Positive EV Betting: The Mathematical Edge Over Sportsbooks

Key Takeaways

- The House Edge is Beatable: Unlike casino games with fixed negative expectations, sports betting markets are fluid; +EV betting exploits temporary inefficiencies in these markets.

- Price Matters More Than Winners: A +EV bettor doesn't ask 'Who will win?'; they ask 'Is this price better than the true probability suggests?'

- CLV is Your Report Card: Consistently beating the Closing Line Value (CLV) is the strongest indicator of long-term profitability, regardless of short-term variance.

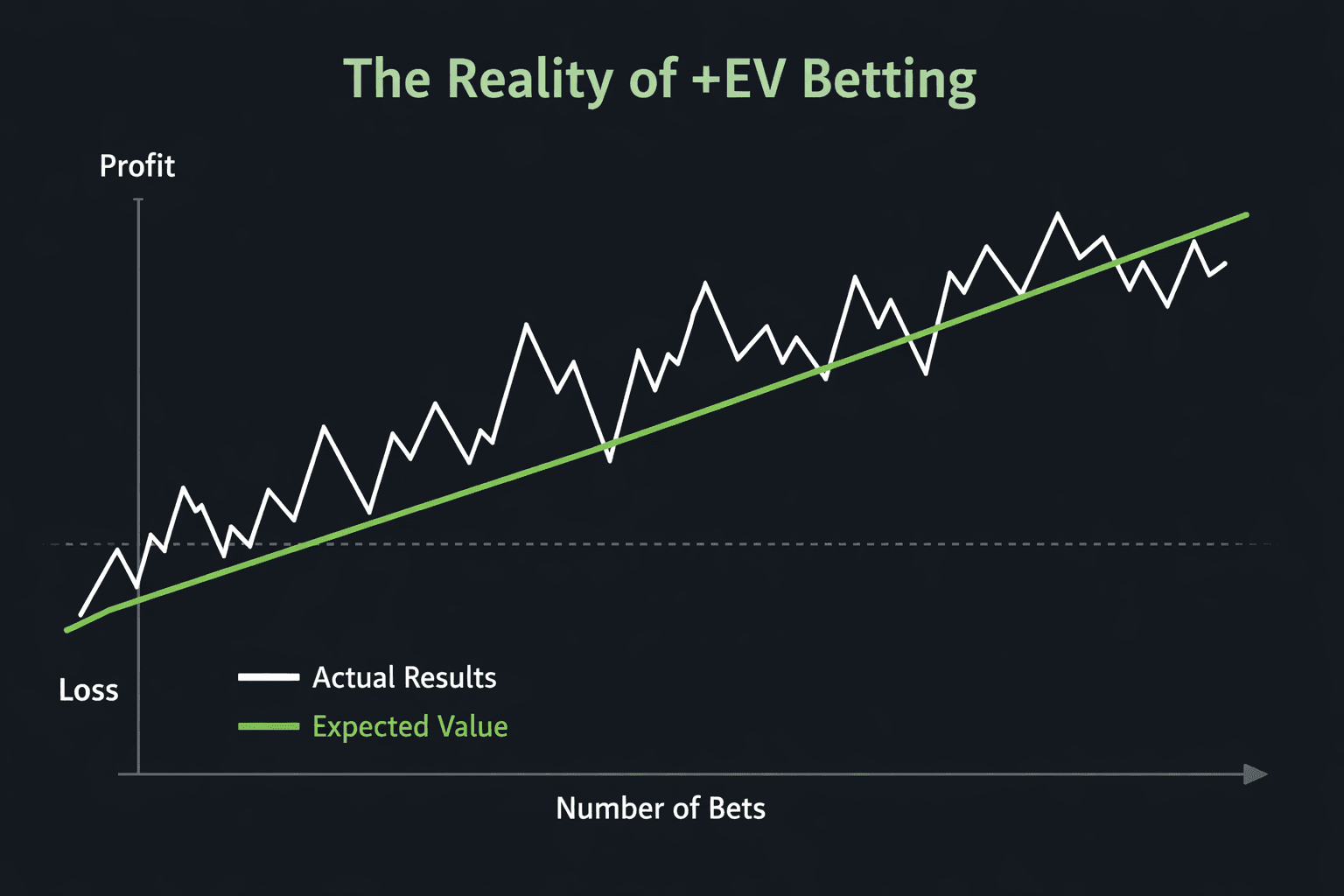

- Variance is Inevitable: Even with a perfect +EV strategy, downswings occur. Proper bankroll management via the Kelly Criterion is mathematically required to avoid ruin.

Definition

Positive Expected Value (+EV) betting is a mathematical strategy that identifies wagers where the implied probability of the odds offered by a sportsbook is lower than the true probability of the outcome occurring. It quantifies the gap between a bettor's edge and the sportsbook's vigorish.

Table of Contents

The average sports fan views betting as a game of prediction. They watch the game, analyze the players, trust their gut, and wager on who they think will win.

The professional bettor views betting as a market of mispriced assets. They ignore the game, analyze the odds, trust the math, and wager on numbers that are statistically wrong.

This distinction is the difference between gambling and investing. The former relies on luck; the latter relies on Positive Expected Value (+EV).

If you are looking to transition from a casual bettor to a profitable sharp, you must abandon the concept of "picking winners." Instead, you must learn to identify value. This guide is the definitive resource on the mathematics, mechanics, and mindset required to execute a Positive EV strategy.

The Mathematics of Expectation#

At its core, sports betting is a probability problem. Every odd listed by a sportsbook represents an implied probability—the percentage chance the book believes an outcome will happen (plus their fee, or "vig").

Expected Value (EV) is the measure of what a bettor can expect to win or lose per wager placed on the same odds an infinite number of times.

The Formula

The formula for Expected Value is:

Where:

- : The true probability of winning.

- : The potential profit.

- : The true probability of losing (1 - ).

- : The amount staked.

A Practical Example: The Weighted Coin

Imagine a coin flip. The true probability of Heads is 50%. If you bet $100 on Heads at standard odds of -110 (implied probability of 52.38%), you would lose money long-term because the payout ($90.91) does not justify the risk.

Now, imagine a sportsbook makes a mistake and offers +110 odds on Heads.

- True Probability (): 0.50

- Potential Profit (): $110

- Stake (): $100

In this scenario, your Expected Value is $5.00. This means for every $100 you bet on this coin flip, you theoretically earn $5.00. You might lose the individual flip, but if you flip that coin 1,000 times, you are mathematically guaranteed to profit roughly $5,000.

This is the holy grail of sports betting: finding the "+110 coin flip" hidden inside a complex market of spreads, totals, and props.

Determining "True" Probability#

The EV equation is simple. The variable that separates the pros from the amateurs is (True Probability).

In the coin flip example, we know the true probability is 50%. In sports, "true" probability is unknown. There is no rulebook stating exactly how likely the Chiefs are to cover -3.5. Therefore, to calculate EV, we must estimate the true probability more accurately than the sportsbook we are betting against.

The Source of Truth: Market Makers

Not all sportsbooks are created equal.

- Retail Books (DraftKings, FanDuel, BetMGM): These books generally cater to recreational players. They shade lines towards public bias and are slower to adjust to breaking news.

- Market Makers (Pinnacle, Circa, Bookmaker): These are "sharp" books. They accept high limits from professional bettors. Because they risk more money, their lines are much more efficient and closer to the "true" probability.

To find +EV, we use the lines from Market Makers as the source of truth to expose mistakes at Retail Books.

The "No-Vig" Fair Odds

Market Makers still charge a vig. To find the true probability implied by a sharp book, we must remove that vig (a process called "de-vigging").

If Pinnacle lists a heavy moneyline at:

- Team A: -150 (60% implied)

- Team B: +130 (43.48% implied)

The total implied probability is 103.48%. The "overround" is 3.48%. By removing this statistically, we find the "Fair Odds" or "No-Vig Odds." If the fair price for Team A is truly -140, but you find Team A listed at -130 on a retail book, you have found a +EV wager.

The Workflow: Finding the Edge#

Manually converting American odds to implied probability, de-vigging market makers, and scanning dozens of sportsbooks is impossible to do in real-time. Lines move in seconds.

This is where automation becomes a necessity.

1. Line Shopping and Aggregation

You cannot be a +EV bettor with one sportsbook account. You need access to the entire market. Using a Line Shopper allows you to see the disparity between books instantly. If five books have the Over at -110 and one book has it at +105, that outlier is an immediate signal of potential value.

2. Live +EV Feeds

Tools like the EdgeSlip Live +EV Feed ingest odds from sharp books, de-vig them in real-time to establish the "Fair Price," and then scan retail books for discrepancies.

- Step A: Sharp Book has NBA Total at 224.5 (-110).

- Step B: Retail Book has NBA Total at 223.5 (-110).

- Step C: The algorithm identifies that betting the OVER 223.5 is +EV because you are buying a point lower than the sharp market valuation.

3. Arbitrage as a Signal

While arbitrage (betting both sides for risk-free profit) is a valid strategy, it is also a massive indicator of +EV. If an Arbitrage Finder spots a discrepancy large enough to guarantee profit, it usually means one side of that bet is significantly +EV. Often, sharps will bet the +EV side ("naked arb") rather than hedging, to maximize long-term ROI.

Bankroll Management: The Kelly Criterion#

Finding positive EV is only half the battle. If you bet too much, variance can wipe you out. If you bet too little, you won't maximize your growth.

The mathematical standard for sizing +EV bets is the Kelly Criterion.

Where:

- : The fraction of the bankroll to wager.

- : The decimal odds minus 1 (e.g., -110 is 0.91).

- : The probability of winning.

- : The probability of losing (1 - p).

Why it matters: Full Kelly assumes you know the exact true probability. Since we are estimating true probability based on market makers (who can be wrong), most pros use a Fractional Kelly strategy (e.g., Quarter-Kelly or Half-Kelly). This reduces volatility and protects the bankroll while still growing it exponentially.

Example: If your model says you have a 4% edge on a bet, the Kelly Criterion might suggest betting 4% of your bankroll. A more conservative approach (Quarter Kelly) would bet 1%. This prevents a bad week from destroying your bankroll.

Closing Line Value (CLV): The Litmus Test#

How do you know if your strategy is working? You cannot look at your Win/Loss record over a week or even a month. Variance is too high.

The only true metric of a sharp bettor is Closing Line Value (CLV).

CLV measures where the odds finished when the game started (Closed) versus where you bet them. The closing line at a sharp book is the most efficient, accurate prediction of the game available.

- You Bet: Packers -3.5 (-110) on Tuesday.

- Closing Line: Packers -5.5 (-110) on Sunday.

You beat the closing line by 2 points. Regardless of whether the Packers cover, this was a great bet. You bought an asset for a cheaper price than the market valued it at expiration.

If you consistently beat the closing line, you will make money long-term. If you are winning money but rarely beating the closing line, you are simply getting lucky, and the regression monster is coming for you.

Common Pitfalls for Aspiring Sharps#

1. Market Limits and Bans

Sportsbooks do not like winners. If you consistently bet +EV lines, especially on obscure props or mistakes, you may be limited (e.g., max bet $13.45).

- Solution: Mix your betting across major markets (NFL sides, NBA totals) where limits are higher and scrutiny is lower. Avoid hammering obvious bad lines on obscure sports unless the ROI justifies burning the account.

2. The Mental Game of Variance

You can bet +EV strategies and lose for three weeks straight. It is mathematically possible. This is where most bettors break. They abandon the strategy, start chasing losses, or increase their unit size.

- Solution: Trust the math. Use a correlation matrix to ensure you aren't over-exposed to a single narrative (e.g., betting the Over on a QB's yards and the Over on his WR's yards increases variance if the offense struggles).

3. Chasing "Steam"

Steam is when a line moves rapidly across the screen because sharps are hammering it. If you see a line move from -3 to -4, and you bet it at -4, you have missed the move. You are now betting a "worse number."

- Solution: Use Custom +EV Alerts to get into the market before the line moves, not after.

Conclusion#

Positive EV betting is not a get-rich-quick scheme. It is a slow, methodical grind that turns sports betting into a distinct asset class. It requires discipline, strict adherence to bankroll management, and the right tools to identify inefficiencies in real-time.

You don't need to know if the quarterback is injured. You don't need to know if it's raining. You only need to know that the price you are paying is cheaper than the price the market dictates.

If you can do that, the math will take care of the rest.

Frequently Asked Questions

What is positive EV in sports betting?▼

How do you calculate Expected Value?▼

Why is Closing Line Value (CLV) important?▼

Is Positive EV betting risk-free?▼

Which sportsbooks are considered 'Sharp'?▼

Related Articles

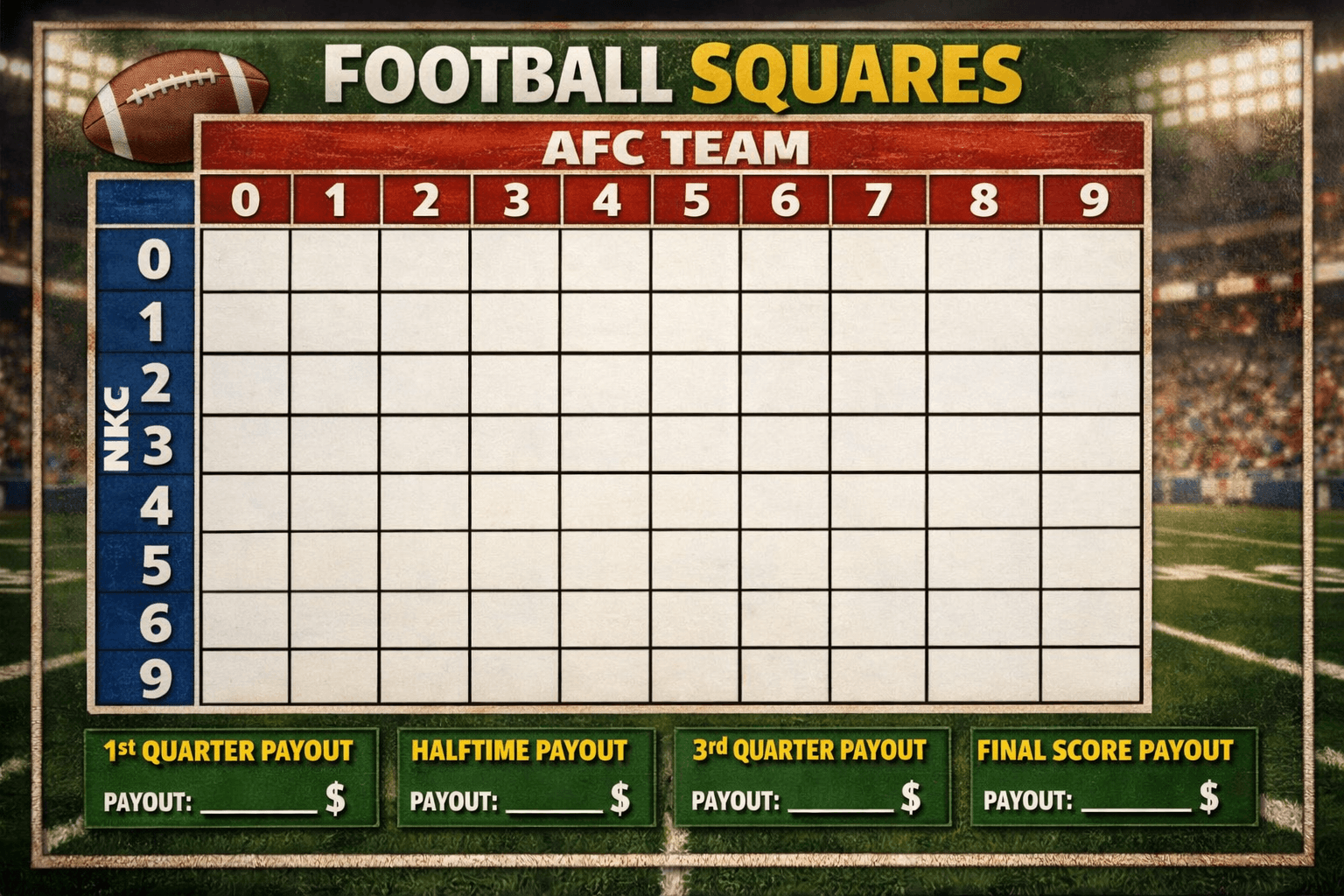

Football Squares Rules: The Definitive Analytics & Strategy Guide

Master football squares with this data-driven guide. Learn the rules, optimal number probabilities, auction valuation strategies, and how to gain an edge in high-stakes pools.

.png&w=3840&q=75)

Middling in Sports Betting: The Math Behind the Most Profitable Play

Master the art of middling. Learn how to exploit line movements to create risk-free windows where you win both sides of a bet. Advanced strategy for sharps.

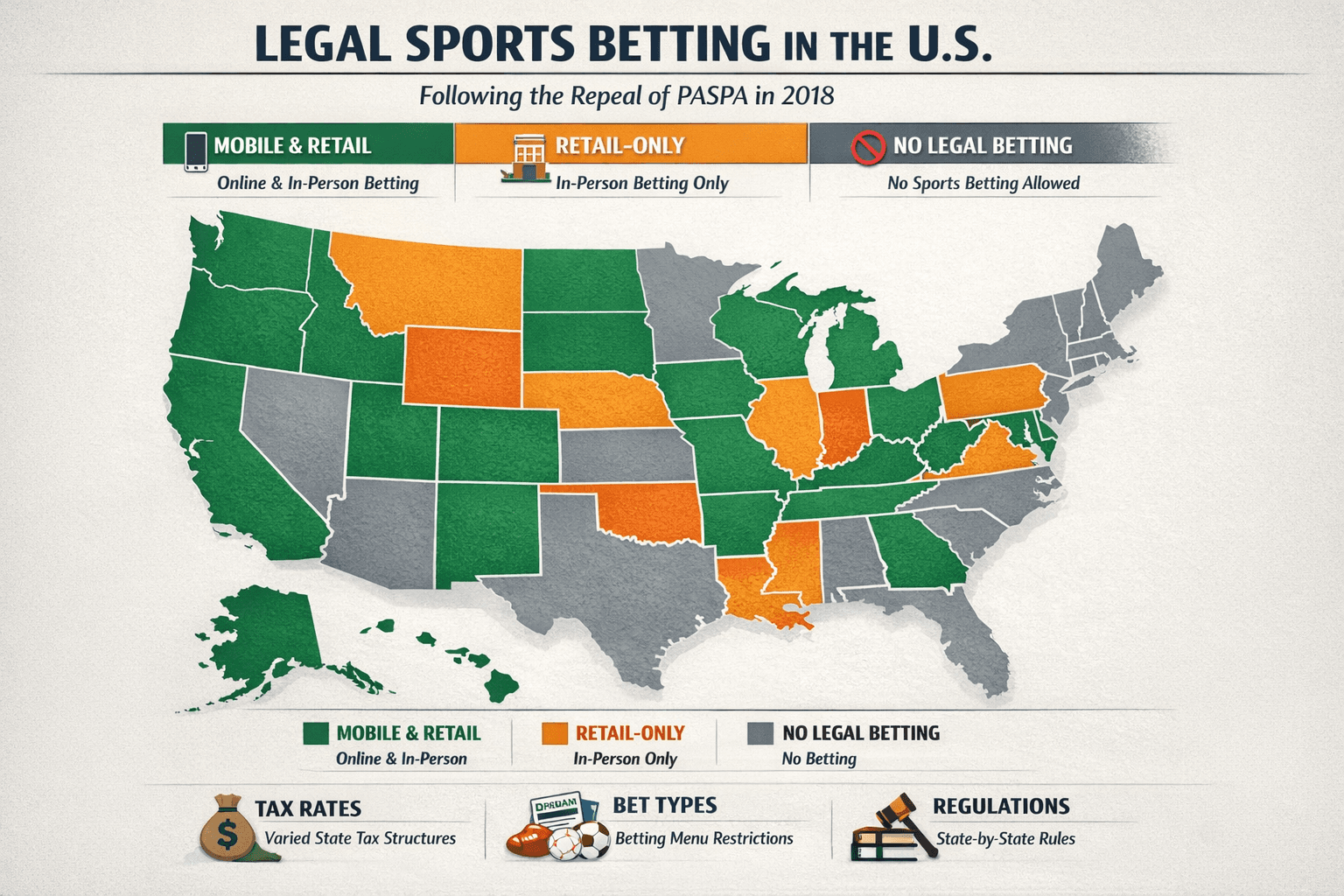

Legal Sports Betting States: 2026 Definitive Sharps Guide

The complete 2026 map of legal US sports betting. Analysis of mobile vs. retail markets, tax impact on odds, prop restrictions, and legislative forecasts.

Alt Markets Explained: Exploiting Derivatives for +EV Betting

Master alternate betting markets. Learn how sharps exploit pricing inefficiencies in alt spreads, totals, and props to find edge beyond the main lines.

Ready to find your Edge?

Join thousands of smart bettors who have stopped guessing and started calculating. Access institutional-grade tools for the price of a standard wager.