No Vig Odds Explained: The Math Behind Fair Value Betting

Key Takeaways

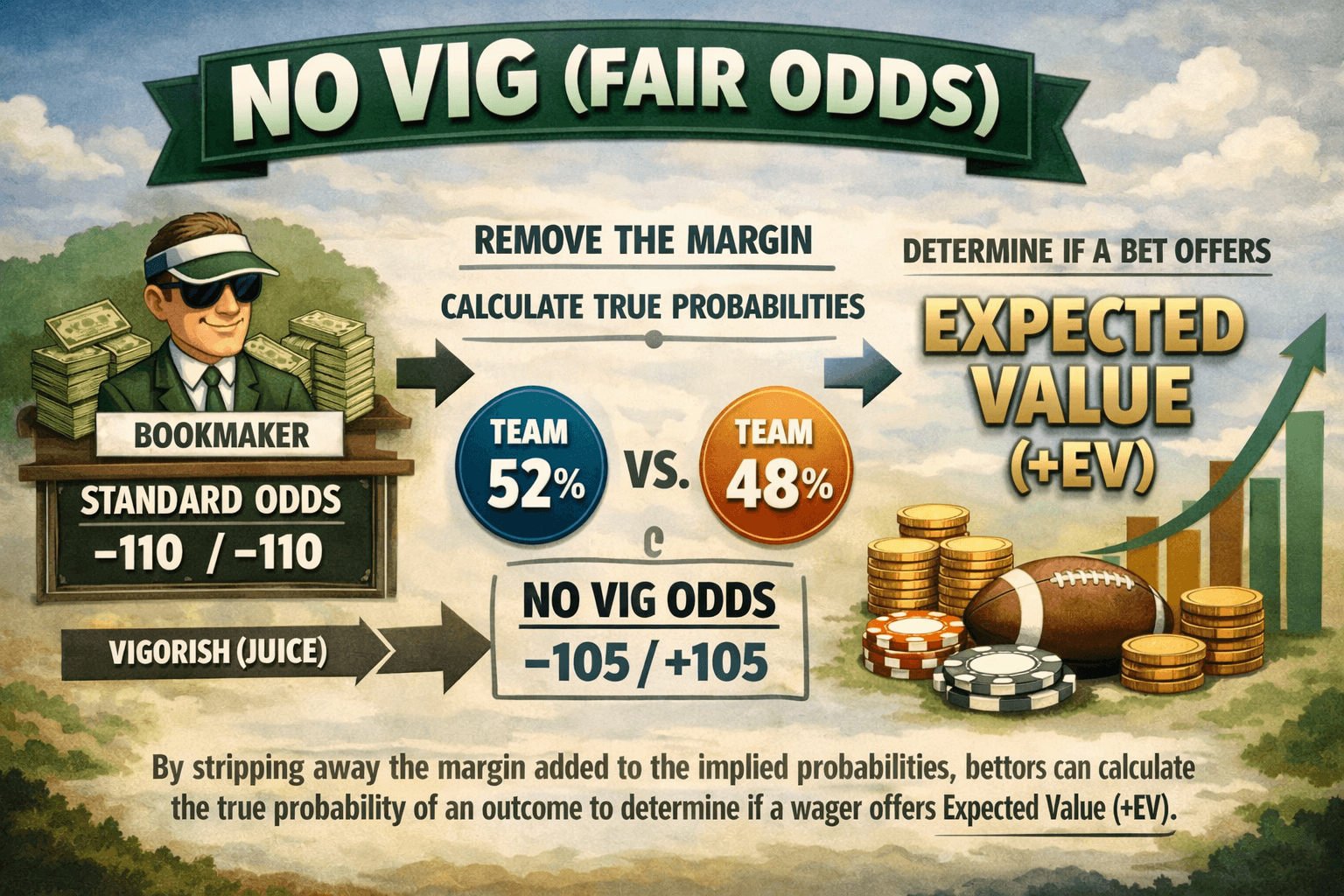

- Vig is the Hidden Fee: The 'vig' or 'juice' is the bookmaker's margin, represented by the overround where the sum of implied probabilities exceeds 100%.

- True Probability vs. Implied Probability: Implied probability is derived from the betting odds, while True Probability is the actual likelihood of an outcome after the vig has been mathematically removed.

- The Source of Truth Strategy: Sharps use No Vig odds from efficient market makers (like Pinnacle) to establish a baseline, then bet against recreational books that deviate from this fair price.

- Positive Expected Value (+EV): A bet is only +EV if the No Vig probability of the outcome is higher than the breakeven percentage of the odds you are betting.

- High-Vig Danger Zones: Futures markets and Same Game Parlays often contain massive holds (20-30%), making it significantly harder to find fair value compared to straight spreads or totals.

Definition

"No Vig" (or fair odds) refers to betting lines with the bookmaker's fee (vigorish/juice) removed. By stripping away the margin added to the implied probabilities, bettors can calculate the true probability of an outcome to determine if a wager offers Expected Value (+EV).

Table of Contents

To the casual sports fan, the odds on the screen are simply the price of a bet. To the sharp bettor, those odds are a distorted reality—a version of the truth that has been manipulated to ensure the house always wins.

Understanding No Vig (or "fair odds") is the single most important concept in sports betting analytics. It is the dividing line between gambling and investing. If you do not know the "No Vig" price of a market, you cannot calculate your edge. And if you cannot calculate your edge, you are betting blind.

In this guide, we will dismantle the bookmaker’s business model, mathematically remove the "juice," and reveal how to calculate the true probability of any sporting event.

The Architecture of the Vigorish#

Before we can remove the vig, we must understand how it is applied.

Sportsbooks do not make money by gambling against you; they make money by charging a fee on every transaction. This fee is known as the vig, vigorish, juice, or hold. It is not an explicit tax added at the checkout counter; rather, it is baked directly into the odds themselves.

The Overround Mechanism

Consider the classic coin toss. The true probability of Heads is 50%, and the true probability of Tails is 50%.

In a fair market (No Vig), the odds would be +100 (2.00) for both sides. If you bet $100 on Heads, you win $100. Over infinite flips, you break even.

However, a standard sportsbook line for a spread or total is usually -110 (1.91) on both sides.

- Heads (-110): You must bet $110 to win $100.

- Tails (-110): You must bet $110 to win $100.

If you calculate the Implied Probability of these odds, you see the distortion:

If you add the implied probability of Heads (52.38%) and Tails (52.38%), the total is 104.76%.

Since the sum of all possible outcomes in any event must equal 100%, that extra 4.76% is the Overround. It represents the bookmaker’s theoretical hold. To find the true probability, we must normalize these percentages back down to 100%.

Calculating No Vig Odds: The Methods#

Removing the vig is not always as simple as slicing the overround in half. Different market conditions and odds distributions require different mathematical approaches to finding the "Fair Line."

1. The Multiplicative Method (Standard)

This is the most common method used for standard markets (spreads and totals) where the odds are relatively balanced. It assumes the bookmaker applies their margin proportionally to the probability of each outcome.

The Formula: To find the No Vig probability () for a specific outcome (), divide it by the Total Market Probability ().

Example:

- Team A: -200 (Implied Prob: 66.67%)

- Team B: +170 (Implied Prob: 37.04%)

- Total Market Sum: 66.67% + 37.04% = 103.71%

Calculations:

- Team A True Prob: $66.67 / 1.0371 = \mathbf{64.28%}$

- Team B True Prob: $37.04 / 1.0371 = \mathbf{35.72%}$

Once you have the true probability, you can convert it back to Fair Odds using the standard conversion:

- Team A Fair Odds: (Decimal 1.55)

- Team B Fair Odds: (Decimal 2.80)

2. The Shin Method (Advanced)

While the Multiplicative method works for balanced lines, it loses accuracy in markets with "longshots" (e.g., heavy underdogs or golf outrights).

Market theory suggests a Favorite-Longshot Bias: bettors irrationally prefer longshots, so bookmakers shade lines more heavily against underdogs to protect themselves. The Shin Method is an iterative algorithm that attempts to account for "insider trading" (informed bettors) and distributes the vig unevenly to counter this bias.

For the purpose of most daily bettors, the Multiplicative method is sufficient, but if you are originating lines for heavy underdogs or multi-way markets, understanding that the vig is not applied equally is crucial.

Why No Vig Odds Are the Holy Grail of +EV#

Why go through the trouble of performing this math? Because Positive Expected Value (+EV) cannot exist without it.

Benchmarking Against Efficient Markets

The most common strategy for semi-pro bettors is Steam Chasing or Line Shopping based on market efficiency.

Books like Pinnacle and Circa Sports are considered "market makers." They accept high limits and welcome sharp action. Consequently, their lines are extremely efficient—they represent the closest thing we have to the "true" probability of an event.

By calculating the No Vig line of a sharp bookmaker, you establish a "Source of Truth." You can then compare this truth against "soft" recreational books (DraftKings, FanDuel, BetMGM) to find discrepancies.

The Workflow:

- Check Pinnacle: They have the Chiefs at -125 / +111.

- Devig the Line: You calculate the No Vig price for the Chiefs is -117.

- Scan Soft Books: You find a recreational book offering the Chiefs at -110.

- Identify Edge: You are buying a ticket at -110 for an event that has a true price of -117. This is a +EV bet.

This specific workflow is the engine behind our Live +EV Feed, which processes thousands of odds updates per second to automatically calculate No Vig prices and highlight where recreational books have made a mistake.

The Breakeven Percentage vs. True Probability#

A common point of confusion for intermediate bettors is the difference between Breakeven Percentage and True Probability.

- Breakeven Percentage: This is the percentage of time you need to win a bet at specific odds to not lose money. At -110 odds, your breakeven is 52.38%.

- True Probability: This is the actual likelihood of the event occurring, derived from the No Vig calculation.

The Golden Rule of Betting:

You only bet when the True Probability is higher than the Breakeven Percentage.

If the No Vig probability of the Chiefs winning is 55.0%, and you bet them at -110 (Breakeven 52.38%), you have a roughly 2.6% edge. Over the long run, this mathematical gap guarantees profit, variance notwithstanding.

Synthetic Hold and Multi-Way Markets#

The concept of No Vig becomes even more critical in multi-way markets, such as "First Touchdown Scorer" or "Futures" markets (e.g., Super Bowl Winner).

In a two-way market (Spread/Total), the hold is usually low (4% - 5%). In a futures market, the hold can be astronomical—often 20% to 30%.

The Futures Trap: If you see a team at +1000 to win the Super Bowl, the implied probability is 9.09%. However, if the book's hold is 25%, the True Probability (No Vig) of that team winning might only be 6.5% (approx +1450).

Many bettors lose their bankroll on futures because they do not realize how much "tax" they are paying. By devigging futures markets, you often realize that none of the options are +EV. The smartest play in a high-vig market is often to pass completely.

Using No Vig for Correlated Parlays

Sophisticated bettors also use No Vig probabilities to price correlated parlays. If you know the true probability of Event A and Event B, and you have a model for their correlation, you can construct a "Fair Price" for the parlay.

If a sportsbook offers a Same Game Parlay (SGP) payout that exceeds your calculated No Vig price, you have found a massive edge. However, be warned: sportsbooks hide massive amounts of vig in SGPs. It is not uncommon to see SGP holds exceeding 35%.

Conclusion: The Path to Profitability#

Sports betting is not about picking winners; it is about buying prices.

A stock trader doesn't buy a stock simply because they like the company; they buy it because they believe the current price is lower than the intrinsic value. Similarly, a sharp bettor doesn't bet on a team simply because they think they will win. They bet because the No Vig calculation reveals that the sportsbook has mispriced the probability.

By rigorously applying No Vig analysis to every wager, you strip away the marketing and the noise, leaving only the raw data. It requires discipline and a willingness to trust the math over your gut, but it is the only proven method to defeat the bookmaker in the long run.

Frequently Asked Questions

What does No Vig mean in sports betting?▼

How do you calculate No Vig odds?▼

Why is removing the vig important?▼

What is the difference between additive and multiplicative vig removal?▼

Which sportsbooks offer the fairest lines for No Vig calculations?▼

Related Articles

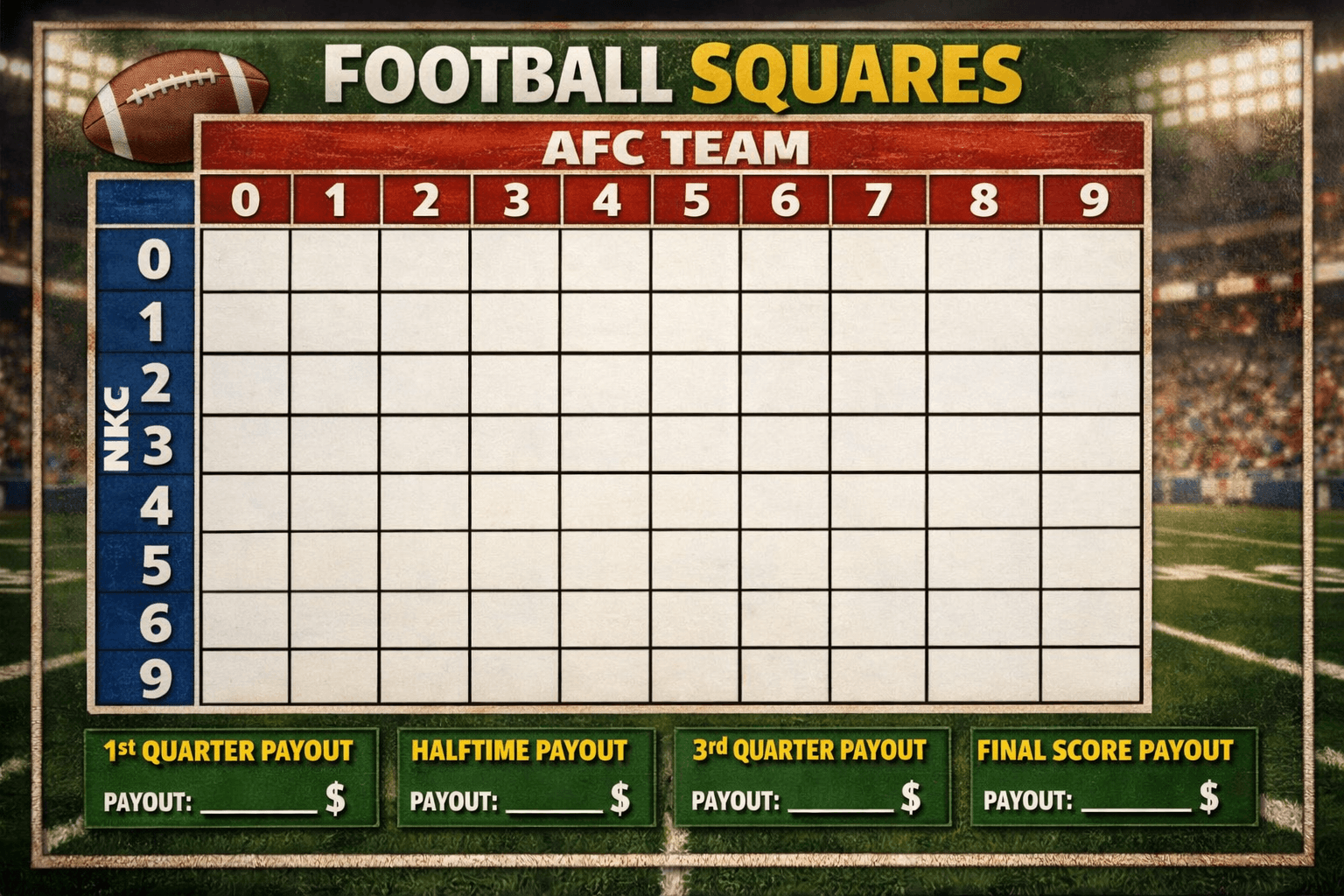

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

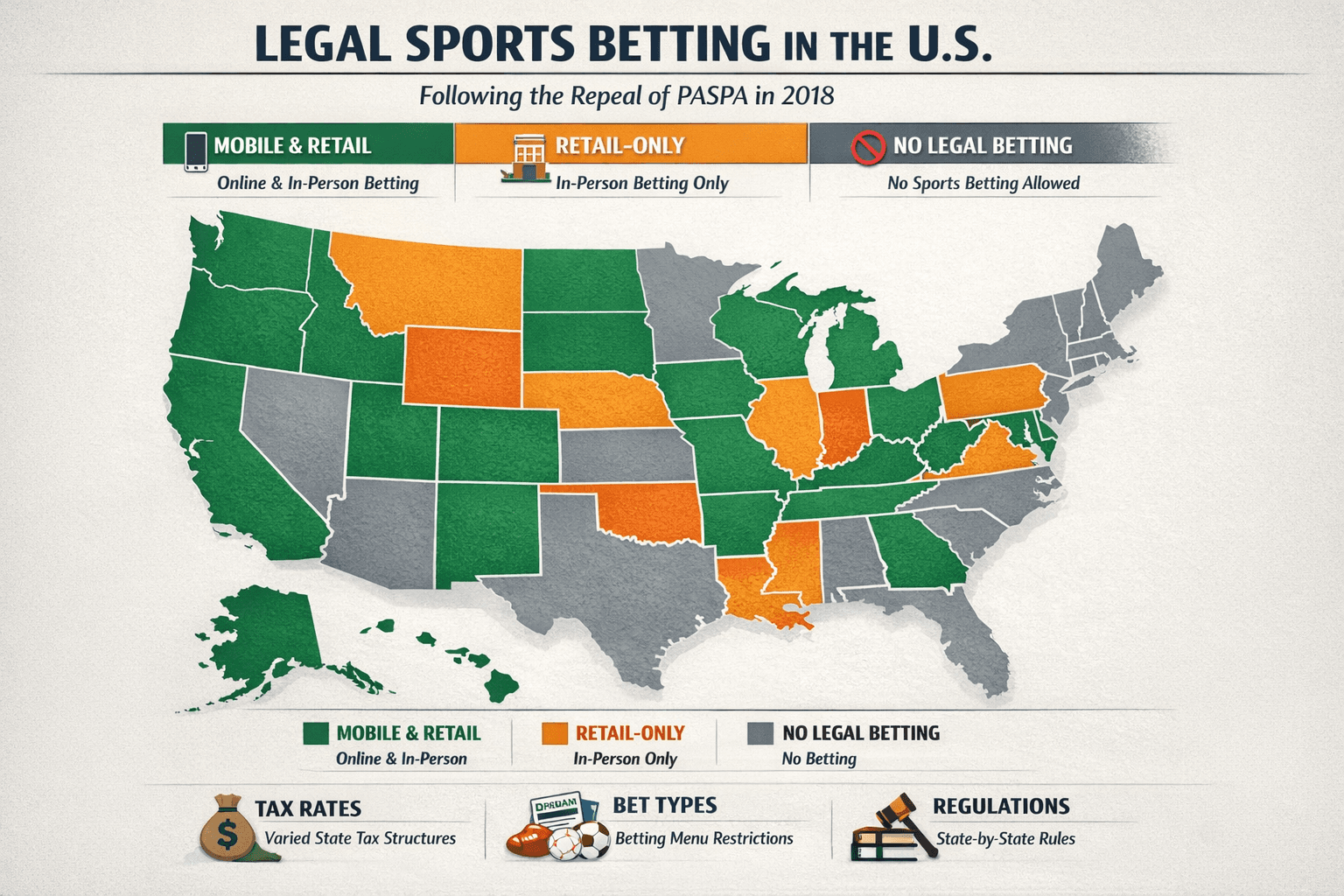

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.