Kelly Criterion: The Mathematical Formula for Optimal Bet Sizing

Key Takeaways

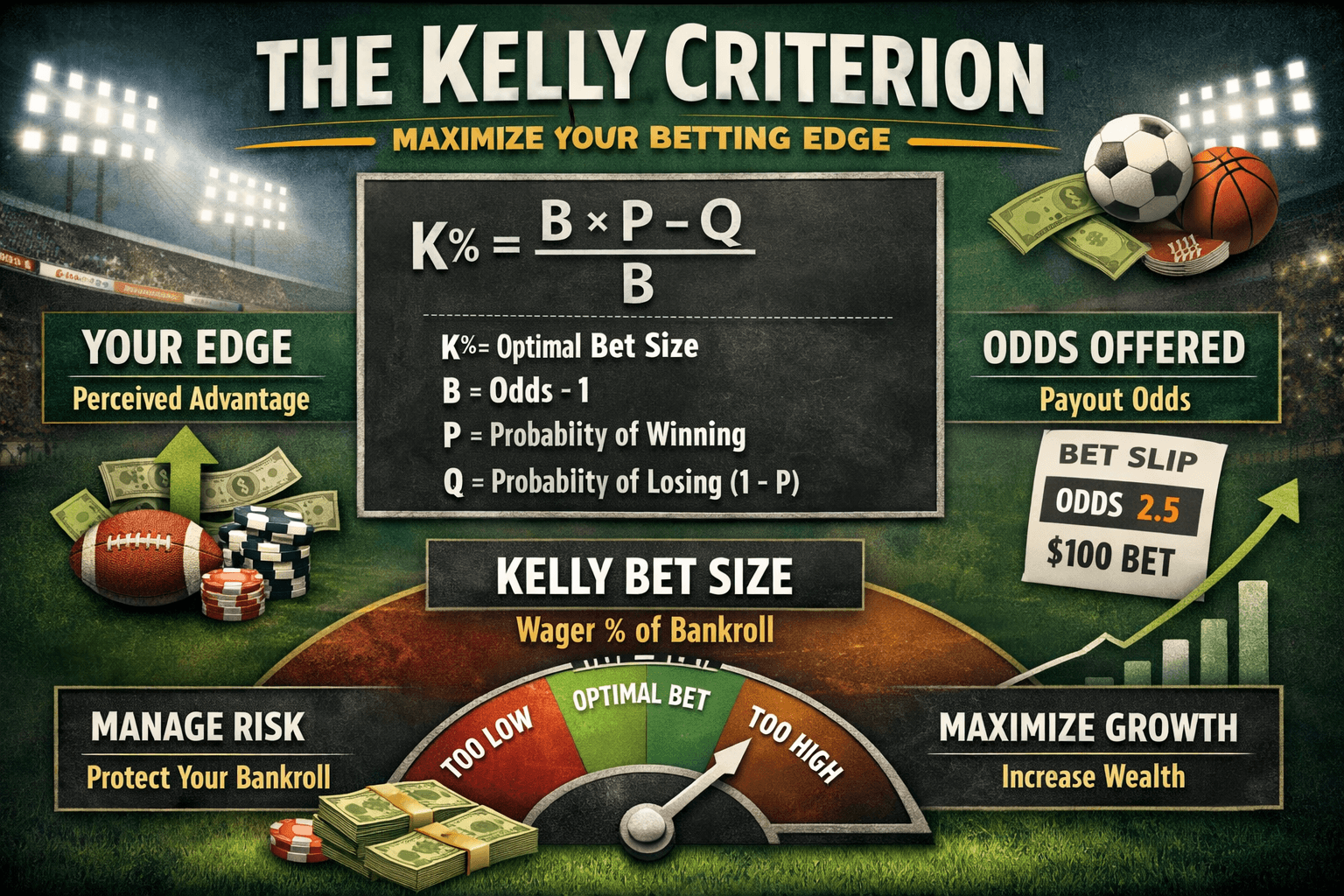

- The Formula: Kelly calculates the optimal bet size using the formula f* = (bp - q) / b to maximize geometric bankroll growth.

- Fractional Kelly: Professional bettors rarely bet 'Full Kelly' due to volatility; 'Quarter-Kelly' is the industry standard for balancing growth and risk.

- Bankroll Management: Kelly betting naturally adjusts your stake size down during losing streaks (protecting the bankroll) and up during winning streaks (compounding profit).

- The Input Problem: The formula relies on knowing the 'true' probability (p); without an accurate model or market-derived probability, the Kelly Criterion can lead to ruin.

Definition

The Kelly Criterion is a mathematical formula used to determine the optimal size of a series of bets to maximize the logarithm of wealth. In sports betting, it calculates the exact percentage of your bankroll to wager based on your perceived edge and the odds offered.

Table of Contents

In the world of professional sports betting, finding an edge is only half the battle. The other half—arguably the more mathematical half—is capital allocation. You can have the best predictive model in the world, but if you mismanage your staking strategy, you will eventually go broke due to variance. This is where the Kelly Criterion enters the conversation.

Most casual bettors stick to "flat betting" (wager 1 unit per game) or "confidence betting" (wager more when you feel good). These are heuristic methods. The Kelly Criterion is different; it is an algorithmic approach derived from information theory that calculates the mathematically optimal bet size to maximize the geometric growth rate of your bankroll over time.

It answers the most critical question in betting: Given a specific edge and specific odds, exactly how much of my net worth should I risk?

The Core Formula#

The standard Kelly Criterion formula for sports betting is often written in a few ways, but the most practically useful version for a bettor is:

Where:

- = The fraction of your current bankroll to wager.

- = The net odds received on the wager (e.g., decimal odds - 1). If you are betting at +110 American odds, .

- = The probability of winning (your "true" win percentage).

- = The probability of losing ($1 - p$).

A Practical Example

Let’s say you are using the Live +EV Feed on EdgeSlip and identify a mispriced NFL line.

- The Line: Buffalo Bills -3 at +100 odds ($2.0$ Decimal).

- Your Model: Gives the Bills a 55% chance to cover.

Here is the math:

- (Even money)

In this scenario, the Kelly Criterion suggests wagering 10% of your entire bankroll on this single bet. If that sounds aggressive, you are starting to understand why professional bettors rarely use "Full Kelly."

Why It Works: Geometric vs. Arithmetic Growth#

To understand why Kelly is superior to flat betting for growth, you must distinguish between arithmetic mean and geometric mean.

If you bet too little, your bankroll grows arithmetically—slow and steady, but you leave compound interest on the table. If you bet too much, you introduce "volatility drag." A 50% loss requires a 100% gain just to get back to even.

The Kelly Criterion finds the exact peak of the profit curve where Geometric Growth is maximized. It bets just enough to exploit the edge aggressively, but not so much that a losing streak destroys your compounding ability. It is effectively the "efficient frontier" of betting.

The Logic of Logarithms

Mathematically, Kelly maximizes the expected value of the logarithm of wealth. Because money has diminishing marginal utility (the difference between $100 and $200 is life-changing; the difference between $1,000,100 and $1,000,200 is negligible), logarithmic growth is the only rational path for a long-term operator.

The Dangers: Why "Full Kelly" is Often Suicide#

While mathematically perfect in a vacuum, Full Kelly makes two dangerous assumptions:

- Infinite Bankroll Divisibility: You can always bet exact pennies.

- Perfect Knowledge of : You know exactly that the Bills have a 55% chance of winning.

In reality, your edge is an estimate. If your model says 55% but the reality is 52%, betting Full Kelly will cause you to over-bet your edge, leading to a negative growth rate and eventual ruin. This is known as the distinction between the "theoretical Kelly" and the "empirical Kelly."

Furthermore, Full Kelly is incredibly volatile. It is mathematically normal for a Full Kelly bettor to experience a 50% drawdown in their bankroll. Most humans cannot handle losing half their net worth and continuing to bet optimally; they tilt.

The Professional Standard: Fractional Kelly#

To mitigate the risk of model error and reduce variance, sharps almost universally use Fractional Kelly. This simply means taking the output of the formula () and multiplying it by a fraction (usually 1/2, 1/4, or 1/8).

Quarter-Kelly ()

This is the industry gold standard for serious sports bettors.

- Growth: You retain about 75% of the maximum geometric growth rate.

- Volatility: You reduce your variance (swings) by 50-60%.

Using our previous Bills example (Full Kelly = 10%), a Quarter-Kelly bettor would wager 2.5%. This is a massive wager in the sports betting world (often called a "max play"), but it keeps you safe from the inevitable variance of sports.

Advanced: Simultaneous Events and Correlation#

The basic formula assumes you are betting on games sequentially—Game A finishes, you update your bankroll, then bet on Game B.

Sunday NFL reality: You have 8 games kicking off at 1:00 PM. If you find value in 5 of them, you cannot bet Full Kelly on all 5 simultaneously. If you did, you might leverage 50% of your bankroll at once. A bad afternoon could wipe you out.

The Solutions

- Proportional Reduction: Sum the Kelly fractions of all simultaneous bets. If the total exceeds your risk tolerance (e.g., 20% of bankroll), scale all bets down proportionally so the sum fits your cap.

- Correlation Matrix: If you are betting on the Chiefs to cover and Mahomes to go Over Passing Yards, these are correlated. You are effectively double-counting your risk. Use a tool like the Correlation Matrix to ensure you aren't over-exposed to a single game script.

Executing Kelly in the Modern Market#

To use the Kelly Criterion effectively, you need two numbers: the sportsbook's odds (easy to find) and the true win probability (hard to find).

You cannot guess . If you guess, you are just guessing with extra steps. You need a source of truth.

Finding "p" (True Probability)

- Origination: Build your own power rankings or regression models.

- Market Width: Use the No-Vig Calculator on a sharp bookmaker (like Pinnacle or Circa). If a sharp book has a line at -110/-110, the true probability is 50%. If a soft book is hanging +105, you have a quantifiable edge.

- CLV (Closing Line Value): Track your bets. If you bet the Bills -3 and the line closes at -4.5, the market has confirmed your probability assessment was likely correct.

Summary: The Discipline of Sizing#

The Kelly Criterion is not a "get rich quick" scheme; it is a "get rich sure" scheme—provided you actually have an edge. It forces you to bet big when the math is in your favor and small when the edge is thin.

If you are serious about treating sports betting as an asset class rather than entertainment, you must graduate from "units" to "percentages." Start with a Quarter-Kelly approach, track your Closing Line Value rigorously, and let the geometric growth do the heavy lifting.

Frequently Asked Questions

What is the Kelly Criterion formula for sports betting?▼

Why do pros use Fractional Kelly instead of Full Kelly?▼

Can I use the Kelly Criterion for simultaneous bets?▼

Does the Kelly Criterion work if I don't have an edge?▼

What is the difference between geometric and arithmetic growth in betting?▼

Related Articles

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

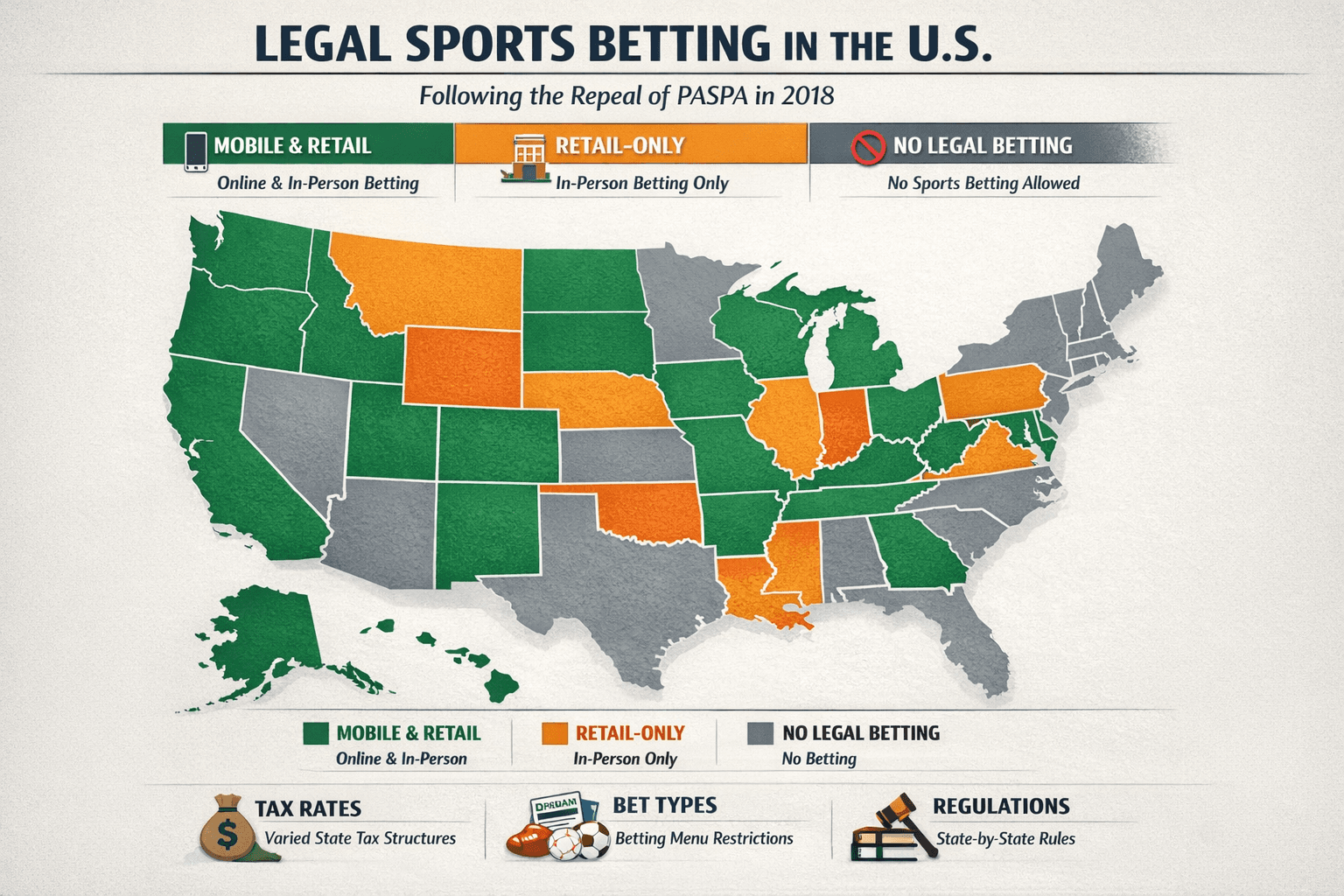

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.