are gambling.

In the ecosystem of sports betting, odds are not merely predictions of who will win or lose. They are prices. Just as a stock trader analyzes the price of a share relative to the company's intrinsic value, a sharp bettor analyzes the odds relative to the actual probability of an event occurring.

To beat the closing line and secure long-term profit, you must view the market through percentages, not team names. Implied probability is the Rosetta Stone that translates American, Decimal, or Fractional odds into a single, usable metric: the breakeven percentage.

This guide is the definitive technical resource on implied probability, how to calculate it, how to strip the "vig" (sportsbook fee) to find true probability, and how to use it to identify positive Expected Value (+EV).

The Core Concept: Price vs. Probability#

Implied probability represents the statistical likelihood of an outcome as suggested by the sportsbook’s odds. Crucially, it tells you how often you need to win a specific bet to break even.

If a sportsbook prices the Kansas City Chiefs at -110, they are not strictly saying "The Chiefs have a 52.38% chance of winning." They are saying, "You must win this bet 52.38% of the time to not lose money."

If your handicapping model—or the sharpest market consensus—determines the Chiefs actually have a 55% chance of winning, you have found an edge. You are buying an asset (the bet) for a price (52.38%) that is lower than its true value (55%).

Calculating Implied Probability#

To operate efficiently, you must be able to convert odds formats into percentages instantly. While most pro-level dashboards handle this, understanding the arithmetic is non-negotiable for manual analysis.

Converting American Odds

American odds revolve around the number 100. They are split into favorites (minus signs) and underdogs (plus signs).

Negative Odds (Favorites):

The formula calculates the risk required to win $100.

Implied Probability = Negative Odds / (Negative Odds + 100)

Example: -150 Odds

150 / (150 + 100) = 0.60 or 60.00%

Positive Odds (Underdogs):

The formula calculates the return on a $100 risk.

Implied Probability = 100 / (Positive Odds + 100)

Example: +200 Odds

100 / (200 + 100) = 0.3333 or 33.33%

Converting Decimal Odds

Decimal odds are the standard for European markets and betting exchanges. They are generally preferred by quants because they represent the total payout (stake + profit) rather than just profit.

Implied Probability = 1 / Decimal Odds

Example: 2.50 Odds

1 / 2.50 = 0.40 or 40.00%

Example: 1.909 Odds (-110 American)

1 / 1.909 = 0.5238 or 52.38%

Converting Fractional Odds

Common in UK markets and horse racing.

Implied Probability = Denominator / (Denominator + Numerator)

Example: 5/2 Odds

2 / (2 + 5) = 0.2857 or 28.57%

The Vig: Why Percentages Don't Add Up#

If you sum the implied probabilities of all possible outcomes in a single game, the result will rarely equal 100%. In a fair market, the sum of probabilities (Team A wins + Team B wins) must be 100%.

However, sportsbooks run a business. They inflate the implied probability of every outcome to create a margin, known as the vig, juice, or hold.

The Standard Market Example: Consider an NFL spread:

- Buffalo Bills -6.5 (-110)

- Miami Dolphins +6.5 (-110)

If we convert these to implied probability:

- Bills (-110) = 52.38%

- Dolphins (-110) = 52.38%

Total Market Probability: 52.38% + 52.38% = 104.76%

That extra 4.76% is the "Overround." It represents the theoretical hold the book has on the market. If the book balances the action perfectly on both sides, they pay out the winners using the losers' money and pocket the overround.

As a bettor, your goal is to overcome this tax. You must find situations where the True Probability (the actual chance of the event) is higher than the Implied Probability (the price), specifically by a margin wide enough to cover the vig.

Devigging: Finding "True" Odds#

"Devigging" is the process of removing the sportsbook's theoretical hold to estimate the market's consensus on the true probability of an outcome. This is essential when using sharp sportsbooks (like Pinnacle or betting exchanges) as a source of truth to bet against softer, recreational books.

There are several methods to devig odds, but the two most common are the Multiplicative Method and the Power Method.

1. The Multiplicative Method (Standard)

This method assumes the vig is distributed proportionally across all selections based on their odds. It is the most common method for 2-way markets (spreads, totals, money lines).

Formula:

True Probability = Implied Probability / Market Total %

Using our NFL Example (Market Total = 104.76% or 1.0476):

- Bills True Prob:

0.5238 / 1.0476= 50.00% - Dolphins True Prob:

0.5238 / 1.0476= 50.00%

In this coin-flip scenario, the true probability is exactly 50/50, but you are paying a price of 52.38%. This is negative expected value (-EV).

2. The Power Method (Advanced)

For markets with a "long tail" (like golf outrights or First Touchdown Scorer markets where the overround can be massive), the Multiplicative method can distort probabilities on longshots. The Power method calculates a constant exponent to reduce the probabilities, providing a more accurate representation for high-vig, multi-way markets.

Note: While complex to calculate manually, the Live +EV Feed on EdgeSlip automatically applies the optimal devigging method based on market type to show you true probability instantly.

Implied Probability and Expected Value (+EV)#

The connection between implied probability and Expected Value (EV) is the holy grail of sports betting analytics.

Expected Value is the calculation of how much you can expect to win or lose per bet if you were to place the same bet infinite times.

The Formula for EV:

EV = (True Probability * Profit if Won) - (True Failure Probability * Stake)

However, a faster heuristic using implied probability is: You have +EV if your Assessed True Probability > Implied Probability of the Odds.

A Practical +EV Example

Let's say a sharp sportsbook (the market maker) has the Golden State Warriors money line at -130. After devigging the sharp line, you determine the True Probability of a Warriors win is 55.0%.

You check a recreational sportsbook and find they have a "boost" or a stale line listed:

- Warriors Money Line: +100 (Even Money)

Step 1: Calculate Implied Probability of the Bet At +100 odds, the Implied Probability is 50.0%.

Step 2: Compare to True Probability

- True Probability (Reality): 55.0%

- Implied Probability (Price): 50.0%

Because 55.0% > 50.0%, this is a +EV bet. You are getting a 55% winning shot for the price of a coin flip. Over a large sample size of thousands of bets, this 5% edge (ROI) will compound significantly.

The Breakeven Chart#

Memorizing these benchmarks helps you assess value in real-time without reaching for a calculator.

| Odds (American) | Odds (Decimal) | Implied Probability (Breakeven) |

|---|---|---|

| -1000 | 1.10 | 90.91% |

| -500 | 1.20 | 83.33% |

| -200 | 1.50 | 66.67% |

| -150 | 1.67 | 60.00% |

| -110 | 1.91 | 52.38% |

| +100 | 2.00 | 50.00% |

| +150 | 2.50 | 40.00% |

| +200 | 3.00 | 33.33% |

| +500 | 6.00 | 16.67% |

| +1000 | 11.00 | 9.09% |

Nuances in Multi-Way Markets (Futures)#

Implied probability becomes deceptive in futures markets (e.g., "Super Bowl Winner"). In these markets, the "hold" is often significantly higher than in game lines—sometimes reaching 20-30%.

Example: If you sum the implied probabilities of all 32 NFL teams winning the Super Bowl in the preseason, the total might be 125%.

This means you are paying a 25% premium on any bet you place. To find value in futures, your edge must be massive. If you bet on a team at +1000 (9.09% implied), but the book has inflated the market so heavily, the "True Odds" might actually be closer to +1400 (6.6%).

Use the Multiplicative Method rigorously here. Sum the total implied percentages of all participants. If the total is 130%, divide your selection's implied probability by 1.30 to see how bad the value actually is.

The Impact of Correlation#

When constructing parlays, implied probability is often misunderstood. Bettors assume that if Leg A has a 50% chance and Leg B has a 50% chance, the parlay has a 25% chance (0.5 * 0.5).

This only holds true for independent events.

In sports, events are often correlated. If a Quarterback throws for 300+ yards (Leg A), the implied probability of his Wide Receiver getting 100+ yards (Leg B) drastically increases. The true probability of the parlay hitting is higher than the multiplied implied probability of the individual legs.

Sportsbooks attempt to price this correlation in, but they often fail to account for the full magnitude of the relationship. Identifying spots where the joint probability is higher than the product of implied probabilities is how specialized syndicates attack Same Game Parlays (SGPs).

Why The "Eye Test" Fails vs. Implied Probability#

The human brain is notoriously bad at understanding probability. We think in binaries: "Will they win?" or "Will they lose?"

Implied probability forces you to think in gradients.

- "I think the Celtics will win" is a useless statement.

- "I think the Celtics win this game 65% of the time" is a thesis.

If the market prices the Celtics at -200 (66.67%), and you think they win 65% of the time, you should not bet on them, even though you believe they will win. The price is too expensive.

This discipline—passing on winners because the price is wrong—is the hallmark of a professional bettor.

Conclusion#

Implied probability is the filter through which all betting decisions must pass. It removes the emotion of fandom and the bias of narrative, leaving only raw numbers.

- Calculate the implied probability of the odds on offer.

- Determine the true probability of the outcome (via modeling or devigging sharp markets).

- Compare. If True > Implied, you have an edge.

The math is simple, but the discipline to adhere to it is rare. By strictly betting only when implied probability is lower than true probability, you move from the realm of chance into the realm of investment.

Frequently Asked Questions

What is the difference between implied probability and true probability?▼

How do you calculate implied probability from American odds?▼

Why do implied probabilities add up to more than 100%?▼

What is a break-even percentage in betting?▼

How does implied probability help find value bets?▼

Related Articles

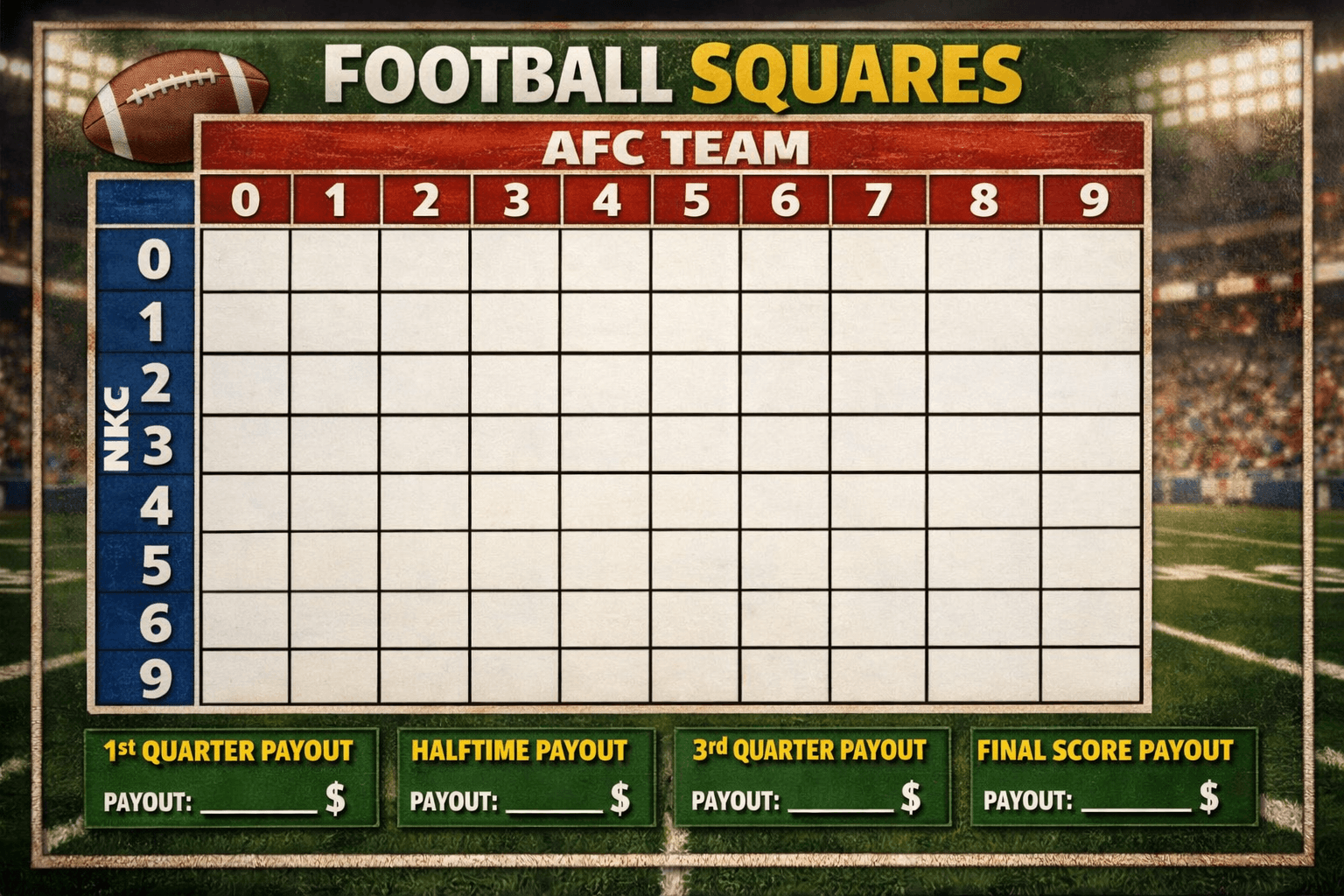

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

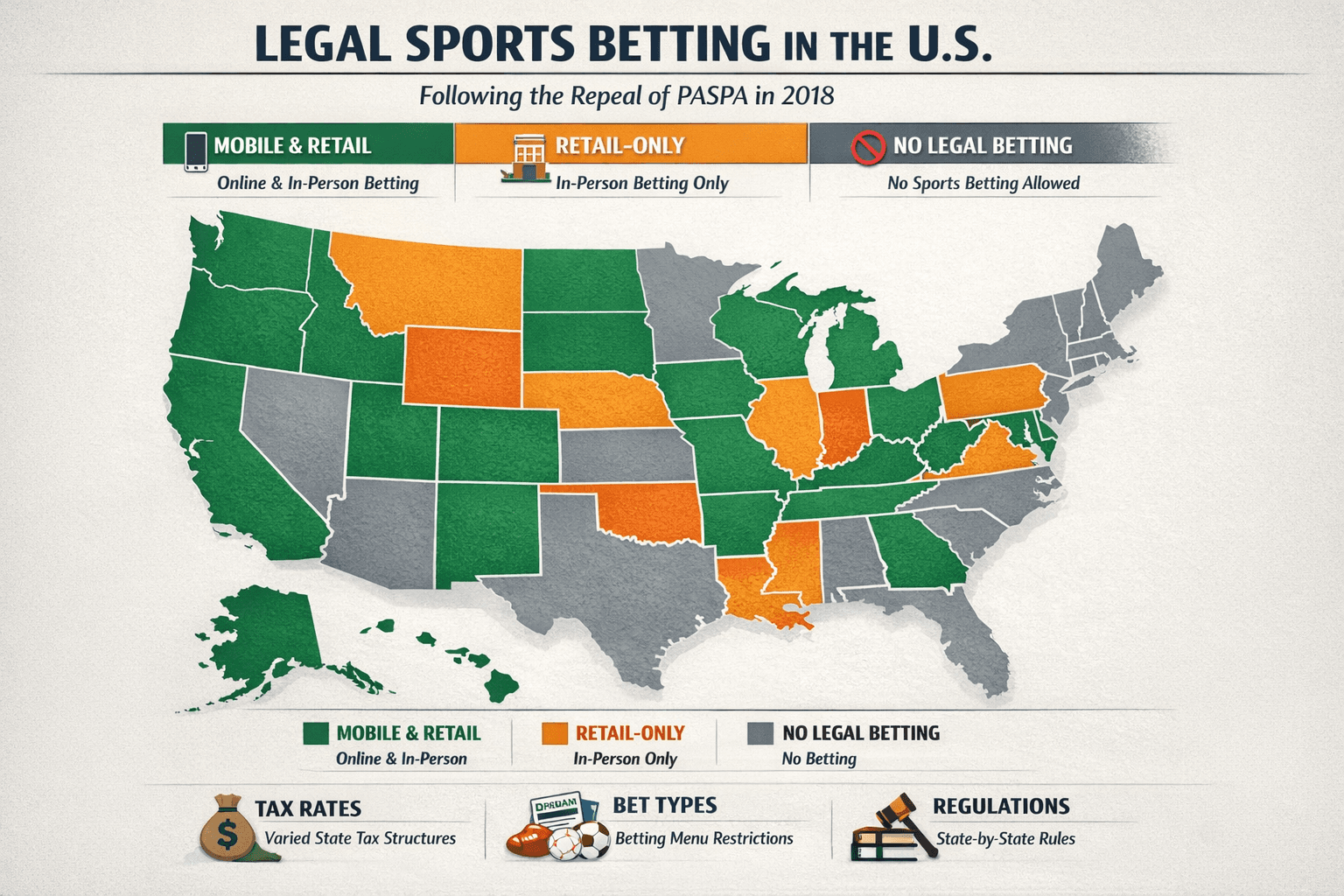

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.